As regular readers will know, one of this column’s favourite market sayings comes from fund management legend Sir John Templeton, who once asserted that “Bull markets are founded on pessimism, grow on scepticism, mature on optimism and die on euphoria.”

Applying this test can potentially help advisers and clients spot where value and future upside opportunities can be found and – just as importantly – avoid areas which are so popular they could be overvalued and capable of doing damage to portfolios.

“History suggests that advisers and clients would do well to ponder Warren Buffett’s aphorism that ‘you cannot buy what is popular and do well’ after the last year’s strong returns from ‘risk-on’ asset classes.”

It is not easy to research an asset class, country or individual stocks, or what may be suitable funds, when no-one else is interested. It is harder still to avoid those which everyone is talking about with great excitement and resist ‘fear of missing out’. History suggests this is the best way to make premium long-term returns, as per Warren Buffett’s aphorism that “you cannot buy what is popular and do well”.

The last 12 months are a fine example of how some careful, but not wilful, contrarian research could have yielded rich rewards. As the pandemic began to make its presence felt, share prices plunged, oil collapsed into negative territory and Government bonds’ haven status meant their prices rose and yields fell. Cryptocurrencies were tossed aside amid the general panic, too.

Yet wind on a year, and equities are beating bonds hands down, with commodities not far behind. Technology is no longer the leading equity sector and defensive areas such as healthcare are relatively out of favour. Commodities (with the notable exception of precious metals) are doing well and cryptocurrencies are going bananas, as evidenced by the flotation of America’s leading crypto exchange just last week.

Studious analysis of these trends may therefore help advisers and clients to spot value and dodge the traps that the coming 12 months and beyond may offer.

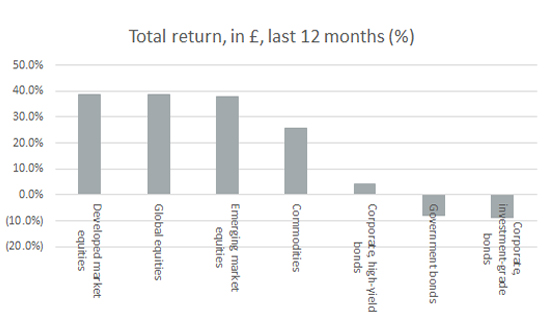

“Incredible as this would have seemed a year ago, ‘risk’ assets are showing the best total returns in sterling-denominated terms over the 12 months, as equities and commodities easily outpace bonds.”

Incredible as this would have seemed a year ago, ‘risk’ assets are showing the best total returns in sterling-denominated terms over the 12 months, as equities and commodities easily outpace bonds. Within fixed income, the riskiest option – high-yield corporate paper – continues to lead Government and investment-grade corporate debt.

‘Risk’ assets are handily outperforming ‘haven’ ones

Source: Refinitiv data. Covers period 16 April 2020 to 16 April 2021

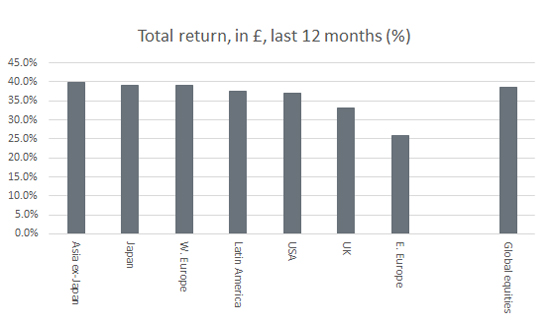

Within equities, Asia and Japan are doing best, perhaps owing to the relatively limited impact of COVID-19 upon their populations’ health and their economy, at least compared to the West and certain key emerging markets. In addition, Asia had learned from prior outbreaks such as SARS and swine flu and was, in many cases, better prepared as a result. Emerging markets overall are coming in from the cold (in another win for contrarians), and America’s dominance of the geographic performance tables is waning a little, too (likewise).

