On Monday 19 April 2021, S&P enacted major changes to its Clean Energy index, expanding the number of constituents, lowering the criteria for inclusion, and changing the weighting methodology.

This index is tracked by two iShares ETFs – one based in Europe and the other over in the US, with combined assets of over $11 billion at the time of writing, representing one of the largest ‘thematic’ ETF strategies in the market. In addition, a BMO ETF was launched in January 2021 to track this index, based in Canada.

So why has this happened, why does it matter and what does it mean for investors?

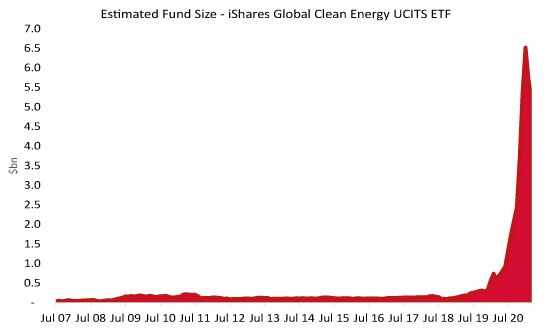

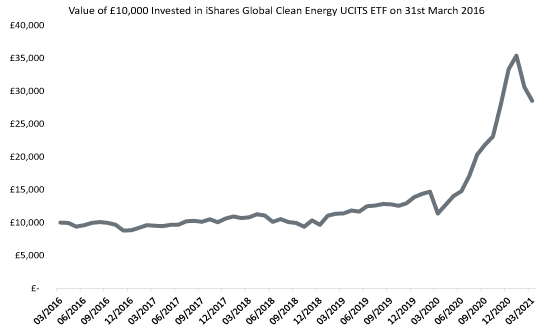

The European-based ETF launched in July 2007, making it one of the oldest thematic strategies around. It aimed to give exposure to the 30 largest global companies involved in the clean energy sector. Although the weighting methodology was complex – based on an exposure score to clean energy, and the size of the company, alongside liquidity – given the number of constituents and a maximum weighting cap of 4.5% for an individual company, it has a bias towards smaller companies compared to an index weighted on size alone. Though the index did have liquidity requirements for underlying stocks, for the first 13 years its assets remained below $1 billion:

Source: Morningstar April 2021

After taking 12 years to raise the first $1 billion, it took just 12 weeks for it to raise the next $1 billion.

As the global climate agenda gained momentum in 2020, including the election of Joe Biden as US President in November, the strategy experienced continued growth, with assets peaking at $6.5 billion in January 2021.

It is not unprecedented for an ETF to lay dormant for several years, before rapidly growing as the asset class comes into favour (for example gold, income investing, inflation-protected bonds). However in this case, given the concentrated nature of the product into smaller companies, it is likely that the flows had an effect on the share price of the underlying companies, given the performance of the fund has closely mirrored the flows into the ETF.

Source: Morningstar, April 2021

Looking at this another way, Renewable Energy Group was one of the 30 holdings in the ETF before the index reconstitution. According to a filing from Blackrock on 25 January 2021, the combined ownership across various Blackrock products was approaching 19%.

As highlighted, S&P recently updated the index to include more companies, including those with a lower exposure to clean energy. This has the potential effect of diminishing its tie with the theme it is aiming to provide. On the other hand, the changes increase the potential investment capacity by a multiple of three. Looking at the recent filings from Blackrock, these changes have been enacted at the fund level. On balance, we feel the index changes are a positive, to ensure liquidity remains in the ETF, without driving the underlying share prices significantly. However, it does serve as a reminder for investors in ETFs to understand what you are buying, especially as the number of ETFs in the market expands.

In the first instance, AJ Bell funds and MPS use ETFs that look to track markets based on company size. Although this poses questions in the long term around the effect of passive investing on the markets – and a potential tipping point – it does ensure that, in the short term at least, the investments we make are highly liquid. In addition to the underlying liquidity of the securities in the ETFs, we can buy and sell the ETF shares on exchanges and platforms with other investors.

However, in some areas we do invest in strategies that look to move away from a size-based weighting methodology. For example, within high yield, we use the JP Morgan Multi Factor Global High Yield Bond ETF. When we invest in these products, one question we pose to the ETF manager is the capacity of the strategy. Although this usually runs into the multi-billions, and is not as pressing an issue as, say, for a UK small company active fund, it is important that we understand where product growth may lead to issues.

As the number of ETFs grow and move away from ‘passive’ strategies, to harness themes, factors, styles or responsible investing, the task of maintaining due diligence of potential investments becomes more complicated. At AJ Bell, we are pleased to have a team dedicated to ETF research to ensure the implementation of our portfolios is not just based on headline measures such as ETF costs, and instead we are taking the time to look under the bonnet.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.