The increased use of outsourced investment management means an ever-more complex web of relationships between advisers and discretionary fund managers (DFMs). The full nature of these arrangements is often misunderstood, and this may leave advisers exposed to substantial risks and liability in the event of client complaints – areas which may not be adequately covered by their professional indemnity (PI) insurance. In this article, we will explore the most common operating models used for adviser/DFM agreements and their consequences for advisers.

The administrative and regulatory burden of running in-house advisory model portfolios continues to put pressure on advisers. MiFID II and PROD requirements have made these problems even more acute. The alternative, where an adviser takes on discretionary permissions, brings similar risks, and is often seen as a realistic choice only for very large firms with sufficient expertise and resources.

As such, the use of multi-asset strategies and third-party DFMs is increasingly popular. There are a variety of ways that an agreement can be made between an adviser and DFM, and it is vital that all parties involved understand the practical implications. The two most typical scenarios are ‘Agent as Client’ (AAC) and ‘Reliance on Others’ (ROO).

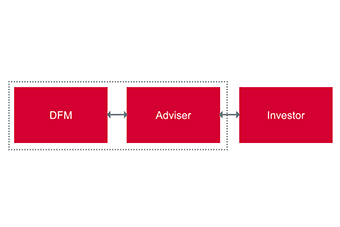

With an AAC arrangement (see COBS 2.4.3R), the investor’s ‘agent’ – their adviser – is fundamentally the client of the DFM. The adviser arranges for the underlying investor’s portfolio to be managed by a DFM, with no direct contractual relationship in place between the investor and the DFM. Rather, the investor’s adviser (the ‘agent’) holds the relationship with the DFM.

An AAC arrangement is shown in the diagram below, with the dashed line representing the DFM’s client relationship with the adviser; this does not extend to cover the investor.

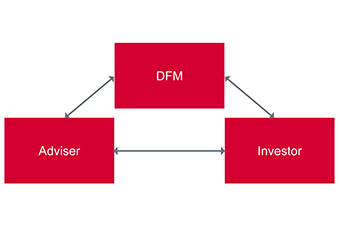

ROO (see COBS 2.4.4R) is an alternative operating model where, via a tripartite relationship, the underlying investor has a direct, contractual relationship with the DFM and, in turn, the DFM relies on the information provided to it by the investor’s adviser.

Operationally, there may seem like there are very few differences between AAC and ROO – certainly from the perspective of an underlying investor. However, these differing regulatory structures do have various implications for all of the parties involved and their responsibilities. One important example is suitability. Under an AAC arrangement, the adviser is responsible for the mandate and also the investment management to that mandate. With ROO, however, the DFM is responsible for the latter, with the adviser retaining responsibility for the suitability of the mandate.

This means that a complaint from an investor under an AAC arrangement may not be able to be brought against a DFM, and the adviser would instead be liable. There are potential consequences here in terms of risk and insurance cover for an adviser, which would need to be analysed carefully.

It is important to state that there is no ‘right’ or ‘wrong’ way to structure DFM/adviser relationships; the most suitable framework will depend on specific circumstances. In many cases, however, advisers may not even be aware which relationship they use with their DFMs.

Advisers should therefore analyse, in conjunction with their DFM and PI insurer, whether the appropriate paperwork and oversight procedures are in place to ensure robust compliance with regulatory requirements and the most critical consideration of all – ensuring the best outcome for underlying investors.

If you have any questions regarding AJ Bell’s investment and fund management solutions, please contact your local Business Development Team. We’d be delighted to learn more about your business and discuss how we can support you and your clients.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.