Asia and Japan are doing the best of the major geographic options

Source: Refinitiv data. Covers period 16 April 2020 to 16 April 2021

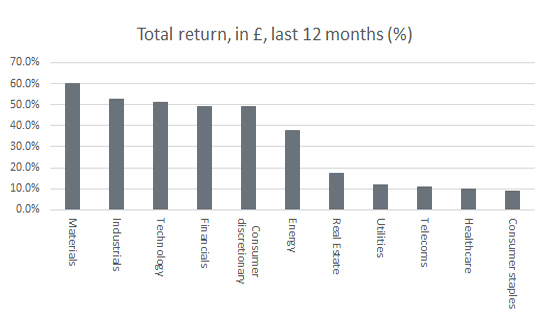

By equity sector, it felt like technology was the only game in town a year ago, with defensive areas like healthcare also proving popular. Yet cyclical, turnaround sectors now lead the way, with defensives and income-generating bond proxies lagging badly.

“All of this fits the prevailing narrative that the combination of vaccination programmes, Government fiscal stimulus and ultra-loose monetary policy from central banks will see the economy through the pandemic and provide a firm base for a robust economic recovery.”

All of this fits the prevailing narrative that the combination of vaccination programmes, Government fiscal stimulus and ultra-loose monetary policy from central banks will see the economy through the pandemic and provide a firm base for a robust economic recovery.

Cyclicals are outperforming growth-oriented and defensive sectors

Source: Refinitiv data. Based on the S&P Global 1200 indices. Covers period 16 April 2020 to 16 April 2021

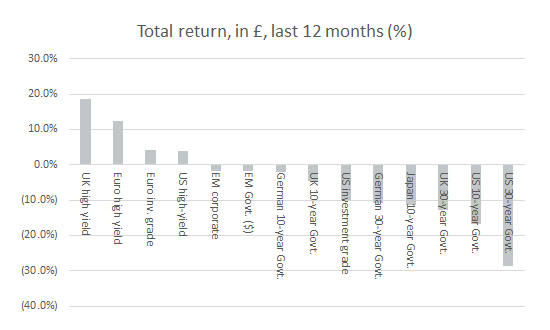

So too do the losses on long-duration Government bonds and the outperformance of high-yield debt. The latter tends to correlate more closely to equities than it does fixed income. A strong economic recovery would help to bring financially-stretched firms back from the brink and leave them better placed to meet coupon payments and return principal upon maturity of their debt.

High-yield debt is benefiting from hopes for an economic upturn

Source: Refinitiv data. Covers period 16 April 2020 to 16 April 2021

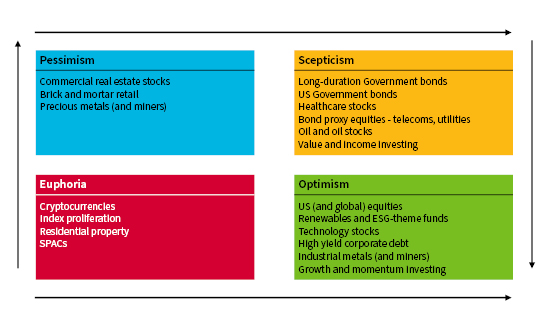

Analysis of those performance statistics means this column currently sees the major asset classes like this as we head into summer 2021, using Sir John Templeton’s four phases as a framework.

Sir John Templeton’s four market phases as seen today

“Euphoria – and optimism – are a lot easier to find than they were a year ago. This is not to say that markets are primed for a collapse, but it may not take much to shake them up a bit as a result.”

Euphoria – and optimism – are a lot easier to find than they were a year ago. This is not to say that markets are primed for a collapse, but it may not take much to shake them up a bit as a result (even if the debt-laden Archegos and Greensill affairs are raising surprisingly few alarm bells so far, given the importance of borrowing to the foundations of both the global economy and the risk-on rally of the past year).

Scepticism pervades fixed income and Government debt, so any adviser or client who fears disinflation or deflation more than inflation could take this as a cue to top up allocations. Conversely, anyone who sees the world returning to normal pretty quickly could seek out value on commercial property stocks or funds, especially those with exposure to office space, while those portfolio builders who are wary of a market wobble – and suspect that central banks will respond with ever greater monetary largesse – may note with interest the underperformance of gold and miners of precious metals.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.