Spiralling inflation and soaring interest rates mean it’s never been more important for advisers to be intimately familiar with the challenges their clients are facing. Any data which helps shed light on this is incredibly valuable, and the FCA’s Financial Lives survey, published in July this year, offers a treasure trove of information on consumer behaviour.

This is an enormous piece of research, in which the FCA surveyed over 19,000 people to gain a deep dive view of how adults use financial services in the UK. The research – mainly carried out in May 2022 – was the third in a series of reports. By comparing results this time to previous years (2017 and 2020) the FCA hopes to build up a picture showing how consumers’ attitudes and their financial positions are changing over time.

Finally, to add value and richness to these results, the FCA also carried out 32 qualitative interviews with a range of people.

The FCA sets a lot of store by their research and believes it will be useful not only for their own work, but also for the financial services industry as a whole. It urges financial services firms to use the results to better understand the needs and experiences of their customers and target markets.

The FCA uses the results of the survey to feed into their three-year strategy, as well as inputting into current reviews and helping the regulator monitor the implementation of other reforms, such as the Consumer Duty.

This article runs through some of the key areas investigated by the FCA.

In addition to the main piece of research, the FCA carried out a short survey covering the six months to January 2023 focused on the impacts of the rising cost of living on people around the UK.

The results are bleak.

Nearly nine out of ten adults cut back on spending compared to the previous six months. Most people had seen their financial situation worsen, and over a third were finding it impossible or difficult to cope financially.

Worryingly, more than half (56%) of UK adults stopped saving or investing, reduced how much they were saving or used their savings to meet daily expenses during the period.

Although the cost-of-living crisis is generally going to hit hardest those who are unemployed, from low-income households and renters, it has implications for society as a whole, showing a shift in all our fortunes. Financial advisers’ clients won’t be immune from these effects.

The Consumer Duty is a major piece of regulation which will set a higher standard of consumer protection in financial services. After committing so much time and resource to its design and implementation, the FCA is obviously keen to make sure it can demonstrate it is having an impact.

The FCA added new questions to the survey in May 2022 to test how firms were already meeting the requirements of the Consumer Duty. When it re-runs this survey – presumably in May 2024 – it will be looking for a sea change in the results and strong evidence the Consumer Duty is working.

It’s worth bearing in mind the FCA is surveying the full range of financial services firms – not just advisers or those in the savings and investments market.

The first area the FCA looked at was consumer support. Around half of adults said they had not used support services in the last 12 months, but of those that did, 84% agreed they helped them achieve what they wanted to do. The main problems in consumer support were poor customer service, IT system failure, sales pressure, errors or not following instructions, and delays.

The FCA also looked at whether products and services met consumers’ needs and offered fair value. The regulator focused on how easy it was to shop around and compare products. Although people were comfortable shopping around for insurance products, they were less likely to do it for pensions, ISAs or savings accounts. We bump up here against FCA’s belief that income drawdown is a ‘product’ you buy after building up a pension, rather than a feature of a pension plan that allows you to access your money.

The final area was communications. Although 27% said communications didn’t help them make a decision, 19% said it helped a lot, and 54% said it helped a little. The FCA is concerned vulnerable customers struggled more in this area, and will no doubt be reviewing firms’ communications to see how they particularly help these consumers.

The results on how people view the financial services industry are a mixed bag. Confidence in the industry has been firmly stuck at about 40% over the last five years. More worrying, only just over one in three UK adults thought financial firms were open or transparent.

When the FCA explored this theme more in qualitative interviews, people cited past scandals such as PPI mis-selling and the banking crisis. It seems these events are going to live long in people’s memories and there is a mountain to climb to get the general public to view financial services more positively.

However, people were much happier with their own provider. For example, around 80% of people had high or moderate satisfaction with their income drawdown or UFPLS provider.

