For the last ten years active fund managers in the UK have been under the pump. In that time the amount of money held in passive index trackers has doubled, from 9% of UK industry assets to 21%, according to Investment Association data. Last year retail investors withdrew £25.7 billion from all investment funds, the worst figure on record by a country mile. But even then, tracker funds saw £11 billion of money coming in from retail investors, which implies that active funds suffered a staggering £36 billion of outflows. To put that in some context, during 2008, which witnessed the mayhem of the Lehman’s Brothers collapse, retail investors still ploughed £4.8 billion into investment funds. 2022 redefined what a bad year means for the active fund management industry.

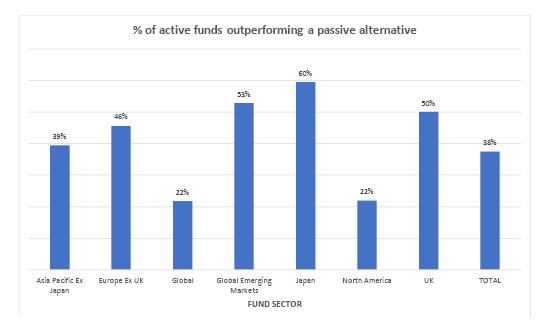

Over the last ten years, only 38% of active equity funds outperformed the typical passive alternative across seven key investment sectors, which doesn’t exactly put bums on seats.

Latest figures from AJ Bell’s Manager versus Machine report go some way to explaining this trend. Over the last ten years, only 38% of active equity funds outperformed the typical passive alternative across seven key investment sectors, which doesn’t exactly put bums on seats. Results were particularly poor in the widely-held global sector, where only 22% of active funds have beaten the passive machines over the last decade. The same goes for the similarly popular North American sector, where again just 22% of funds have outperformed a comparative tracker fund. These results do not paint active managers in the best light, to say the least, but it’s important to draw reasoned conclusions from the data, rather than simply characterising active managers as money-grabbing charlatans. Indeed, there are some mitigating factors which go a long way to explaining why active managers have not done very well compared to passive competitors over the last ten years.

Percentage of active funds outperforming a passive alternative

Source: AJ Bell, Morningstar

In theory, active managers raise the overall market return in the long run by allocating capital more efficiently, so even passive investors probably owe them some gratitude.

The first thing to consider is that not all active managers can outperform the market, and by extension, passive funds tracking the market. The market return is made up of the activity of all investors, and many of them are still active. In theory, active managers raise the overall market return in the long run by allocating capital more efficiently, so even passive investors probably owe them some gratitude. However, when it comes to active managers’ performance versus the market, there have to be some losers, and that’s before charges are taken into account. The typical active equity fund costs around 0.7% more per annum than a tracker, and that’s a deficit that needs to be made up before investors receive any performance benefit. So, expectations suitably lowered, we can turn to the reasons why active managers have found the last ten years particularly hard.

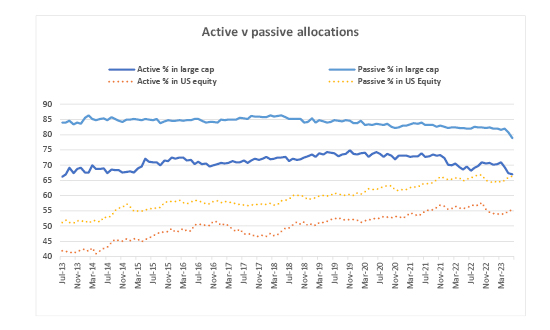

The global fund sector plays an outsized role in the poor overall showing from active managers, simply because of the sheer number of funds in this sector. If fund managers in this area were pulling their weight, rather than just 22% of them outperforming, the overall proportion of active managers beating a passive alternative would be nudging up to a more respectable 50%, which might be viewed as a neutral position. But in the global stock market, the last decade has been characterised by two long-running trends which have favoured a passive way of investing. Namely the dominance of US stocks, and large cap stocks. Global fund managers have been underweight these two winning areas compared to their passive peers as the chart below shows. Outperformance from these market segments has therefore boosted global passive funds at the expense of their active competitors, rather than it simply being a case that active managers are hopeless at picking good stocks for investment.

Active vs passive allocations

Source: AJ Bell, Morningstar

Bizarrely though, global fund investors might not be too miffed, even if they’ve got a fund that has underperformed the average passive machine.

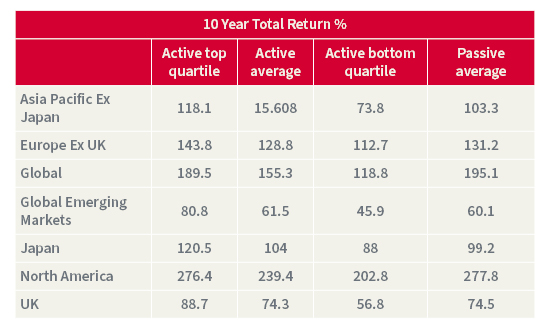

Bizarrely though, global fund investors might not be too miffed, even if they’ve got a fund that has underperformed the average passive machine. That’s because performance from this sector has been so strong, that absolute returns have been pretty spectacular, as the table below shows. Even bottom quartile global funds have doubled investors’ money over the last decade, and have returned more than top quartile funds in the UK, Global Emerging Markets and Asia Pacific ex-Japan sectors.

Active vs passive returns

Source: AJ Bell, Morningstar

Unlike many disciples of passive or active investment, private investors needn’t be dogmatic in their use of either strategy.

What this table also shows is that if you are able to pick better-performing funds, preferably in the top quartile, then you have a good chance of beating a tracker. There is of course, no sure-fire way to do this. But investors can tilt the odds in their favour by doing some research and weeding out some of the dross. One of the most important things to look for when picking an active manager is their performance track record. This isn’t a guarantee of superior returns going forward, but the longer an active manager has been able to showcase outperformance, the more this is likely to be a result of skill, rather than luck.

Unlike many disciples of passive or active investment, private investors needn’t be dogmatic in their use of either strategy. It’s possible to mix and match active and passive funds within a portfolio, perhaps picking active managers you have a great deal of confidence in, and then gap-filling using trackers. It’s also worth noting there are some areas that are not well-served by passive funds, or where outright performance is not the only goal, which probably favour an active approach. For instance, looking for opportunities in smaller companies, investing for income, or reducing volatility. Each approach has its own strengths and weaknesses, and ultimately active and passive funds are both tools at your disposal, rather than a rigid lifelong doctrine you need to cleave to.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.