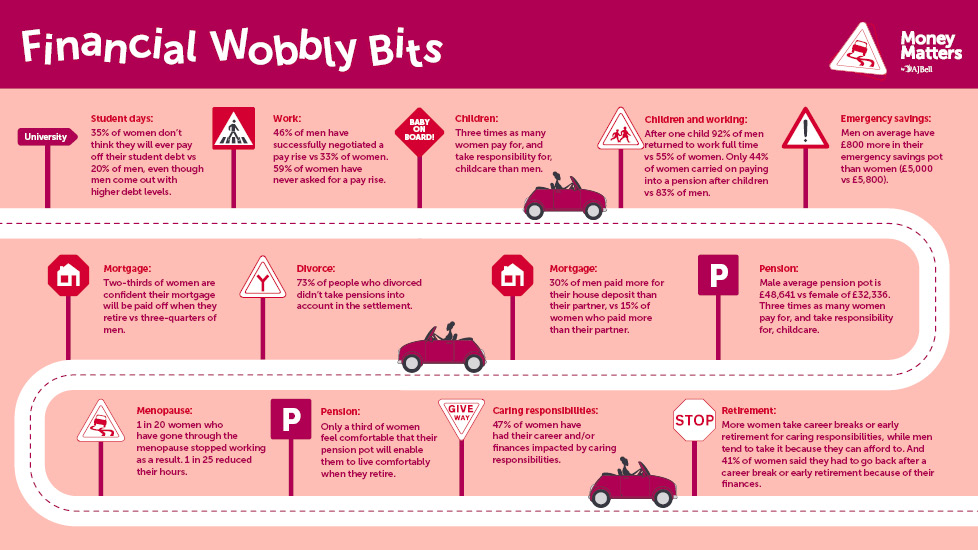

We’ve all experienced “Financial Wobbly Bits” and recent high interest rates and a cost-of-living crisis has certainly added to the pressures on all our lives.

But women have been disproportionately affected, partly because on average they tend to earn less and partly because they don’t have the same financial cushion in place that men have.

That financial cushion, the gender investment gap, is something we’ve been thinking hard about for a couple of years.

We launched AJ Bell’s Money Matters campaign back in 2021 with an eye-opening bit of research which revealed that, on average, British women have less than half of the savings and investments (not including property) that men have and cumulatively that amounts to a £1.65 trillion gap

The latest gender pay gap figure came in at 9.4% so it raised the question – what happens during women’s lives that ultimately makes them poorer, and what can be done about it?

We didn’t just want to conduct a bit of research; we wanted to really identify and interrogate the reasons for the gap and create a kind of toolkit to help make women more financially resilient.

“Many women are having to make tough choices… Fifteen percent told us they’d quit work because of caring responsibilities; eighteen percent had cut back on their hours and seven percent had taken a lower paid job.”

There’s always a bit of controversy when we talk about financial gender inequality, but helping more than half of the population avoid these potholes can only help create a richer society which will in turn help everyone.

And whilst it might seem counter-intuitive to work backward, there’s been so much focus on getting over 50s back into the workplace that discovering that half of all women over 50 surveyed said their career and finances had been impacted by caring responsibilities in later life felt like the right place to start.

I’ve just hit my own half century and to be honest it’s now that I’m really starting to think about what my retirement will look like and how much longer I will need to work to make my dreams a reality.

What if I had to cut my hours, change job to one that paid significantly less or quit work entirely? What would that do to my pension and my plans?

At the moment I don’t have grandkids to look after, and my mum is still wonderfully healthy, but this is the time many women are having to make tough choices about how they spend their time.

Fifteen percent told us they’d quit work because of caring responsibilities; eighteen percent had cut back on their hours and seven percent had taken a lower paid job in order to be able to juggle all those balls.

Think of all that experience, all that labour that could be boosting productivity but instead is leaking out of the labour market.

“Women’s pension pots take a big hit during this period with only a quarter of women maintaining contributions at the same level and the same number cutting contributions entirely whilst taking parental leave.”

Men are impacted too, but to a lesser degree, which is why there’s also a difference in the reasons men and women gave for returning to the workplace after retirement, with women more likely to say they had returned to work because they needed the money and men because they needed a new challenge or sense of purpose.

It’s no coincidence all political parties have been focusing in on the thorny issue of childcare costs as we head towards the next general election.

Although more men are taking up the option of paternity leave and sharing in childcare responsibilities, it still has a disproportionately large impact on a woman’s working life, with many mothers taking career breaks or quitting work entirely, especially those with more than one child to look after.

Women’s pension pots take a big hit during this period with only a quarter of women maintaining contributions at the same level and the same number cutting contributions entirely whilst taking parental leave.

And the financial implication of having children is prompting some women to delay having children or to make the decision not to have children at all.

With an already aging population, that trend could have massive implications for the future.

There is cause to be optimistic. Resources like Money Matters are providing those financial toolkits I spoke of earlier and younger women in particular are prepared to have sometimes tricky conversations about their financial lives.

Sixty percent of those aged 25-34 said they had discussed finances with their partners before they had children compared to just a quarter of 55-64-year-olds and that younger generation is now more likely to split childcare costs and parental leave.

But women are still less likely to ask for a pay rise than their male colleagues and more likely to priorities softer benefits like hybrid working or extra holiday entitlement over share schemes and higher pension contributions.

I’ve seen a lot of commentary railing about the “pinkification” of women’s financial resources and there will be plenty of people who will look at this survey and find fault.

But the differences between an average woman’s finances and an average man’s finances are clear and this research report only serves to highlight what we already know.

Women have “Financial Wobbly Bits” – points in our lives where our fortunes – literally – diverge from men’s.

Addressing that head-on shouldn’t be considered rude, sexist or wrong. It should be seen as an opportunity for discussion and for change.

To see the Money Matters “Financial Wobbly Bits” report and for a mini guide to financial fitness please visit www.ajbellmoneymatters.co.uk

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.