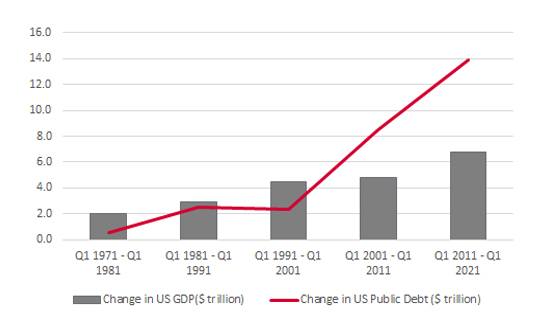

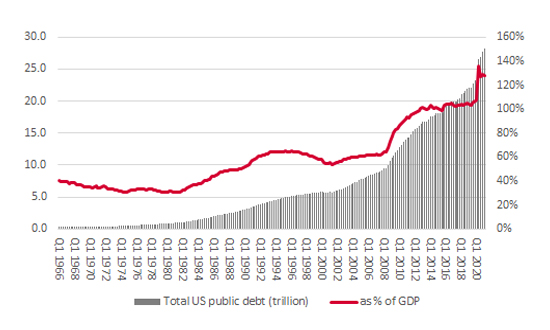

During the first 200 years of its existence, the US accumulated a cumulative federal debt of $1 trillion, the equivalent of 30% of its GDP. In the last 40 years, that figure has surged to $28 trillion.

The good news is that the US economy has grown too, as annual GDP has advanced from around $3 trillion to $23 trillion. As a result, America’s national debt-to-GDP ratio has therefore grown from roughly 30% to 128% and that is bad news for two reasons.

Extra debt is generating progressively lower returns in GDP

Source: FRED – St. Louis Federal Reserve database

US debt-to-GDP continues to surge

Source: FRED – St. Louis Federal Reserve database

“It is hard to escape the conclusion that the Fed needs to keep interest rates low to help the US Government fund its record debts and support financial markets, while it also needs to raise them to keep a lid on inflation, support the dollar and maintain its credibility with investors.”

Whether you side with Reinhart and Rogoff or their detractors, the challenge that faces the US Federal Reserve is undeniable.

“In the end, every option available to the chair Jay Powell and President Biden may help in some areas but do damage in others, as if to confirm the view of Stanford University professor Thomas Sowell that “There are no solutions, only trade-offs.””

Advisers and clients now have to assess which way they think the Fed (and the White House) will go and to what degree the central bank’s ultimate policy path is priced into bonds, equities, commodities and currencies. In the end, every option available to the chair Jay Powell and President Biden may help in some areas but do damage in others, as if to confirm the view of Stanford University professor Thomas Sowell that “There are no solutions, only trade-offs.”

To make a reasoned decision here – and then draw up an appropriate asset allocation – investors will need to think like the Fed and its officials. History is very clear that there are only four ways out once a national debt reaches the US’s current levels, relative to GDP.

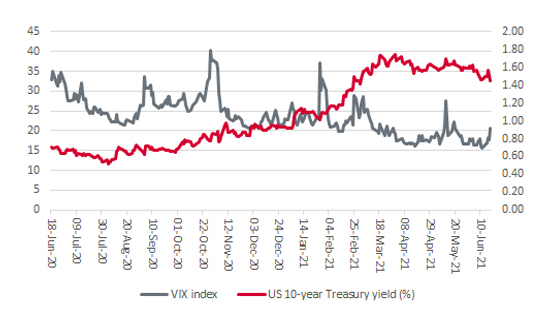

If growth is unlikely (or at least relies on wanton Government borrowing and overspending), then inflation may still be the likeliest outcome, but the Fed will not want to tighten policy too far, too fast. Just look at how financial markets are welcoming talk of two Fed rate hikes to the far-from-challenging level of 0.75% by the end of 2023. Equity and commodity prices are wobbling and volatility indices such as VIX are moving higher.

The VIX, or ‘fear index’, is creeping higher again even as bond yields slide lower

Source: Refinitiv data

“US ten-year Treasury yield is going lower, the last thing you would expect if inflation is coming, especially when yields are already miles below the current rate of increases in the cost of living.”

Yet the US ten-year Treasury yield is going lower, the last thing you would expect if inflation is coming, especially when yields are already miles below the current rate of increases in the cost of living.

These trends may not be as mutually exclusive as advisers and clients might think.

Perhaps the bond and stock markets are getting ready for the return of volatility and bumpier times ahead. But then the chances of the Fed raising rates or hauling in QE may recede further, as the end of the debt-fuelled bull market and economic upturn would surely be seen as deflationary and any policy response would have inflation as its ultimate goal.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.