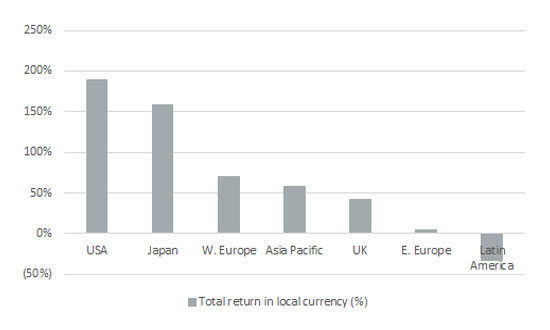

Investors with exposure to Japanese equities, following Tokyo’s Prime Minister Shinzō Abe departure for health reasons in September and his replacement by right-hand man and Liberal Democratic Party stalwart Yoshihide Suga, now have several questions to ponder. After all, the ‘Abenomics’ era – which began in December 2012 when Mr Abe returned to power five years after his first term ended with a sudden resignation – saw Japan’s headline Nikkei 225 index offer a total return (including dividend reinvestment) of 158% in local currency terms. That ranks Japan in second place out of the seven major geographic options available to investors over that time span, behind only the rampant US equity market.

Japan has been a strong performer during the Abenomics era

Source: Refinitiv data. Covers period of second Abe premiership, 26 December 2012 to 28 August 2020.

“Mr Suga has lot to live up to, and not just because he is replacing Japan’s longest-serving modern-day Prime Minister. The ‘three arrows’ of Abenomics are seen as having provided huge amounts of support to Tokyo’s financial markets.”

That leaves Mr Suga with a lot to live up to, and not just because he is replacing Japan’s longest-serving modern-day Prime Minister. The ‘three arrows’ of Abenomics – fiscal stimulus, monetary stimulus courtesy of interest rate cuts and Quantitative Easing (QE) from the Bank of Japan (BoJ) and widespread structural reform – are seen as having provided huge amounts of support to the Tokyo market. Investors will be wondering whether the new PM will keep on firing them, or whether he gets chance, since his term as leader of the LDP and Prime Minister only runs to September 2021, when elections are due on both fronts.

Mr Suga therefore has work to do, especially as public satisfaction with the prior administration’s handling of COVID-19 had slumped by the time Mr Abe stepped down (even though the number of daily deaths had not exceeded 20 since May). Appeasing investors may be lower down his list of priorities and there are three reasons why investors may have doubts about building, or adding to, their exposure to Japanese equities.

1. The political situation is less clear. Mr Suga’s early pronouncements have focused on mobile phone charges and boosting Japan’s digital economy, while the ongoing global pandemic will also require attention. This may suggest that ongoing reform is not going to be top of Mr Suga’s list of things to do.

2. Abenomics may have boosted the stock and bond markets but it failed in its overall economic goals. The goal was to boost economic growth and drive inflation toward the BOJ’s 2% target but the programme’s success rate here is mixed, given that Japan is back in recession and headline inflation is 0.1%. In addition, the BoJ’s enormous QE scheme, which is running at ¥80 trillion (£588 billion) a year, is seen as distorting the markets by some. The central bank’s ¥683 trillion in assets represent around 125% of GDP and leave it holding some three quarters of all Japanese Exchange-Traded Funds (ETFs), more than half of the Japanese Government Bond (JGB) market and some 10% of the stock market, according to some estimates.

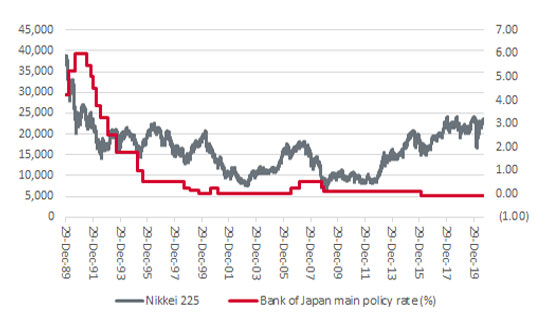

“The long-term bear case is still based on the assumption that Japan cannot break free from the legacy of the bursting of the debt-fuelled property and stock market bubble which peaked on 31 December 1989.”

