The number of interest rate rises continues to gather pace on a global basis. Last month (Friday 26 February), this column noted how there had already been five hikes in borrowing costs, even if they had been across a range of frontier markets – Zambia, Venezuela, Mozambique, Tajikistan and Armenia. There have now been six more – Kyrgyzstan, Georgia, Ukraine, Brazil, Russia and Turkey.

This is interesting for three reasons.

“Financial markets are still taking the view that a strong upturn is coming, because US Government bond prices are currently going down, and yields are going up, regardless of what the Fed says

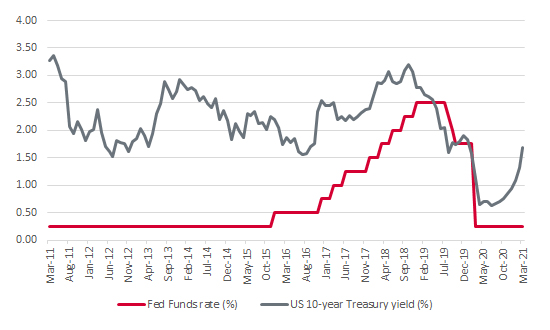

Mr Powell does not seem concerned about inflation and is seemingly willing to risk its resurgence to ensure that the economy gets back on track in the wake of the pandemic. Yet financial markets are still taking the view that a strong upturn is coming, because US Government bond prices are currently going down, and yields are going up, regardless of what the Fed says – and that is a huge change from the last decade or so, when bond and stock markets have been happy to slavishly take their lead from central bank policy announcements.

US Treasury yields are rising even as the Fed stands pat

Source: Refinitiv data, US Federal Reserve

“One way in which advisers and clients can monitor what the markets think of central bank policy – and not just in the US, but across developed markets – is to look at how small-cap stocks are performing.”

One way in which advisers and clients can monitor what the markets think of central bank policy – and not just in the US, but across developed markets – is to look at how small-cap stocks are performing.

Small-cap stocks are perceived to be riskier than their large-cap counterparts and with good reason. As such, their first use to advisers and clients is that they can be used to judge wider market risk appetite – if small caps are rolling higher, we are likely to be a bull market, and vice versa.

Small-caps can be a useful barometer in another way, too. There are exceptions to every rule but, in general, small caps tend to be younger firms that are still developing. They are potentially more dependent upon certain key products or services, a narrower range of clients and even key executives. They can be less robustly financed than large caps and are thus more exposed to a downturn, especially as they are less likely to have a global presence and be more reliant on domestic markets. Equally, they are more geared into any local economic upturn.

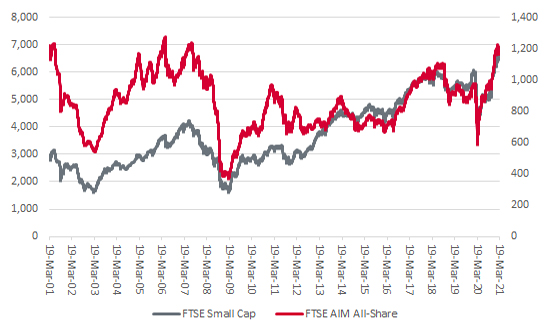

It is therefore interesting to see how the UK’s FTSE Small Cap index trades at record highs, while another one, the FTSE AIM All-Share, stands near 20-year peaks (although the latter is still well below its technology-crazed highs of 1999–2000).

UK small-cap indices are surging

Source: Refinitiv data

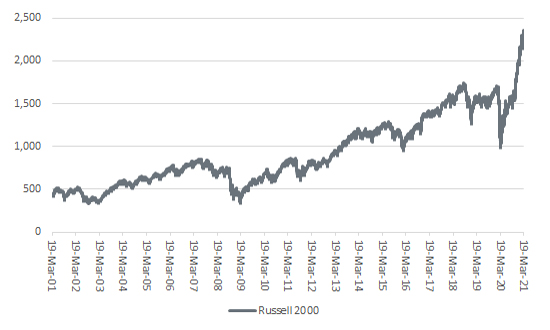

“The Russell 2000 now trades near its all-time highs, having gone bananas since last March’s low. Such a strong performance suggests that markets are in ‘risk-on’ mode and pricing in a strong economy recovery for good measure.”

America’s Russell 2000 index, the main small-cap benchmark on the far side of The Pond, is up 16% this year and by 116% over the past 12 months. That beats the Dow Jones Industrials, S&P 500 and NASDAQ Composite hands down on both counts. In fact, the Russell 2000 now trades near its all-time highs, having gone bananas since last March’s low. Such a strong performance suggests that markets are in ‘risk-on’ mode and pricing in a strong economy recovery for good measure.

US small-cap benchmark is also flying

Source: Refinitiv data

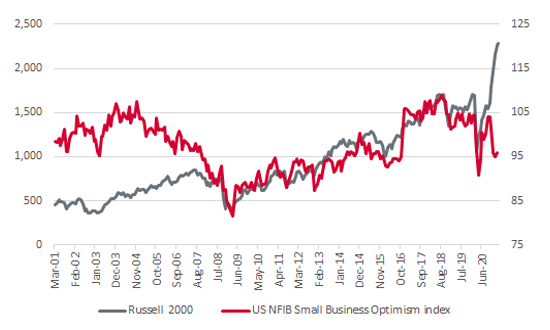

One data point which does not quite sit so easily with the US small-cap surge is the slight pullback in America’s monthly NFIB smaller businesses sentiment survey, which still stands 12 percentage points below its peak of summer 2018.

US smaller company business sentiment still lags former peaks

Source: Refinitiv data, NFIB

This indicator must be watched in case it does not pick up speed as America’s vaccination programme continues and lockdowns are eased. Further weakness could suggest the recovery might not be everything markets currently expect.

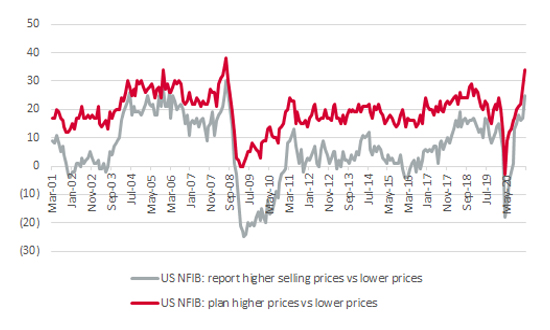

“Inflation-watchers will be intrigued by the NFIB’s sub-indices on prices and especially the shift in mix towards smaller companies that are planning price rises rather than price cuts.”

Equally, inflation-watchers will be intrigued by the NFIB’s sub-indices on prices – and more particularly the balance between firms that are reporting higher rather than lower prices for their goods and services, and especially the shift in mix towards smaller companies that are planning price rises rather than price cuts.

US smaller companies are planning to raise prices

Source: Refinitiv data, NFIB

If both trends continue, then bond markets could just be right in fearing that the Fed is behind the curve and that a crack-up inflationary boom is upon us.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.