Seven years on since pensions freedoms were introduced, we still have ongoing issues with over-taxation of ad hoc pension payments made under the “new” rules.

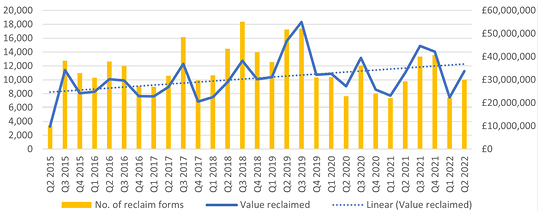

These are not insignificant amounts. In the latest Pension Schemes Newsletter (July 2022) the total value of repayments HMRC made to those that had overpaid tax from 1 April 2022 to 30 June 2022 was £33,689,819, from just over 10,000 reclaims.

In total since April 2015 HMRC have processed over 330,000 reclaim forms and repaid close to £900,000,000. The magic £1billion mark will likely be reached in the next 12 months – and the trend is for the quarterly reclaims to keep getting higher.

Source: AJ Bell analysis of HMRC Pension Flexibility Statistics

And this isn’t even the whole picture when it comes to overpayment of tax. These are only the figures for those that take the time to complete the paperwork for the in-year reclaims. There will be many who are happy to wait for the P800 calculation, either because they have smaller reclaims or their payments are due near the end of the tax year. And, of course, some will simply not realise they have overpaid tax.

So, why does this issue arise and how do you get the overpayment back?

Since 6 April 2015 it has been possible to take uncrystallised funds pension lump sums (UFPLS) and flexi-access drawdown payments from defined contribution pension schemes. These payments are subject to Income Tax and HMRC has set out to pension scheme administrators how tax codes must be applied under PAYE.

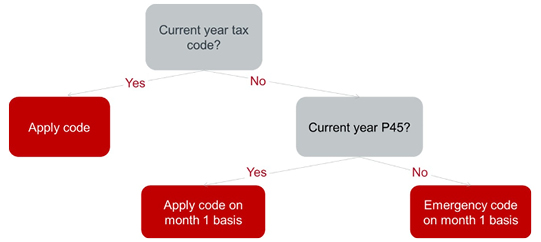

When the member can provide the administrator with a current year tax code then this can be used and applied on a cumulative basis. In practice this often only happens when the member is taking a regular income as the current year code is supplied after the first payment is made.

If the member retires from employment and then starts taking benefits they may have a P45 valid in the current tax year, if this is the case this can be used but must be on a “month 1” basis. If the member has no current year tax code or P45 then an emergency tax code will be used, also on a month 1 basis.

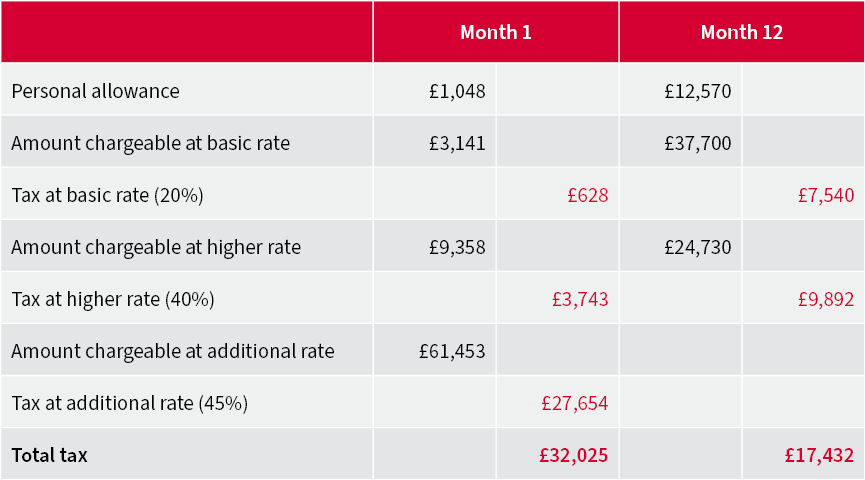

When a payment is made on the month 1 basis, the member will be taxed on that pay period only. Effectively this means that each month is treated discretely, with a twelfth of the personal allowance and each tax band applying.

