On 24 September 1869 Wall Street experienced what was dubbed Black Friday. Equity markets fell by 20% over the next week, roiled by the US government selling down its gold holdings, a move that should not have been a surprise, given it was the government’s policy. Fast forward almost 150 years to 24 September 2018 and Technology and Consumer Discretionary Index Funds will be sellers of approximately $10bn of shares across 24 stocks, representing around a half of the average daily trading volume for these companies. This is likely to have little impact on the market, as the fundamentals of the companies are unchanged and the sales have been flagged in advance, so in theory buyers should materialise for these shares. However, we believe there is a small chance of a large downward move in share prices for these companies if the trading is not handled correctly by the ETF providers.

It is all down to index providers MSCI and S&P. In 1999 they developed a company classification system called GICS (Global Industry Classification Standard), to determine if, for example, a company was an Energy company or a Utility company. The key factor determining the classification of a company is where it derives its revenues, however there is a qualitative overlay from a team of analysts to determine if this classification is correct.

Although this process is fairly robust, from time to time the classification of companies is fairly subjective and needs refreshing.

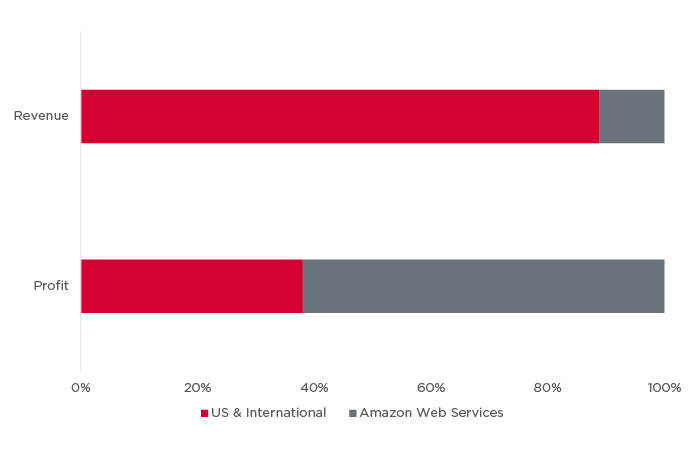

Amazon generated $103.9bn of net revenue in the first six months of 2018. Around 90% was from its website selling things to consumers around the world, with the remaining 10% coming from its cloud services known as AWS. As such, GICS classify Amazon at its most granular level as an Internet & Direct Marketing Retailer, which at the higher classification level is part of the Consumer Discretionary sector. This seems reasonable based on the revenue split, however, when looking at profits, the picture is reversed - $3bn of its $4.9bn profit for the first six months was generated by its cloud division – making it look much more like a Technology company.

Segmental breakdown of Amazon net sales and operating profits.

Source: Amazon

When these classifications were developed 19 years ago, it would have been hard to imagine that such a large portion of funds would select their holdings based on the GICS classification of a company. A Technology ETF tracking an MSCI or S&P benchmark will determine which companies to invest in based on the GICS classification.

In essence the ‘active’ decision of which stocks to invest in has been made by the index provider and its classification methodology. If GICS decided Amazon should be a Technology company rather than Consumer Discretionary, then all Technology ETFs would have to purchase Amazon.

