Legendary US journalist Edward R. Murrow may be best known for the line which he used to end his broadcasts – “Good night, and good luck” – but this column’s favourite comment of his goes “Anyone who isn’t confused really doesn’t understand the situation.”

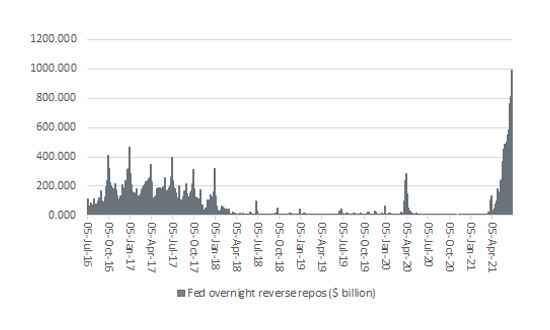

Well, there is one particularly confusing situation out there in the narrow world of financial markets right now, and that is the US overnight (reverse) repo market. This may sound esoteric, but it is not, because a reverse repo is the direct opposite of quantitative easing (QE), in that it drains cash from the banking system, and the US Federal Reserve is using reverse repos in vast quantities even as it continues to run QE at $120 billion a month.

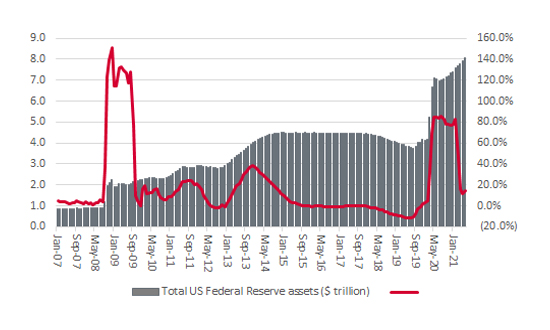

US Federal Reserve assets now exceed $8 trillion

Source: FRED – St. Louis Federal Reserve

“The US Federal Reserve is using reverse repos in vast quantities to drain liquidity from markets and the US financial system even as it continues to run QE at $120 billion a month.”

That programme means the US central bank’s asset base now exceeds $8 trillion, or more than a third of US GDP, for the first time ever. But as fast as the Fed is pumping liquidity into the system with one hand, it is taking it away with another.

Confused? You should be.

By way of a reminder…

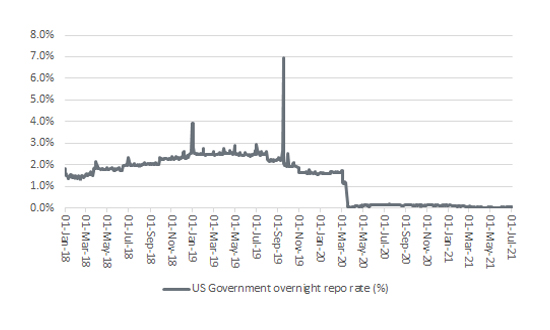

US repo rates spiked in 2019 but have ground ever lower since

Source: Refinitiv data

“At the last count, the Fed’s outstanding reverse repo liabilities were $791 billion, the equivalent to six a half months of QE.”

Fed reverse repo deals have spiked in the past three months

Source: FRED – St. Louis Federal Reserve

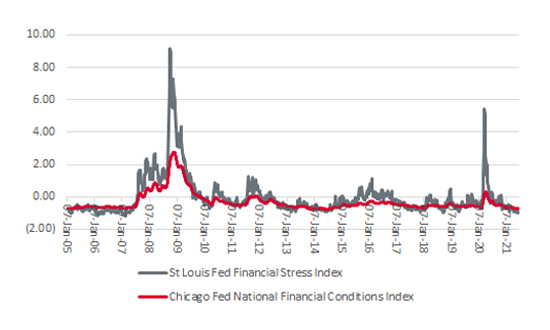

Perhaps the US Federal Reserve is laying the groundwork for tightening monetary policy after all and taking these initial steps to test how financial markets (and the economy) will react. The answer appears to be ‘so far, so good’ on both counts. The S&P 500 trades at record highs while there is no sign of financial stress anywhere in the system, at least according to the tried-and-tested St. Louis Fed Financial Stress and Chicago Fed National Financial Conditions indices. Both are trading very close to their all-time lows.

US economy is showing no signs of financial stress at all

Source: FRED – St. Louis Federal Reserve

“This initial foray into tightening policy could be seen by Fed officials as a success since neither financial markets nor the economy appear to be wavering. But any business model or asset valuation that is being goosed by zero-interest-rate policies (ZIRP) and QE will face bigger tests if the Fed really is going to surprise the markets and tighten monetary policy, no matter how gently.”

This has several potential implications.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.