This is opposed to a “month 12” basis where the full annual personal allowance and tax bands are available. When a one-off or annual payment is made ideally a month 12 basis would be used but HMRC rules do not permit this in relation to flexible pension payments such as UFPLS and flexi-access drawdown.

For the 2022/23 tax year the emergency code is 1257L. This means that anyone receiving their first payment who doesn’t have a current year tax code or P45 will be taxed on a month 1 basis as follows*:

It does not make any difference when in the tax year the payment is made, it will be treated the same whether paid in May or March.

Having a current year P45 may impact the bands given above, but the basic principle of only receiving a twelfth of the personal allowance and each subsequent band still applies.

*Members who are resident in Scotland will have different tax bands and rates, but the same theory will apply.

When someone is only taking a one-off payment the use of the month 1 basis means that over-taxation is likely to occur.

All UFPLS payments are 25% tax free and 75% subject to Income Tax. The 75% that is taxed will have the bands applied as above. All of a flexi-access drawdown payment is subject to Income Tax, so the bands would apply to the full amount.

The example below demonstrates the over-taxation that could occur on a one-off UFPLS payment of £100,000 (where £25,000 would be tax free, £75,000 subject to Income Tax), or a one-off flexi-access drawdown payment of £75,000. It assumes there is no other income in the tax year.

In this example the over-taxation is £14,593 (£32,025-£17,432).

If you are trying to calculate the tax that will be paid on a member’s one-off payment it is worth noting that the monthly personal allowance is always given on a month 1 basis, however large the payment. Where the member would be over the £100,000 threshold for the tax year the personal allowance is withdrawn via the tax code issued by HMRC after the first payment has been made.

When new payments are set up the scheme administrator should apply the tax code for the first payments as per the flow chart. They will inform HMRC when the first payment is made, and HMRC will then issue a new tax code so that the subsequent withdrawals made over the year should correct the tax position as they will be taxed on a cumulative basis.

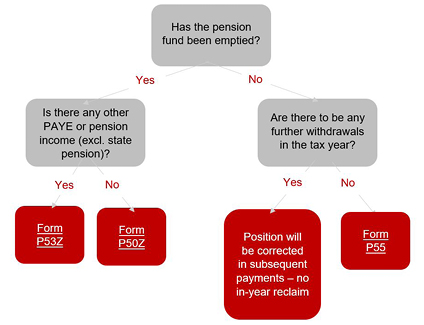

If a one-off payment has been made in the tax year, it is likely that tax will have been overpaid. When this is the case the additional tax paid can be reclaimed in one of two ways:

If members are taking a one-off pension payment it is important they are aware of how the tax works to avoid nasty surprises, especially if they are withdrawing funds for a specific purpose that is time sensitive.

It is also likely that the first instalment of regular payments may be overtaxed (unless monthly income starts in April). This is less of an issue as it should get corrected throughout the year, but the first payment may still be less than the member would be expecting.

The issue of over-taxation has been raised with HMRC on many occasions, both by the industry and the Office of Tax Simplification. One argument HMRC has used to keep over-taxing is that it is better for those on low income to be overtaxed initially, so they do not have a tax bill later once the money is spent. However, where the member has told their scheme administrator that they are only taking one payment in the tax year it seems very inefficient for everyone involved to deduct tax at a rate that will never be correct.

What we would like to see is a more pragmatic approach, so when the member has made it clear they only intend to take a one-off payment in the tax year scheme administrators are allowed to use a “month 12” basis – effectively giving the whole personal allowance for the payment, and then full bands after that. Yes, there is a risk that if the member changed their mind, or their circumstances changed, and they needed to take a subsequent payment in the year then they would face higher tax charges relating to these, but warnings could be given when the first payment was made, and these cases would be the exception.

Surely it would be better for a few to be taxed incorrectly, rather than the thousands we have now.

This article was previously published by FT Adviser

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.