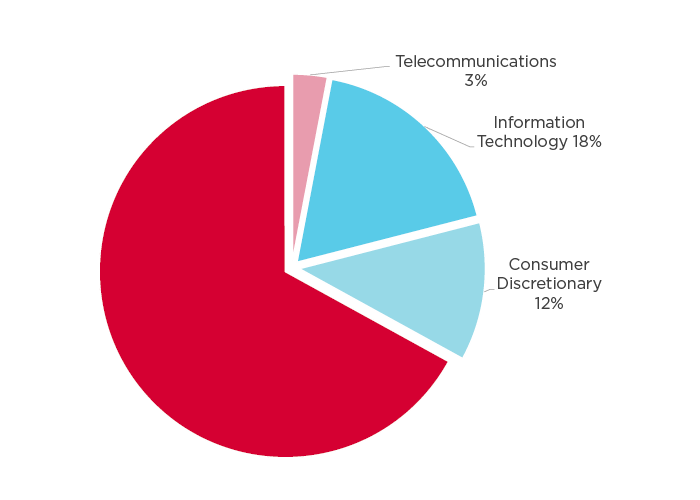

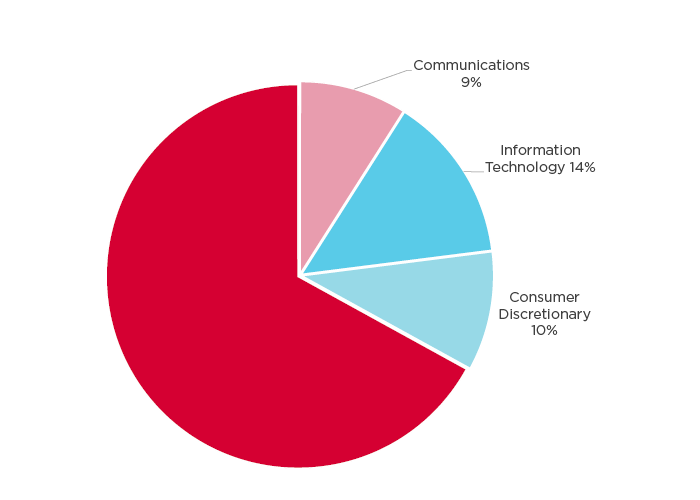

GICS is making a substantial change to its classifications on 28 September. These will be enacted by S&P indices on 24 September, followed by MSCI indices in November. Any ETFs tracking these indices will have to make large purchases and sales to mirror the new breakdown. Overall, 9% of the MSCI All Country World Index is being moved into new sectors, including the creation of a new Communications sector. It largely affects the Technology and Consumer Discretionary sectors, where stocks such as Facebook, Alphabet (currently Technology) and Netflix (currently Consumer Discretionary) will form part of the new Communications sector.

MSCI ACWI Sector Composition

Source: MSCI

These changes have been estimated by Credit Suisse to affect more than 20 ETFs with over $70bn of assets under management. Technology ETFs will be forced sellers of $1.5bn of Facebook shares and $2.5bn of Alphabet shares, over half of the average daily traded volume. ETFs will want to implement these changes in a timely manner to reduce the chances of a return difference versus the index, at the same time they will need to be careful not to move the share price significantly. We have not seen such a large reclassification of companies in recent history and as a result, it is also the first time we will see such a material, point in time change of the underlying holdings of passive ETFs.

It is important to understand the growing influence of index providers in capital markets as more and more investments switch to passive implementation.

When selecting the ETFs that we invest in for our passive funds and MPS we look beyond the headline cost of the ETF, also placing a focus on the construction of the index the ETF tracks. We currently hold investments in the iShares S&P 500 Information Technology ETF. This fund has assets of $1.5bn, substantially smaller than the SPDR Technology Select ETF with assets of $22.8bn. The smaller size of the iShares ETF should make it easier for it to make the necessary changes in a timely manner, although we believe there is an outside risk that the share prices of Alphabet and Facebook could fall significantly if not handled with care by the capital market teams of both BlackRock and State Street. We are engaged with both ETF providers and if we are not satisfied with how the trades will be handled, we will look to switch to an alternative product – for example, Vanguard has already started to make the changes to its ETFs ahead of the index change dates.

As a multi-passive asset manager with a choice of ETFs and index funds at our disposal, we are in an advantageous position compared to multi-passive funds implemented with just their own products – alongside making sure the funds represent good value for money, we are able to navigate potential liquidity challenges in the passive landscape, which remains a key concern for many investors nervous about using passive instruments in their portfolios.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.