Earlier this summer, the FCA published the latest results from its Financial Lives Survey. For those of you who have not yet perused this, it is a veritable tome of statistics, commissioned by the FCA to give them an insight into the financial lives of consumers.

This is the third in a series, comparing the results gathered in May 2022 to previous years’ findings from 2020 and 2017. The FCA is therefore building up an enormous amount of data which, it hopes, will monitor trends in consumers’ attitudes to finance and financial services.

One key area to zoom in on is consumers’ attitudes to financial advisers.

The survey shows that 8% of adults had received financial advice in the previous 12 months. This figure is inching up slowly over time; up two percentage points since 2017. Unsurprisingly, the proportion increases with wealth, and almost one in three (31%) with investible assets of £100,000 or more had received financial advice.

Where people get their financial advice is also interesting. Three quarters of these people used a financial adviser. But the number receiving automated advice online increased eight-fold, although remaining at a relatively low 1.5% of all adults.

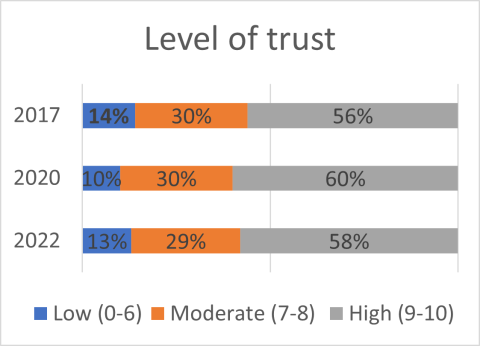

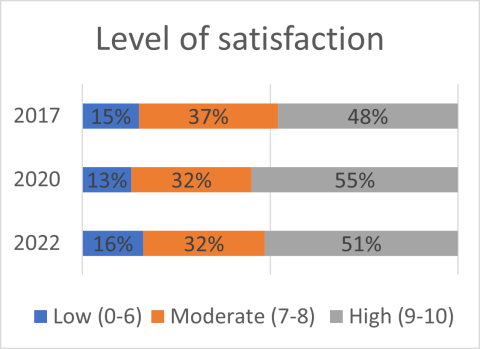

The FCA went on to ask these people receiving financial advice how much they trusted their adviser and how satisfied they were with them. As you would expect the results are positive.

87% of people trusted their adviser and a similar figure (84%) were satisfied with them. And 85% were confident with the advice they had been given.

These figures are a resounding positive for advice. Those people who work with financial advisers know and understand their worth, and the difference they are making to their financial lives. They trust them. And they trust the advice they are given – 85% were confident in the plan they had been given.

So, if advice is such a positive thing, why don’t more people reach out and work with a financial adviser?

The answer is that although those working with financial advisers trust them and appreciate their worth, those that don’t are still wary of the benefits they bring.

The FCA identified that 28% of all adults hadn’t received regulated advice in the last year but may need it as they had £10,000 or more in investible assets or £10,000 or more in their DC pension and intended to access it or to retire in the next two years. These people, however, were wary of the advice profession with only one in five agreeing that financial advisers are unbiased and less than half (45%) believing financial advisers act in the best interests of their clients.

This is worrying and shows that there is still some way to go until the wider general public view financial advisers as the trusted professionals they are.

That work is ongoing. Hopefully the next reiteration of this survey will show more people generally view financial advisers in the same light and with the same high regard as their clients hold them in.

Source: Figures 6.6 and 6.7, FCA Financial Lives Survey 2022

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.