Environmental campaigners may grimace, and advisers and clients who run strict environmental, social and governance (ESG) screens are likely to remain indifferent, but yield-seeking portfolio builders will doubtless be delighted to see Royal Dutch Shell promise higher cash returns to shareholders in the second half of the year (7 July). The oil major was already expected to be the fourth-highest individual dividend payer in cash terms in the FTSE 100 this year, chipping in some £4 billion, or more than 5% of the forecast total for the entire index, all on its own.

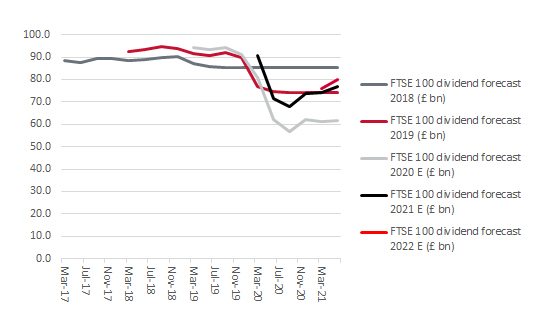

“Aggregate dividend forecasts for the FTSE 100 in 2021 have already advanced for three quarters in a row, buoyed by more optimistic forecasts for miners and banks, and now the oils have started to get in on the act.”

Aggregate dividend forecasts for the FTSE 100 in 2021 have already advanced for three quarters in a row, buoyed by more optimistic forecasts for miners and banks, and now the oil majors have provided a further boost. This reflects higher metals prices and the recent steepness in the yield curve as confidence in the economic recovery grows. A strong oil price and gushing cash flow at major producers can therefore only help to underpin consensus forecasts of a 3.7% yield from the FTSE 100 in 2021, with 3.9% potentially on offer in 2022.

Dividend forecasts for the FTSE 100 keep rising

Source: Company accounts, Marketscreener, analysts’ consensus forecasts

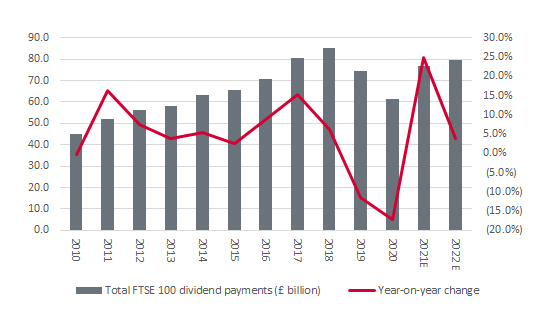

Based on the latest analysts’ consensus forecasts, 95 FTSE 100 firms are expected to pay a dividend in 2021, against 84 in 2020, as corporate confidence returns. Total FTSE 100 payments (excluding special dividends) are now expected to grow by 25% this year to £76.9 billion.

That is, however, still shy of 2018’s £85.2 billion peak – even 2022 is quite not expected to return to that level as corporate profits, cash flows and confidence look to recover from the effects of the pandemic.

Dividends are not expected to return to 2018 levels until at least 2023

Source: Company accounts, Marketscreener, analysts’ consensus forecasts

Even so, boardrooms do seem to be taking a more positive view of the world because 13 FTSE 100 constituents have also declared share buyback programmes this year, with an aggregate value of £8 billion.

By contrast, just two FTSE 100 firms – JD Sports Fashion and Severn Trent – have tapped investors for money so far this year and that was for just £714 million between them. That compares to 14 deals which raised a total of £16.3 billion in 2020.

“For the moment, cash is flowing into the pockets of advisers and clients rather than out, as dividends and buybacks are outpacing cash calls from initial public offerings, secondary placings of stock and secondary fund raisings.”

That may offer some encouragement to those advisers and clients who have hefty exposure to UK equities within their portfolios, bearing in the mind the adage about how ‘bull markets end when the money runs out’. For the moment, cash is flowing into their pockets and not out, as dividends and buybacks are outpacing cash calls from initial public offerings, secondary placings of stock and secondary fund raisings. Even so, this is a trend which must be monitored. A sudden rush of deals could be a potential red flag, especially if quality declines as numbers grow – at least if history is any guide.

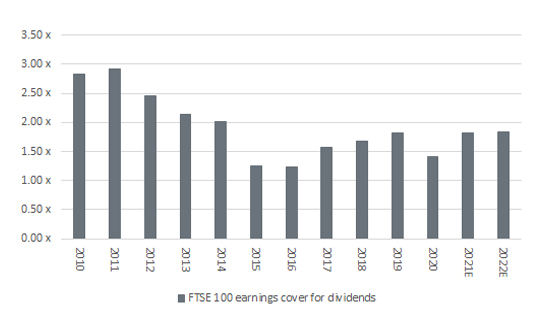

Advisers and clients can also draw comfort from how earnings cover is improving, too. At 1.83 times for 2021 and 1.84 times for 2022, dividend cover is seen reaching its highest level since 2014.

Earnings cover for FTSE 100 dividends is forecast to reach a seven-year high in 2021

Source: Company accounts, Marketscreener, analysts’ consensus forecasts

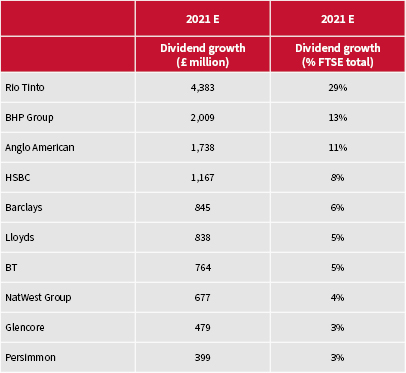

“Miners, banks and oils are forecast to generate 51% of FTSE 100 dividends this year, and miners and banks are expected to provide 90% of 2021’s forecast £15.3 billion increase in payments between them.”

Even so, income-seekers cannot quite set off on a victory lap yet, even as the dividends cuts of 2020 start to fade into the background. Miners, banks and oils are forecast to generate 51% of FTSE 100 dividends this year, and miners and banks are expected to provide 90% of 2021’s forecast £15.3 billion increase in payments between them.

Moreover, just 10 companies are expected to generate 87% of 2021’s dividend increase. Rio Tinto and BHP are the top two, so income-seekers will need to keep an eye on the price of iron ore in particular. The yield curve and trajectory of interest rates and Government bond yields must be followed too, given their importance to the big banks’ net interest margins and earnings power.

10 biggest forecast dividend increases by FTSE 100 member in 2021

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

A renewed drop in economic activity – for whatever reason – could therefore still pose a big risk to dividend forecasts. Analysts currently believe that aggregate FTSE 100 (adjusted) net profits will come very close to the pre-pandemic peaks in 2022, although they are still seen coming in some 10% below the 2011 zenith, when commodity prices were roaring higher and miners and oil producers generated 42% of the FTSE 100’s profits between them. A stumble in profits would potentially threaten dividends too.

The fact that analysts are not expecting profits to immediately return to former highs is in some ways encouraging, as it suggests they are not going overboard. It also leaves scope for an upside surprise in terms of profits and dividends if metal and oil prices in particular keep rising, or at least stay firm, and shows how the FTSE 100 could be an interesting index if central banks are wrong and the economic upturn brings a sustained bout of inflation along with it.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.