3. Japan’s economy is still bedevilled by poor demographics and huge public debts. This is the long-term bear case – namely that Japan cannot break free from the legacy of the bursting of the debt-fuelled property and stock market bubble which peaked on 31 December 1989. The economy has rarely gained sustained traction since and the Nikkei 225 still trades at 40% below its all-time high, despite 25 years or more of QE and zero or negative interest rates.

Zero or negative rates have not helped the Nikkei return to past highs

Source: Refinitiv data, Bank of Japan. Since Nikkei 225's peak on 31 December 1989.

Bulls of Japanese equities will sweep aside such concerns.

1. Debt and demographic concerns are neither new nor unique to Japan. As the US, UK and Europe all slip into the public debt mire, there may be less chance of the markets picking a fight with Japan’s bond market or currency. Nor have these issues stopped the Nikkei rising 5% over the past year, despite COVID-19, or advancing from a modern-day low of barely 7,600 in 2003 to more than 23,500 today. Ultra-loose monetary policy from the BOJ is helping here, as investors look for returns better than those available from cash or JGBs, and the BoJ seems unlikely to throttle back any time soon, either.

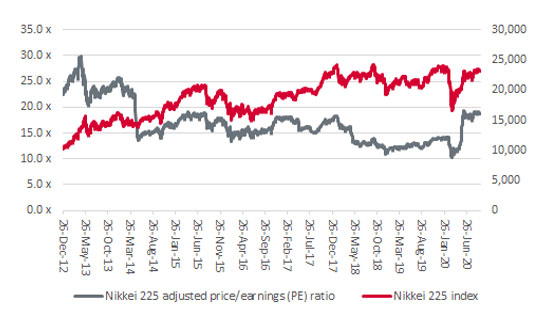

2. Japan could offer value. The fact that the bear cases are not especially new would suggest they are at least partly factored into valuations already. In addition, the Abenomics actively promoted corporate governance reforms and even prompted the creation of a new stock index, the JPX Nikkei 400, where return on equity, dividend and buyback policies and shareholder relations were key entry criteria. Before the pandemic, Japan was trading on a lowly price/earnings ratio (PE) relative to its history, thanks to Abenomics’ focus on profitability, and the latest spike in the PE simply reflects the hit to corporate earnings from the pandemic-related global recession.

Japanese stocks looked cheap before the pandemic

Source: Refinitiv data. Covers period since start of Abenomics, 26 December 2012.

“The Japanese market is packed with high-quality manufacturers and exporters, giving it leverage into whatever form of global upturn follows the pandemic.”

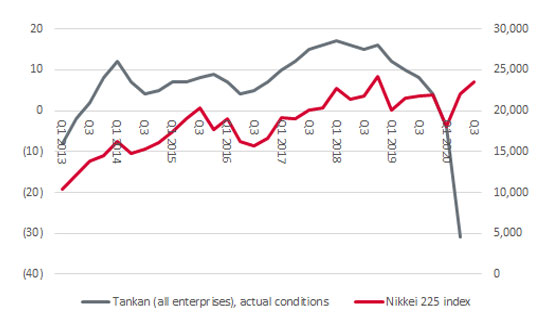

3. Japan provides exposure to a global recovery. The Japanese market is packed with high-quality manufacturers and exporters, giving it leverage into whatever form of global upturn follows the pandemic. Business confidence is currently low, using the quarterly Tankan – or the Business Short-Term Economic Sentiment Survey – as a guide, but any upturn could quickly feed through to share prices.

A global economic recovery could boost Japanese stocks

Source: Refinitiv data. Covers period since start of Abenomics, 26 December 2012.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.