April 2024 is destined to go down in history as one of those big dates when the pension rules changed. We have had quite a few of these before, including 1988, 2006 and 2015. But add 2024 to that list.

The removal of the lifetime allowance from pensions has meant a rewrite of the current rules, and new concepts to understand. It’s worth taking a step back from the detail to survey the bigger landscape.

In 2024, you can pay into a pension up to certain limits. And you can take out a tax-free cash amount worth 25% of the benefits, alongside an income which will be taxed. There is a limit of £268,275 (the lump sum allowance) on the amount of tax-free cash you can take over your lifetime, but there are no limits on the pension amount.

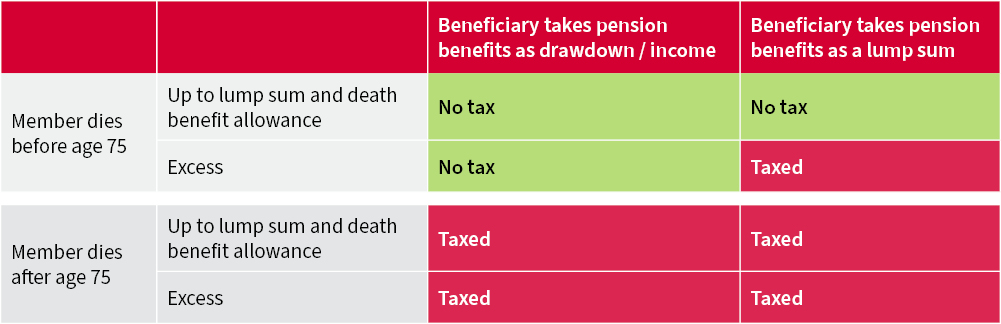

When you die you can pass any remaining pension funds to your loved ones. If you die after age 75, then regardless of whether it’s paid out as a lump sum or income, your beneficiaries will pay income tax on any pension money they receive.

If you die before 75 then if they take a lump sum there will be a limit on the amount they can take tax free. This limit – the lump sum and death benefit allowance – is £1,073,100 – but tax-free lump sums you took in life will also use this up (including any serious ill health lump sums) as well as any tax-free lump sums paid out on death. Anything over this is taxed.

But, importantly, if you die before age 75, then the whole amount can be paid out as an income completely tax free (with no limit).

So why would a beneficiary opt to take a lump sum? Take the remaining funds as drawdown, and then, if you want, take the whole amount in one payment the next day. It’s vital those close to the £1,073,100 limit make sure their expression of wishes forms are up to date, so the right people are nominated, and they get the option of drawdown.

How income tax applies to pension death benefits after April 2024 (assuming benefits are settled within two years of being notified of death).

If the pension benefits are paid to an individual then they are liable to income tax at their marginal rate.

If the benefits are not paid within two years of the scheme being notified of the death, then the whole amount is subject to income tax, regardless of how it is paid.

Of course, the new rules sound simple if starting with a blank piece of paper. But it’s the transition from the old to the new which will create the headaches. Spending a bit of time understanding the transition rules could be really valuable – especially for your clients who are close to the allowances.

The general rule is if you took pension benefits before April 2024, then your new allowances will be reduced by 25% of the lifetime allowance you used up. But there are nuances within that. Interestingly, some clients or their beneficiaries may be able to request that a smaller amount is deducted, to make up for the fact they previously took less than the 25% maximum lump sum, so boosting their allowances. This will be relevant for some who took cash from their defined benefits scheme or decided to waive their full tax-free cash entitlement.

April 2024 is only four months away. Advisers might want to spend some time now understanding the rules, identifying which of their clients are affected, and setting a strategy in place for them. The clock is ticking, and we will soon reach this next historical pension date.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.