The tax pool is a record of the tax actually paid by the trustees of a discretionary trust on income they receive. All Income Tax can enter the tax pool, apart from tax paid by trustees on income used to meet trust management expenses.

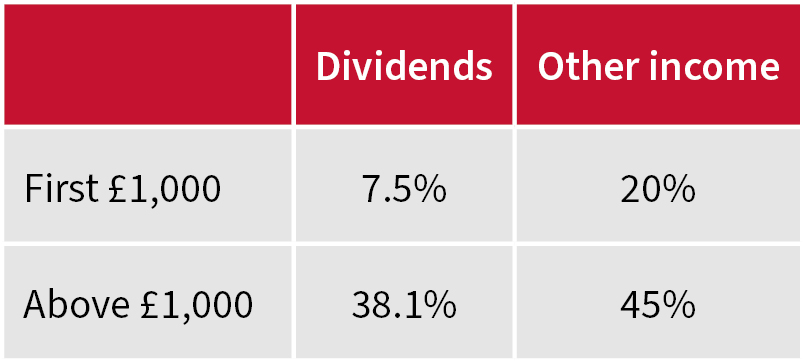

Under the Income Tax rules for discretionary trusts, the trustees will pay Income Tax at various rates depending on the source and availability of the standard rate band for trusts. If the income is from a mix of sources, then a combination of these rates will be applied. The tax pool then increases by the amount of tax paid.

Trust income distributed to discretionary trust beneficiaries is payable with a 45% Income Tax credit in all cases, i.e. it is deemed to be trust income, regardless of its actual source. The 45% tax credit means that the beneficiary could claim some or all of the tax back if they’re a non-taxpayer or pay tax at 20% or 40% (rest of UK rates – different rates apply to Scottish taxpayers).

The pool is a crucial tool for trustees to check that they have actually paid enough Income Tax on the income received to support the 45% credit due to beneficiaries when a distribution is paid.

If the 45% tax credit exceeds the actual tax paid by the trustees in the year, then the deficit needs to be made good. The trustees can do this by using an existing balance in the tax pool from Income Tax paid in other years or, in the absence of this, the trustees must make up the difference through the Trust and Estates Tax return if they have already made a payment.

Consider an example – the Linda Smith Discretionary Trust.

The trust investments have generated dividends of £10,000. The trustees want to distribute all the income after tax to one of the beneficiaries, Kelly.

The trustees would pay tax of 38.1% on the dividend income (assuming the standard rate band of £1,000 has already been used). On a £10,000 gross dividend, £3,810 tax would be due, and that amount enters the tax pool.

If the trustees paid the balance of £6,190 as net income to Kelly, they would do this with a 45% tax credit under distribution to beneficiary rules. The tax credit would be £5,065, making the gross value of the distribution to Kelly £11,255.

Kelly is a non-taxpayer and can reclaim all of the 45% tax credit. This means she can receive the net income of £6,190 and reclaim the £5,065 tax credit.

However, the trustees have only paid £3,810 in Income Tax and there is therefore a shortfall in the tax pool between these values of £1,255.

The trustees could make this up using tax on other income received that has not been distributed.

However, what if there is no balance in the tax pool?

It is essential that trustees are aware of how the tax pool works, to avoid getting out of their depth and suffering additional tax charges and potential penalties.

This article was previously published by New Model Adviser

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.