You don’t need a degree in finance to understand that both company earnings reports and major economic indicators/events influence the investing landscape.

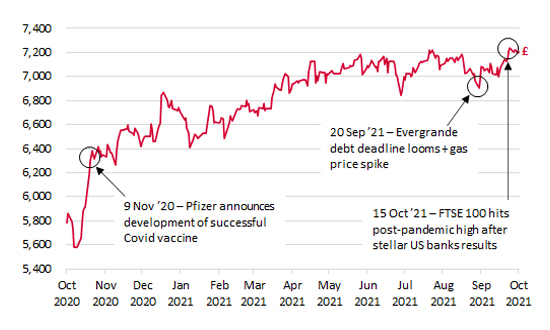

However, looking at how London markets have performed over the last – complicated – 12 months, it’s interesting to dig into those peaks and troughs and explore trends. Just weeks ago, at the start of the latest round of company earnings, the FTSE 100 surged to a pandemic high despite ongoing concerns about supply snarl-ups and rising prices.

Events that shook the FTSE 100 over the last 12 months

SOURCE: Sharepad/ONS/Company results/AJ Bell

US banks in particular exceeded expectations, but it wasn’t just banks and it wasn’t just US companies reporting forecast-busting figures. It’s not surprising that stellar results whet investor appetites.

“Investors are pretty good at picking up cues and pricing them in.”

They’re straightforward and immediate. If profits and earnings are up, there’s an instant catalyst to buy and vice versa when the numbers disappoint.

The X-factor is surprise. Advisers and investors are pretty good at picking up cues and pricing them in, so often it’s more about how a company does relative to expectations rather than how it makes out in absolute terms. Sometimes just meeting expectations will disappoint investors.

Updates from individual firms may have a significant impact on their own share price but a limited one on the wider market in isolation. However, in combination, a results season can set the tone for the markets.

Economic data typically acts more like a drip, drip of incremental news which gradually shifts investor sentiment in different directions. Often, individual releases like GDP figures don’t tend to make big ripples unless there’s a major upset.

“It can take days or even weeks for the ramifications [of big events] to really permeate.”

For example, China’s latest growth numbers unsettled many people but that’s because any slowdown seems unusual, and they came off the back of events which have already impacted sentiment towards China – from the tech crackdown in May to the Evergrande debacle that came to a head in September.

Both of those events in singularity took time to permeate through to big market movements, primarily because it was hard to know immediately what the situations might mean; it can take days or even weeks for the ramifications to really permeate. It buys advisers and investors time, and gives them breathing space to make adjustments in their portfolios and to get comfortable with the winds of change.

It’s why the anticipated interest rate hike from the Bank of England which has received so many column inches has seemingly had a modest influence on markets so far.

Even when it comes, it’s unlikely to merit much of a move, unless the MPC (Monetary Policy Committee) goes bonkers and shoots for a whole 1% all in one go, but that’s about as likely as the UK experiencing a white Christmas in June.

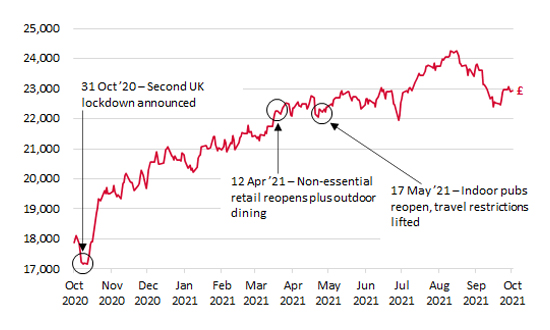

Events that shook the FTSE 250 over the last 12 months

Source: Sharepad/ONS/Company results/AJ Bell

The more UK-facing FTSE 250 index has endured a year of uncertainty. COVID hasn’t run in a smooth line, lockdowns have had to be re-implemented, ‘Freedom Days’ have had to be shifted and sometimes the expected benefits are undone by crises like the ‘pingdemic’, which saw many businesses scrabbling to find the staff they needed just to keep operations going.

When the economy has enjoyed a smooth run, when the recovery juggernaut ploughed through, the FTSE 250 soared; its domestic companies expected to benefit from a return to something like business as usual.

Gas prices, on the other hand, nestle between the two extremes. On the one hand, rising prices and the impact they were having on energy providers could be clearly seen. The energy cap was going up, and small providers were dropping like flies.

“The next six months are shaping up to bring more of those heart-stopping, unexpected moments that markets hate to love.”

But it was a single day, a day of extremes, that made waves. This was one day when global affairs leaked into the domestic humdrum. After a 37% jump in 24 hours, the gas price cooled as the Russian president stepped forward and seemed to imply more supply would be forthcoming to Europe. Whether his words were sincere, or simply more politics, is still to be seen but it certainly added up to a rollercoaster 24 hours.

Forget the next twelve months, the next six months are shaping up to bring more of those heart-stopping, unexpected moments that markets hate to love and many more of those priced in economic set-pieces.

And for the next quarterly results – the judgement is still out on that one… Even among companies that have beaten analysts’ estimates, there have been warnings that margins are set to be eroded, and that supply issues and inflation will take their toll. Advisers and investors love certainty but in the unexpected there are opportunities as well as potholes.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.