The Market in Financial Instruments Directive (MiFID II) and Packaged Retail and Insurance-based Investment Products (PRIIPS) regulations have been in force for some time now, having come into effect in January 2018. A key purpose of their introduction was to improve transparency in relation to costs and charges across investment products through additional disclosure requirements. Specifically, asset management firms are required to disclose transaction costs incurred in the management of investors’ capital within their products.

This additional disclosure is designed to help investors make informed choices. In this article, we will look at an overview of how these costs are calculated and what they mean for fund investors.

It is important to note that these disclosures are not reflective of any new additional costs. Transaction costs have always been incurred in managing a fund, just as they would be if an individual was managing a portfolio of investments themselves. It is simply that firms are mandated to fully disclose these costs within their products so that investors can assess the total cost of ownership for products.

Transaction costs represent the expenses of dealing in the underlying investments in a fund’s portfolio. Transaction costs for funds are made up of three parts:

In a simple form, the costs disclosed to investors can be calculated as follows:

total transaction costs = explicit costs + implicit costs – anti-dilution benefits

These are the ‘direct’ charges incurred through the purchases or sale of the fund’s underlying instruments. Typically, these are things such as commissions paid to brokers for execution, and taxes levied on listed instruments such as Stamp Duty in the UK.

As their name suggests, implicit costs are not directly incurred by the fund manager, rather, they are the inherent costs incurred while transacting within a marketplace. These represent the difference between the price of a security (mid-price) immediately before an order is placed in the market (this is sometimes called the ‘arrival price’), and the price that the trade is actually executed at. This difference is sometimes called ‘slippage’. Due to market movements, implicit costs can be positive or negative.

Large investor subscriptions or redemptions often mean that a fund manager is required to trade in the underlying portfolio, and the costs of this are borne by all investors in the fund rather than just the investors who have caused the trading. To combat this and protect investors from their investment being ‘diluted’ by these costs, funds use anti-dilution mechanisms to mitigate the effects of these costs.

For example, swing pricing, dual pricing or a fixed-dilution levy may be used to cover the costs of dealing from new transactions. The MiFID II and PRIIPS rules allow for the calculated value of anti-dilution mechanisms to be subtracted from overall transaction costs – but only up to the amount of dilution caused by trading activity. Fund managers using an anti-dilution mechanism may therefore disclose relatively low transaction costs.

The AJ Bell Funds ("the Funds") use a swing price mechanism, whereby transaction costs are included within the calculated price of a fund’s net asset value (NAV).

As a fund’s NAV price is calculated using the ‘mid’ value of the underlying assets, the mechanism is designed to reflect the cost of purchasing, or selling, the underlying assets of a fund’s portfolio within the marketplace. This is done by considering the difference between an asset’s ‘mid’ price and its ‘offer’ price, when purchasing, and its ‘bid’ price, when selling.

In practice, in the case of large purchases into the fund, the price will swing up, increasing the value of the investment, and in the case of large redemptions the price will swing down, lowering the value of the investment. In both cases the swing movement is designed to offset the costs incurred through transacting in assets of the portfolio because of capital flows in (or out) of a fund.

We believe that this is the most effective means of protecting all investors’ interests when it comes to the effects of transaction costs on an individual’s investment. This is distinct from a dilution levy that is charged separately to a fund’s price, whilst still included within the overall cost to an investor either redeeming or purchasing shares within a fund.

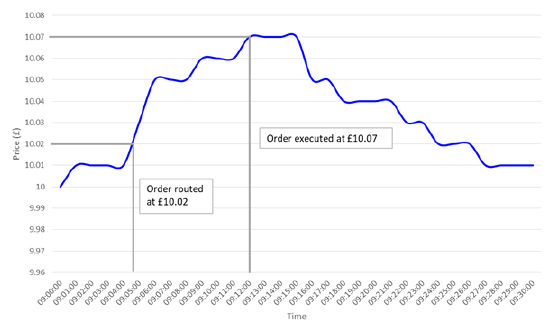

To show how transaction costs are calculated, let’s look at a theoretical example. In this example, a fund manager is purchasing 10,000 units of a security from a broker which charges a commission of 3%. The purchase is routed to the broker just before 9.05am and, at that time, the mid-price is £10.02. The price of the security is steadily rising, and when the broker executes the order at 9.12am, the mid-price is £10.07. This is shown in the graph that follows.

The explicit cost is the broker’s commission: 10,000 x £10.07 x 3% = £3,021

The implicit cost is due to the market movements: 10,000 x (£10.07 – £10.02) = £500

So, total transaction costs here are £3,521.

Our scenario showed the price for a purchase where the market was rising. If the price had fallen, then the implicit transaction cost would actually have been negative. This works the opposite way for sales – rising markets result in negative costs and falling markets show positive costs.

The level of transaction costs can be a measure of the execution quality obtained by a fund manager. Transparency has certainly been increased across the board, with some asset managers choosing to go further than regulations strictly dictate and disclosing transaction costs not just in funds, but also in model portfolios, as AJ Bell Asset Management does.

However, whilst it would be tempting to think that ‘smaller is better’, when comparing fund transaction costs you have to make sure that you are not comparing apples with oranges.

Aligned with our commitment to providing investors with cost-effective solutions, the AJ Bell Investments Team keeps a close eye on all costs incurred within the management of our funds. As a ‘fund of funds’ proposition, our Funds range implements its active asset allocation strategy through investment within passively managed strategies. As a result we would expect our costs to be typically lower than similar products that invest within actively managed funds whose portfolio turnovers are at a higher rate as part of their investment strategy.

Also, although we haven’t gone into the technical details in this article, there are some slightly different calculation methods for implicit costs, such as a different method for new (under three years old) funds, which can produce subtly different results.

Disclosure of transaction costs has provided another way for investors to compare funds. Although it can be a fairly complicated area, it pays to do your research beyond the headline numbers – as we have seen, there are some nuances to be aware of when reviewing these costs.

Finally, it is important to note that net performance includes all the costs discussed in this article and so, as well as looking at the total costs of a fund, analysis of net performance remains a robust method of assessment between different products.

Our full strategic asset allocation brochure is available to download, here. If you’re interested in a conversation on how the AJ Bell Funds or Managed Portfolio Service could complement your investment strategy, or simply want more insight into our portfolios, enquire with your local Business Development Team representative below.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.