In July 2020, the Chancellor asked the Office of Tax Simplification (OTS) to investigate Capital Gains Tax (CGT) and to “identify opportunities relating to administrative and technical issues as well as areas where the present rules can distort behaviour or do not meet their policy intent”.

‘Simplifying by design’ is the first of two reports to be produced by the OTS and sets out recommendations to help the Government to consider simplifying the design of CGT and make the tax easier to understand and predict, across four areas:

The second report next year will further explore technical and administrative issues.

This CPD article intends to summarise the current position and outline the key findings and eleven recommendations of the OTS under each of the four areas above.

The immediate press coverage has been around a ‘CGT raid’, with rates quoted as doubling.

Whilst the Treasury has confirmed “the Government’s priority right now is supporting jobs and the economy…”, the report does raise some interesting, if not radical, talking points with the potential to raise revenues over the long term.

It is important to remember that, although the OTS was requested to carry out this work by the Chancellor, there is no obligation for this or any other Government to make changes based on the recommendations.

The report seeks to fulfil its commission by highlighting how the present position distorts behaviour or makes things complex in practice and by providing potential solutions for the Government to consider once it has decided on a direction for policy.

1) Rates and boundaries

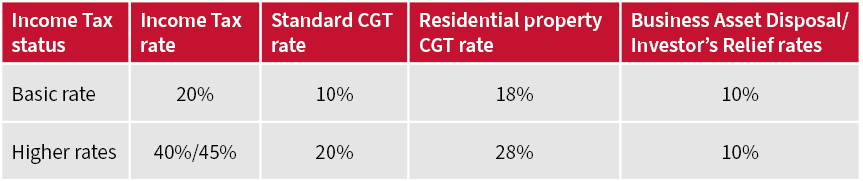

The rate of CGT that applies to a gain depends on the level of the individual’s taxable income and the type of asset that has been sold or gifted.

The below table compares the current tax rates for income and gains above the respective personal allowance and annual exempt amount.

The report tells us that CGT raises £8.3 billion a year from 265,000 people with an average (mean) liability to tax of £32,000. Although Income Tax raises 20 times as much revenue (£180 billion per year) than CGT, the mean tax liability per taxpayer is more than 5 times less, at £5,800 [source: HMRC].

The OTS believes that the difference between the rates of tax on income and capital gains can distort decision-making and can create an incentive for families and businesses to arrange their affairs so that income can be classed as capital gains and accordingly taxed at lower rates.

It also believes that the boundary between income and capital gains is under pressure from the use of share-based remuneration and the accumulation of retained earnings in smaller owner-managed companies.

So the direction of travel depends on what the Government wants to achieve with the tax policy itself and any potential simplification. Does it want to change the behaviour of people and businesses? Or make the tax and any potential liability easier for taxpayers to understand and predict?

OTS recommendations

2) The annual exempt amount

The current annual exempt amount for CGT is £12,300.

The data provided by HMRC to the OTS showed that, after allowable losses, 263,000 people reported gains for the 2017/18 tax year and it is thought that 50,000 people had net gains just below the threshold.

It is for the Government to decide what the policy objective of any threshold is but the annual exempt amount has been described over time as one or more of the following:

Respondents to the OTS’s call for input agreed that the threshold was currently too high to be a true administrative de minimis and it was currently acting more like a relief. This would typically be true amongst advised clients, who will find their adviser or investment manager using their CGT allowance each year where appropriate within their portfolio(s) as part of their annual review.

When the threshold was originally introduced by Nigel Lawson in 1982, its objective was to act as compensation for inflation. However, the OTS views this is an inefficient way of achieving that policy objective when it does not consider holding periods or asset values.

OTS recommendations

3) Interaction with lifetime gifts and IHT

It is perhaps not surprising that the OTS focuses on the interaction between CGT and IHT, as in 2019 it published similar reviews and reports on IHT.

CGT is not payable on unrealised gains when someone dies.

If the assets are inherited, then the new owner is given the market value as at the date of death to use as the ‘new’ acquisition cost. Any previous increase in value (or loss) is wiped out – often referred to as the capital gains uplift.

This capital gains uplift not only applies to investments and shares, but also business property, farms and residential property.

Gifting assets can also attract CGT in the same way as the sale or disposal of an asset.

Although some business assets already benefit from relatively favourable treatment through Business Asset Disposal Relief (formerly Entrepreneurs’ Relief) or Gift Holdover Relief, the capital gains uplift on death is still more generous than both.

It has been suggested to the OTS that it would simplify decision-making around succession if there were no capital gains uplift on death. Notwithstanding the IHT implications, people would be able to decide how and when to pass on their assets without the uplift influencing their decision-making.

OTS recommendations

The OTS considers that, at present, the way IHT and CGT interact is incoherent and distortionary. There have been three further recommendations for the Government in this area.

4. Business reliefs

Business Asset Disposal Relief

Relief for the disposal of certain business assets against CGT has been available since the introduction of the tax in 1965. Currently, Business Asset Disposal Relief (formerly Entrepreneurs’ Relief) can reduce the tax payable on the disposal of qualifying business assets, by taxing the gains at a special rate of 10%, up to a lifetime limit of £1 million.

There is clearly a policy judgement for the Government as to the extent CGT reliefs should be used to seek to stimulate business investment and risk-taking.

However, the idea that Business Asset Disposal Relief is an effective way of making such an incentive has been called into question. In his Budget speech in March 2020, Chancellor Rishi Sunak described Entrepreneurs’ Relief as: “Ineffective – with less than 1 in 10 claimants saying the relief has been an incentive to set up a business.” It was at this time that the lifetime limit was reduced from £10 million to £1 million.

A separate tax rate for Business Asset Disposal Relief also adds further complexity to a CGT regime that already has multiple rates.

The OTS heard from respondents who said that risk-taking would be better encouraged by smaller upfront (cash) reliefs at the time an investment is made, rather than by an eventual reduction in a tax liability on disposal.

Enterprise Investment Schemes provide upfront Income Tax relief for external investors. They also encourage repeated investment via a deferral of CGT for those who wish to reinvest gains.

That said, it is accepted that there is a case for the existence of a relief in relation to retiring business owners, particularly those who founded or scaled up their company. Business Asset Disposal Relief in its current form, however, is far broader than this, and so would require reform were it to specifically target this specific objective.

Investors’ Relief

Investors’ Relief was announced at Budget 2016 as an ‘extension of Entrepreneurs’ Relief’ to external investors in unlisted trading companies.

The responses received from investor groups, accountants and lawyers as well as the OTS’s own survey told it that interest in this relief and take-up are virtually nil.

OTS recommendations

This article was previously published by FT Adviser

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.