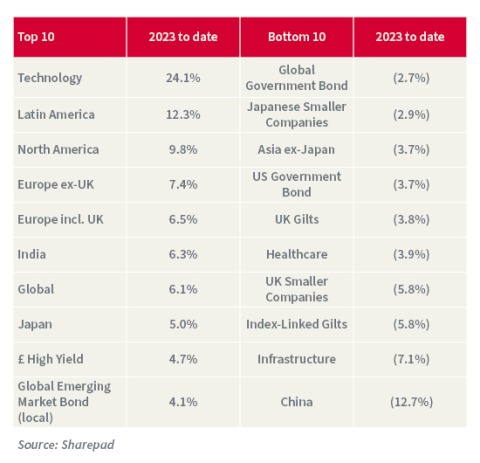

Making money from the financial markets is never easy – if it were, then none of us would be working and there would be no productive assets or companies in which to invest – but clear patterns are developing as 2023 works its way toward its conclusion. In simple terms, 2023 is looking like a ‘risk on’ year, with technology stocks, Latin American equities, Indian equities and high-yield (or junk) bonds leading the way. By contrast, the laggards are China, the UK, small caps, and interest-rate sensitive options (or at least long duration assets) such as government bonds, infrastructure and healthcare.

Source: Sharepad, based on Investment Association (IMA) classifications, from 1 January 2023 to the close on 30 August 2023.

“Markets are shrugging aside 2022’s recession fears but at the same time they are neglecting small caps, while they are avoiding long duration assets (where cashflows are back-end-loaded over a lengthy period of time) but again embracing technology, which in many cases shows a similar profile.”

There do appear to be some apparent contradictions here. Markets are shrugging aside 2022’s recession fears but at the same time they are neglecting small caps, while they are avoiding long duration assets (where cashflows are back-end-loaded over a lengthy period of time) but again embracing technology, which in many cases shows a similar profile.

The dominance of the Magnificent Seven of Alphabet (GOOG:NDQ), Amazon (AMZN:NDQ), Apple (AAPL:NDQ), Meta (META:NDQ), Microsoft (MSFT:NDQ), NVIDIA (NVDA:NDQ) and Tesla (TSLA:NDQ) helps to explain why tech is doing well, as they are all profitable and cash generative and showing growth now. Even so, the performance of tech in 2023 represents a remarkable turnaround from 2022, when the sector was out in the cold, to beg the question of whether 2023’s losers are capable of a similar renaissance in 2024 and – if so – what would be needed to trigger it.

The most intriguing one here may be small caps. Global equity markets may be busily convincing themselves that a recession is no longer on the cards, not even a soft landing (let alone a hard one) but small caps do not seem to agree. This seems odd, when, by rights, younger, up-and-coming firms are generally more sensitive to their local economy, as they have yet to broaden out either their geographic reach or their offering of goods and services.

Based on Investment Association data, small caps in the UK and Japan are down by 5.8% and 2.2% respectively in 2023 to date, while they are squeezing out small gains in Europe and (0.8%) and the US (3.7%).

“The modest performance of American small caps is particularly jarring, given the rosy scenario that markets are currently painting for the US economy.”

The modest performance of American small caps is particularly jarring, given the rosy scenario that markets are currently painting for the US economy. The main American small-cap benchmark, the Russell 2000, may be up this year but it is making very heavy weather of it and lags both the S&P 500 and the NASDAQ Composite by some distance, as the former is up 18% and the latter by 41%. In fact, the Russell still lies 22% below its 2021 all-time peak, which is intriguing given its current 17.5% weighting toward industrials, 15% to financials and 13.9% to consumer discretionary, sectors which can be seen as cyclical.

US small cap benchmark is lagging NASDAQ and the S&P 500

Source: Refinitiv data

“The FTSE Small Cap set a new all-time high in 2021 and the FTSE AIM All-Share reached a two-decade peak in the same year, but that optimism has long since dissipated.”

This soggy showing is in keeping with the dismal returns on offer from the UK’s FTSE Small-Cap and FTSE AIM All-Share indices, even if it does not sit easily with equity markets’ conviction that there is no economic trouble ahead. The FTSE Small Cap set a new all-time high in 2021 and the FTSE AIM All-Share reached a two-decade peak in the same year, but that optimism has long since dissipated.

UK small cap indices also continue to struggle

Source: Refinitiv data

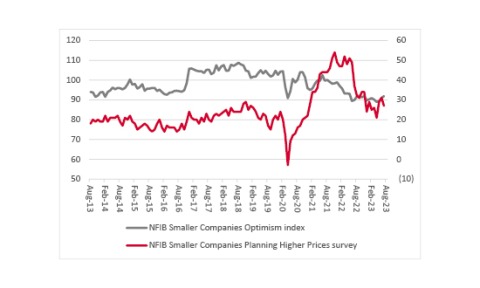

The struggles of US small caps are at least in keeping with the monthly NFIB smaller businesses sentiment survey, which still stands 19 points below its peak of summer 2018.

“Further weakness could suggest the recovery might not be everything markets currently expect. Equally, inflation-watchers will be intrigued by the NFIB’s sub-indices on prices.”

This indicator must be watched in case it does not pick up speed. Further weakness could suggest the recovery might not be everything markets currently expect. Equally, inflation-watchers will be intrigued by the NFIB’s sub-indices on prices – and more particularly the balance between firms that are reporting higher rather than lower prices. US smaller firms seem much less optimistic here on this front, even if the reading is still relatively elevated.

US smaller company business sentiment also trails lags former peaks

Source: Refinitiv data, NFIB

If both trends continue, then small cap equities could be harbingers of tougher times ahead for larger caps (since markets always come looking for the lieutenants first and the generals later), but a more conducive environment for another laggard asset class, namely fixed income and government bonds in particular. Equally, improved performance from small caps (and higher prices for their goods and services) could point toward a recovery in 2024 in cyclicals and value names and a fresh shift away from long-duration assets like technology and bonds.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.