The UK stock market has enjoyed quite the ride this year, with the FTSE 100 keeping pace with the S&P 500 in the US and hitting new record highs. It is certainly helping to raise the profile of what has been an unloved part of the investment universe – however, investors often overlook one of the UK’s key attributes.

You might think having a rich pool of takeover targets on cheap valuations is why the UK stock market is finally getting more attention from investors domestically and abroad. That is certainly true to an extent – but there is something else which is grossly underappreciated and needs to get on more people’s radars, as it could help improve how investors perceive the UK market.

The power of being niche

One of the UK stock market’s best qualities is its veritable feast of niche companies. You might call them boring, and others might label them as unglamourous – what is clear is that the UK has experts in a narrow field.

Forget the fanfare around tech companies in the US disrupting the way we live and work. The UK is chock-a-block full of businesses that have identified a gap in the market and stuck to their knitting – focusing on what they do best, even if it there is limited scope for innovation.

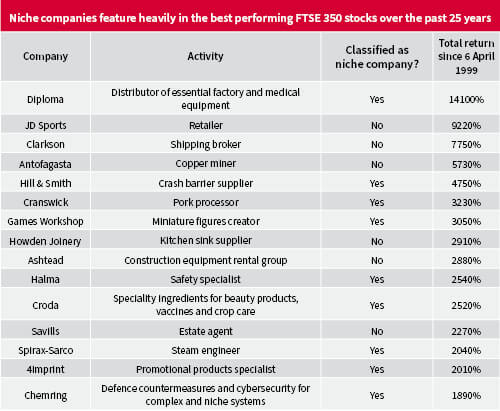

We analysed the FTSE 350 index of mid and large-cap companies from the date ISAs launched on 6 April 1999 until 1 May 2024, comparing total returns – which encompasses the change in a share price and any dividends paid along the way.

Nine of the top fifteen best-performing stocks over this 25-year period fall under the category of ‘niche’ businesses. Is that coincidence? I think not.

It does not matter that their business model may have barely changed in decades. Their success is down to giving customers what they want, in an efficient manner, via a well-run and expertly-managed operation which has enabled them to slowly take market share from competitors. This rinse and repeat approach can be highly lucrative, as this pack of companies has shown.

They are quietly getting on with the job, growing profit and paying more dividends which, when reinvested, help to enhance the returns for investors thanks to the power of compounding.

Widgets and crash barriers

Diploma is the top performer on the table, delivering a 14,200% total return since 6 April 1999. Anyone lucky enough to have owned the stock during that time could have made a mint. It is a notable example of how boring is beautiful when it comes to investing.

The company supplies widgets, cables and seals vital to keeping factories running. It also distributes important items that doctors and laboratory scientists need to do their job, making it an unsung hero supporting the healthcare sector.

The company supplies widgets, cables and seals vital to keeping factories running. It also distributes important items that doctors and laboratory scientists need to do their job, making it an unsung hero supporting the healthcare sector.

What else is on the list? Businesses involved in crash barriers, pork processing, miniature figures of trolls and specialist ingredients for the life science industry feature on the list of niche UK stocks delivering stellar returns since 1999. There are also companies involved in such activities as steam management and promotional pens. None of these businesses are glamourous but all of them are successful.

Examples of niche winners

For example, Hill & Smith is a leader in attractive niches where it would be incredibly hard for a new business to waltz along and suddenly take market share. Significant sums of money go into new and existing infrastructure projects each year, and safety is paramount. In addition to the provision of road barriers, Hill & Smith is active in such unglamourous areas as pipe supports for the energy sector and security fencing. Someone has to do these jobs and Hill & Smith proudly does it well.

Just look at 4imprint which is as wildly different to the bright lights of AI, cloud computing or other go-go growth sectors as you can get. 4imprint is a key player in the US promotional products market – think branded pens, caps and coffee cups. The fact more than 25,000 distributors serve this market might imply this is not a niche activity, yet we would argue otherwise. It does promotional items, full stop – easy to understand and the only company of its kind on the UK stock market. A 2,010% total return since 6 April 1999 is noteworthy.

Next time someone says the UK stock market is full of old-economy, fuddy-duddy companies, recite the fantastic returns from companies on the table in this article.

While something that has done well in the past isn’t guaranteed to continue doing so in the future, the long-term achievements of the UK stock market’s niche champions would suggest the upper, middle and lower ends of the London Stock Exchange might contain more opportunities that its’ unloved reputation suggests.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.