The start of the new school year is traditionally the time that offices, which languished half empty over the long summer holidays, are suddenly bustling with life. Lunch dates are made, career catch-ups scheduled and goals recalibrated. This year, COVID threw everything up in the air and everybody’s watching to see where the pieces will eventually settle.

As of 19 July, the Government’s work from home guidance has been withdrawn but, unlike last year, it’s not been replaced with public calls for a swift return to the office. Businesses are being left to set their own agenda and many are in no hurry to issue that particular call now, if ever.

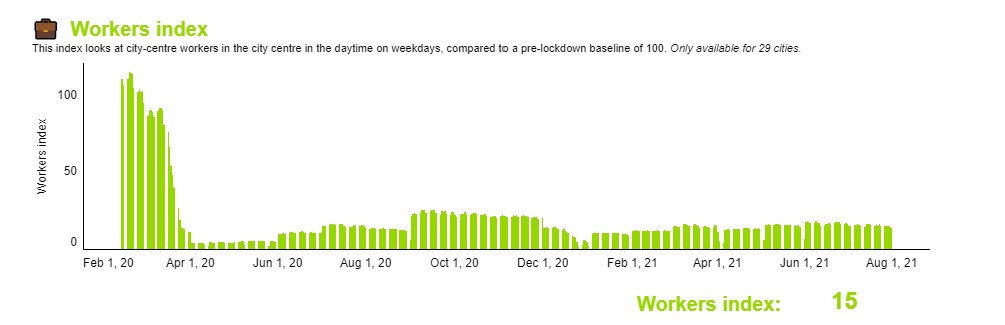

City centre workers still shun the office post-freedom day

Source: Centre for Cities

Company after company has been lining up to announce plans to embrace the hybrid work model on a permanent basis.

Perhaps it’s the uncertainty of what the autumn might bring and how the Delta variant might feature, perhaps it was the timing, coming just at the start of the summer holiday season, but Freedom Day didn’t spark the mass return of the white-collar worker.

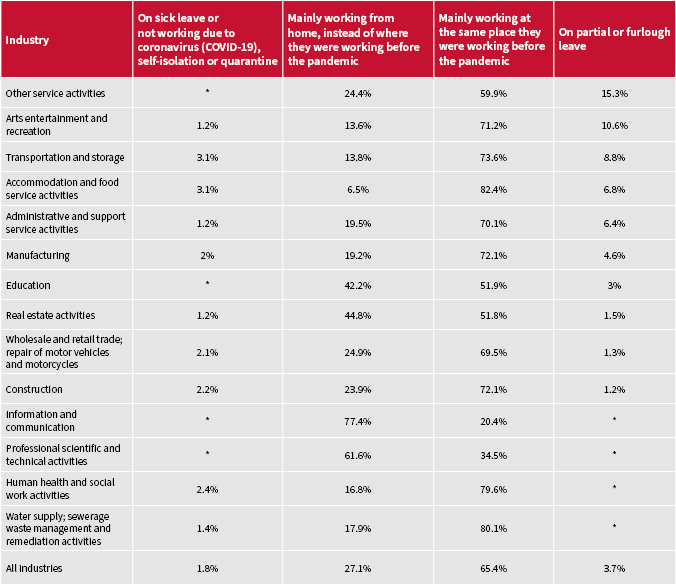

In fact, company after company has been lining up to announce plans to embrace the hybrid work model on a permanent basis. Some, like BP (BP.) and KPMG have said they do expect employees to sit at their desks for at least a couple of days every week, others like Deloitte and most recently Premier (PFD) Foods have said people should make their own decision about where they work best.

Working arrangements broken down by industry – 12 July to 25 July 2021

Source: ONS

There will be losers, not least businesses in our towns and cities that rely on office trade. With footfall repressed, spend is a fragment of what it was before the first lockdown and it seems unlikely it will ever return to what it was.

It doesn’t work for every sector but, after years of half-finished discussions about the pros and cons of a flexible workforce, the pandemic forced change in sectors that could change and for many the change has been good. Employers are eyeing the potential savings they can make on building costs and many employees have found a new work-life balance that they’re loathe to give up.

There will be losers, not least businesses in our towns and cities that rely on office trade. With footfall repressed, spend is a fragment of what it was before the first lockdown and it seems unlikely it will ever return to what it was. Advisers would love a crystal ball, a way to give themselves and investors a glimpse into the future. Past performance can’t quite oblige but it does give us an indication of how markets have sized up direction of travel.

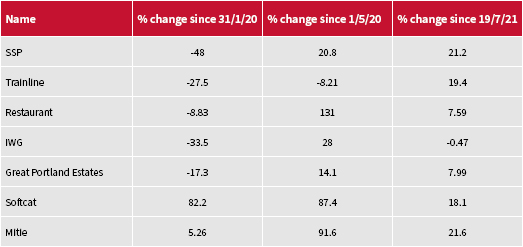

The winners and losers of the office shutdown

SOURCE: Sharepad

Cast your mind back to that first lockdown, the surreal full stop to everyday life. Very few businesses escaped a drubbing as people were told to shore up in their homes, only travelling for work if that work was considered vital for the country to keep ticking over.

Streets were suddenly empty and share prices tumbled as investors adjusted their portfolios, seeking out growth in the few sectors that suddenly became very busy. IT infrastructure provider Softcat (SCT) helped firm after firm set up secure, cloud-based solutions so their business could continue from kitchen tables and bedrooms. Similarly, Mitie (MTO) kept essential workspaces clean and secure.

Homeworking was expected to be a blip, a temporary experiment that would be remembered fondly at the next Christmas bash. By May, many advisers and investors were thinking ahead – which businesses would benefit from the return of the status quo? – because that’s exactly what most people expected: that the lockdown would lift, and normal service would be resumed.

Perhaps there was a spot of bargain hunting as well, which helped turn around fortunes in shares of businesses that love office footfall, like SSP (SSPG) and The Restaurant Group (RTN) and office providers from the traditional, like Great Portland Estates (GPOR) to the flexible, like IWG (IWG).

Each decision will be watched and weighed, not only from within but also by competitors… Can employers get away with paying less to workers desperate to avoid the commute?

Fast forward and post-Freedom Day share prices hint that advisers and investors are in flux, believing the most likely scenario to be a partial return to what was. Long-term leases and the need for businesses to bring their people together seems to suggest that the era of the bespoke office isn’t over altogether; rent collections have been fairly resilient and, in the short term, many firms will be prevented from exploring the kind of flexible options offered by the likes of IWG.

There’s plenty to work through and each decision will be watched and weighed, not only from within but also by competitors. What works, what’s productive, what stifles and what inhibits new recruits from learning, from climbing the ladder. Can employers get away with paying less to workers desperate to avoid the commute?

Lockdowns changed things. The Intel CEO Pat Gelsinger had it right – he said: “If you have a little blip, people go back to the old way. Well, this ain’t a blip.” But what’s the new way and how much of the old way will drift back in? One thing that could change the soft slide backwards is another full stop, another lockdown, and it will be even harder to expound the benefits of the old.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.