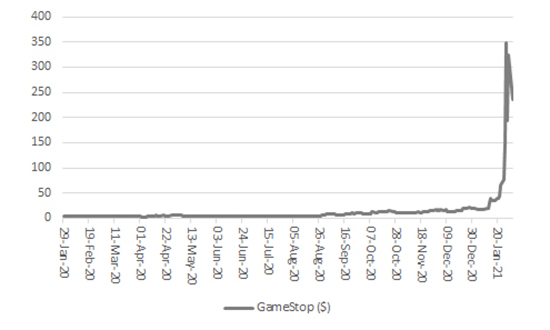

One of the most intriguing things about the surge in shares in loss-making American video games and consoles retailer GameStop (GME:NYSE) is how they gained so much in a week when the broader US indices had their worst five-day spell since October. Such gyrations (and share price charts) do not normally breed confidence.

GameStop has charged higher on a ‘short squeeze’

Source: Refinitiv data

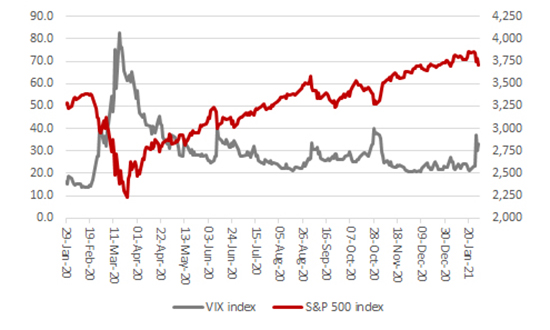

The spike in the VIX, or ‘fear’, index that accompanied the stampede into GameStop and trampling of hedge funds’ positions by retail investors (at least to some degree) is therefore equally eye-catching, especially in the context of overall US equity market valuations, which on some metrics look very lofty by historic standards, as discussed by this column last week (SHARES, 28 January 2021).

Spike in the VIX index may warn of more volatility to come

Source: Refinitiv data

“Add three other ‘softer’ gauges of sentiment toward US equities to a spike in the VIX, or ‘fear’, index and advisers and clients can perhaps understand why some market participants appear to be buckling up and preparing for a bout of market volatility.”

The VIX is a measure of expected volatility so someone, somewhere, is buckling up in preparation for choppier times ahead (although extreme readings are often useful contrarian indicators). Add in three other ‘softer’ gauges of sentiment toward US equities, and advisers and clients can perhaps understand why – although there are enough variables at play to give support to the bullish view – the Dow Jones, S&P 500 and NASDAQ Composite benchmarks could yet confound the doubters.

The first indicator relates to GameStop and the epic ‘short squeeze’ which has inflicted pain on hedge funds that were betting on a drop in the share price and instead were confronted by stunning gains.

Those hedge funds have mismanaged their risks and paid the penalty. To be caught shorting stocks where total short positions exceeded the total free float of the target company left them exposed to a squeeze if the fortunes of that firm turned around unexpectedly, or if what remain bouncy markets started to lift all boats on the tidal wave of liquidity provided for markets by central banks’ ultra-loose monetary policy.

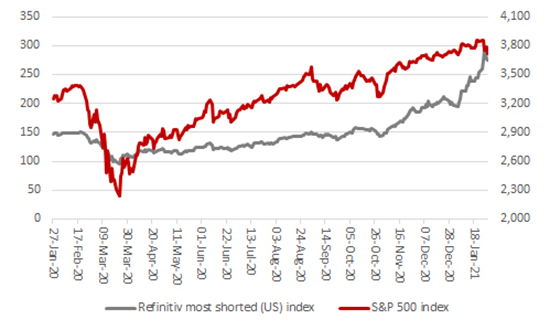

“Credit where credit is due to the retail investors who spotted this and profited from it. But the most shorted stocks in America have been massively outperforming the wider benchmarks since last November, perhaps to suggest that GameStop was a professional hit first and one where market technicals trumped company fundamentals.”

Credit where credit is due to the retail investors who spotted this and profited from it.

