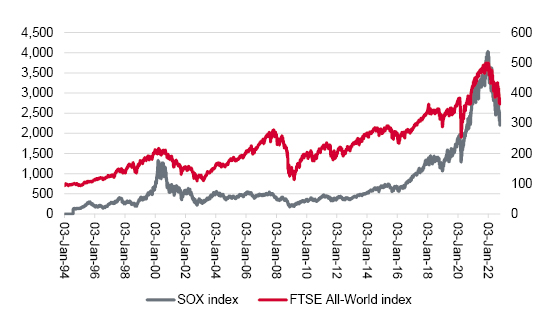

Regular readers of this column will be well aware of its faith in the Philadelphia Semiconductor index, or SOX, as a valuable indicator on two fronts.

This all makes the imminent third quarter reporting season from the global chipmakers and chip equipment makers particularly important, again for two reasons:

“A string of weak earnings reports or – even worse – downbeat outlook statements for the fourth quarter and 2023 could reinforce bear cases for the economy and equities. Equally, bulls will counter that the opposite could hold true, especially as the big slide in chip stocks’ valuations may suggest a good deal of bad news is already expected and discounted.”

A string of weak earnings reports or – even worse – downbeat outlook statements for the fourth quarter and 2023 could reinforce bear cases for the economy and equities. Equally, bulls will counter that the opposite could hold true, especially as the big slide in chip stocks’ valuations may suggest a good deal of bad news is already expected and discounted.

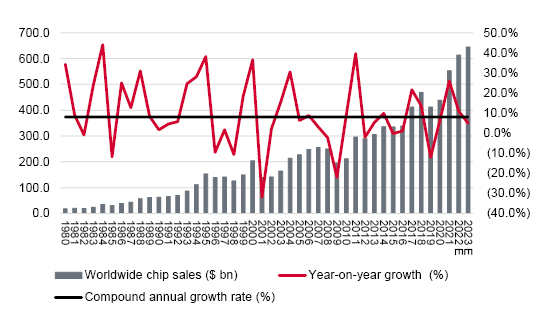

“Global silicon chip sales have shown an impressive 8% compound annual growth rate over the past 40-odd years, a figure which easily surpasses worldwide GDP growth trends. However, the industry is notoriously boom-and-bust.”

Global silicon chip sales have shown an impressive 8% compound annual growth rate over the past 40-odd years, a figure which easily surpasses worldwide GDP growth trends. However, the industry is notoriously boom-and-bust.

Is the latest chip boom about to become a bust?

Source: WSTS, SIA, Gartner

This is due to either one, or a combination of:

“The good news is industry bodies such as the WSTS and SIA are not forecasting a bust for 2023, with 5% sales growth in the consensus forecast. The bad news is the scene may be set for a bust after all.”

The good news is industry bodies such as the WSTS and SIA are not forecasting a bust for 2023, with 5% sales growth in the consensus forecast.

The bad news is the scene may be set for a bust after all.

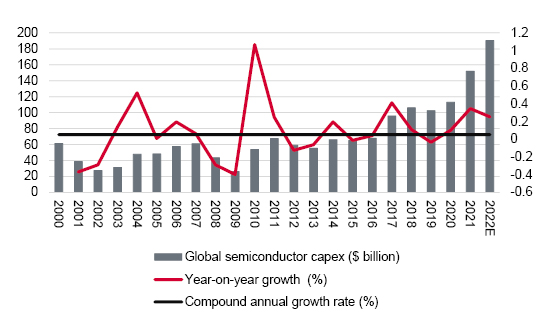

Investment in new chip-making capacity is booming

Source: WSTS, SIA, SEMI

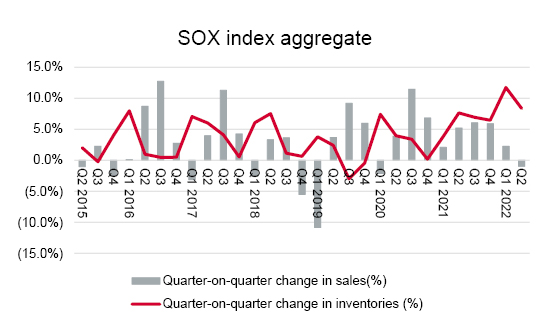

Surge in inventories suggests end demand is weakening …

Source: Company accounts, for all 30 members of the SOX index

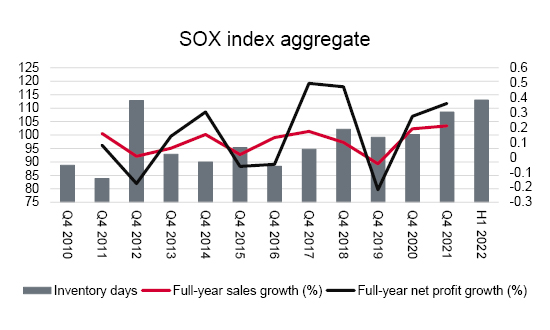

… and inventory days stand at a ten-year high

Source: Company accounts, for all 30 members of the SOX index

“The most important part of the third quarter results season may not be the headline third quarter profit figures or any revenue and profit guidance from management teams for the final quarter of 2022, but the third quarter balance sheets.”

In this respect, the most important part of the third quarter results season may not be the headline third quarter profit figures or any revenue and profit guidance from management teams for the final quarter of 2022, but the third quarter balance sheets. Any sign that inventories are on the way back down could be a good sign for the chip companies, and indeed for global end demand. But any increases could be a worrying one, especially if unsold stocks of chips outstrip sales growth and lead to another increase in inventory days.

It may be that chip firms have intentionally stockpiled products in the wake of 2020 and 2021’s shortages, but they will be hoping that end demand holds up. If it doesn’t then chip and chip-equipment makers may have a big problem on their hands, although consensus forecasts for 2023 are already looking for just a 4% increase in sales and flat net profit.

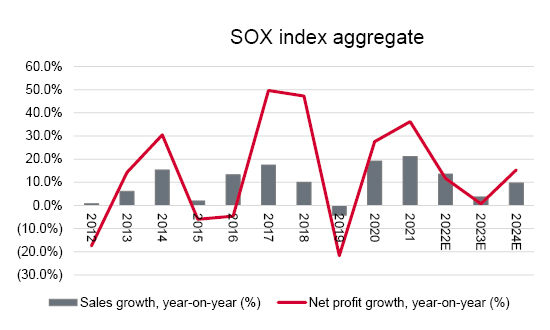

Analysts already expect a SOX slowdown in 2023

Source: Company accounts, for all 30 members of the SOX index, Marketscreener, analysts’ consensus forecasts

A forward price/earnings multiple of 15 times for 2023 and 13 times for 2024 looks interesting, but that assumes the earnings forecasts are accurate (and the underlying premise of broadly flat operating margins of 36% from 2022 to 2024 does look flawed given the industry’s volatile history). It now remains to be seen whether the SOX retains its status as a valuable early-warning signal of better or worse economic and stock market conditions ahead. Peaks in the SOX called broader market tops in 2000 and 2006 and bottoms heralded better times ahead in 2002, 2008, 2018 and 2020.

Analysts already expect a SOX slowdown in 2023

Source: Refinitiv data

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.