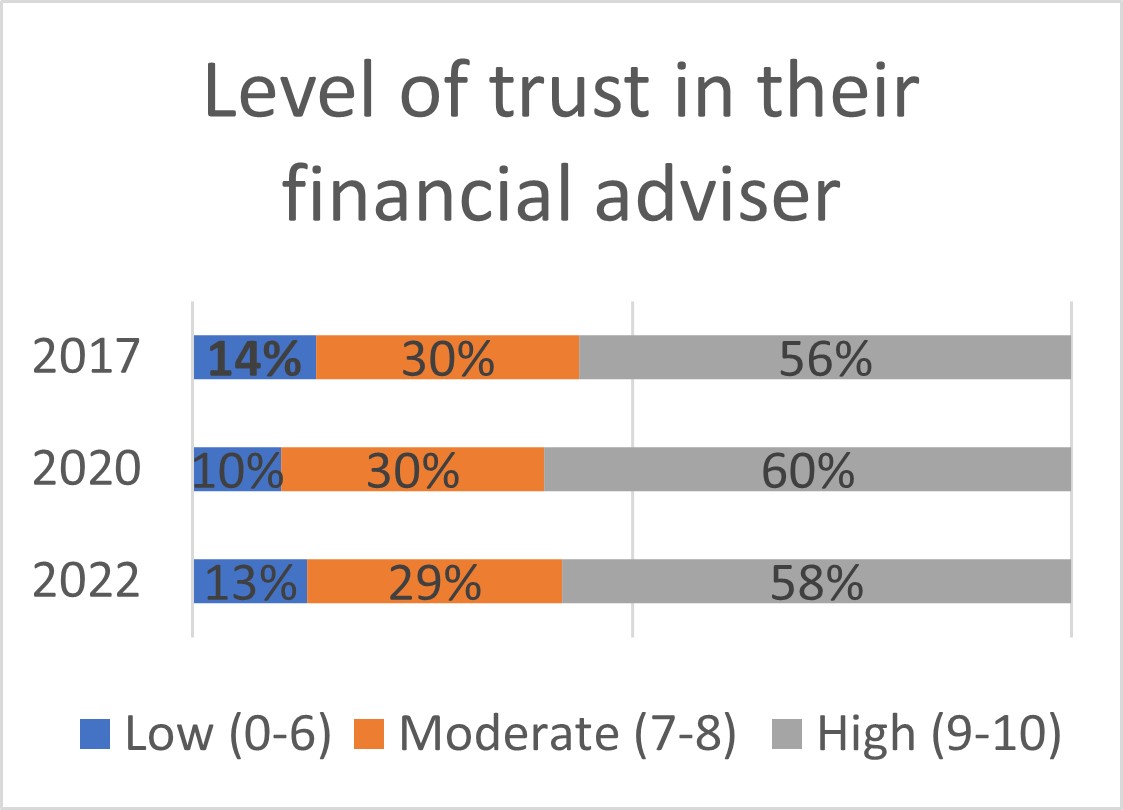

The FCA went on to ask people receiving financial advice how much they trusted their adviser and how satisfied they were with them. As you would expect the results are more encouraging.

Some 87% of people trusted their adviser and a similar figure (84%) were satisfied with them. And 85% were confident with the advice they had been given.

Source: FCA Financial Lives Survey 2022

These figures are a resounding positive for advisers. Those people who work with financial advisers know and understand their worth, and the difference they are making to their financial lives. They trust them. And they trust the advice they are given – 85% were confident in the plan they had been given.

But only 8% of UK adults receive financial advice, so how can this be widened out?

The FCA has identified that 28% of all adults hadn’t received regulated advice in the last year but may need it as they had £10,000 or more in investible assets or £10,000 or more in their DC pension and intended to access it or to retire in the next two years.

The Treasury and FCA are currently reviewing the advice/guidance boundary to improve the help and support available to savers. Part of this reform has to concentrate on how to widen out access to financial advice, but that isn’t going to be able to support that figure of 28% of people who may need help. So government needs to look to other solutions which could include regulated guidance.

In looking at wider solutions, it’s going to be important not to jump to conclusions involving product solutions, and to instead focus on outcomes consumers experience. Those 28% of UK adults have varied and different needs and experiences, and any solution needs to be flexible.

The results here show automatic enrolment has created a nation of pension savers. Two thirds of non-retired UK adults have a pension in accumulation, and 59% are contributing to it.

However, one third of respondents said their pot was worth less than £10,000. Automatic enrolment is obviously still in its relative infancy and more action or policy change is needed to raise contribution levels.

One in three people do not know how much their pension pot is worth. Pensions dashboards could help here, giving people the ability to see all their retirement pots in one place with their estimated retirement income.

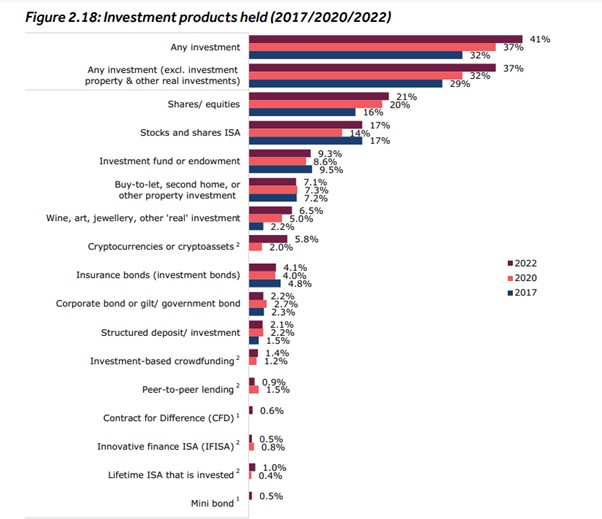

Finally, the survey shows four in ten UK adults hold investments, a definite upwards trend on previous years (37% in 2020 and 31% in 2017).

The range of investments were probably as expected – but there were areas that had seen a rise. For example, investment in ‘real’ investments (wine, art, jewellery etc) has tripled from 2.2% to 6.5%. And investment in cryptoassets has also increased to 5.8% from 2% in 2020.

When the FCA delved a bit deeper it found just 19% of 18–34-year-olds had investments in 2020, and this has now jumped to 29%. Men made up 70% of the new young investors in May 2022, and a greater proportion of these new young investors had an annual income of less than £50,000 compared to everyone who invested (83% vs 70%).

What is clear is that a whole new cohort of investors are emerging, tempted into investing for more ‘emotional’ reasons. When asked, 40% of new young investors said they had done so for the novelty or to learn something new, and 37% for the challenge, excitement or fun. Social motivations are obviously playing a big part as well – a quarter said they invested to talk or learn from others.

The FCA’s Financial Lives Survey is an important piece of research, packed with many statistics and details of people’s financial lives. It’s worth financial advisers reading through this data, and hopefully it can help them gain a better insight into their customers’ financial needs and desires.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.