But the most shorted stocks in America have been massively outperforming the wider benchmarks since last November. This suggests that GameStop was a professional hit first – hedge funds forcing other hedge funds out of their positions by squeezing share prices higher – with retail investors cottoning on (or even being encouraged to follow a trail of breadcrumbs?) and piling in second. The share gains may have little or nothing to do with the company’s fundamentals and everything to do with market technicals and unalloyed financial speculation – something that tends to develop a lot closer to stock markets’ tops than it does stock markets’ bottoms.

Short squeeze in the US dates back to November

Source: Refinitiv data

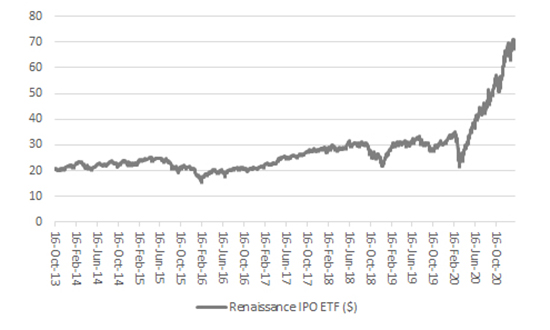

“It is not just old, previously downtrodden stocks that are feeling the love. Market newcomers are receiving plenty of adulation, too.”

But it is not just old, previously downtrodden stocks that are feeling the love. Market newcomers are receiving plenty of adulation, too. This can be seen in US-traded Renaissance IPO Exchange-Traded Fund (ETF), which is designed to mirror the returns from 80% of the market capitalisation of the universe of companies that have gone public in America within the last two years, minus its running costs. Airbnb (ABNB:NDQ) and DoorDash (DASH:NYSE) were both added at the last quarterly review in December. The ETF currently tracks 49 stocks and it is up by a third since November, helped by strong early gains in those two recent market entrants. Investors snapping up IPOs for the early share price ‘pop’ and to make a quick gain can also sometimes be a sign of a frothy market.

New market entrants are getting a warm welcome in the US

Source: Refinitiv data

“One other trend that can be a sign of animal spirits and that, as a result of which, investors and traders are perhaps taking on more risk than they would normally, is margin debt.”

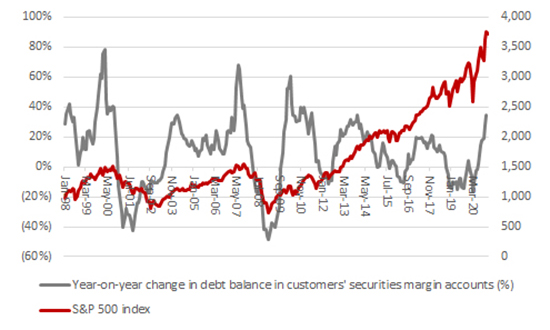

One other trend that can be a sign of animal spirits and that, as a result of which, investors and traders are perhaps taking on more risk than they would normally, is margin debt. This is the amount of money an investor can borrows from their broker via a margin account to buy shares (or even short sell them).

Regulations cap the amount that can be borrowed at 50% of the account balance but, even so, margin debt is at record highs. This looks smart and gears towards returns when markets are rising (as the investor or trader can get more exposure) but looks less clever when markets are falling. Indeed, falling asset prices can force so-called margin calls where the investor or trader must start repaying the loan – and sometimes they must sell other positions to fund that repayment, creating a negative feedback loop in markets.

Margin debt stands at record highs in the US

Source: Refinitiv data

There is no sign of such forced selling yet, although it will be worth watching for it should GameStop’s shares start to sag, and there is no guarantee that history will repeat itself and see these trends act as an early warning sign of a market top. After all, central banks keep on pumping out liquidity and emboldened investors and traders, accustomed to their support, may simply demand more if there is a market dislocation – although whether this is a trend to be encouraged over the long run is questionable. As British economist (and shrewd stock market participant) John Maynard Keynes once noted, “When the capital formation of a country becomes the by-product of a casino, the job is likely to be ill-done.”

“When the capital formation of a country becomes the by-product of a casino, the job is likely to be ill-done.” John Maynard Keynes.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.