Pension Credit has historically been chronically underclaimed by those who are eligible, with hundreds of thousands of households potentially missing out on thousands of pounds of valuable extra income per year. This is particularly tragic because those who are eligible for Pension Credit are likely to be among the poorest households in the UK.

The rising cost-of-living has brought greater urgency to the issue, in particular because a successful Pension Credit application automatically triggers cost-of-living payments worth hundreds of pounds, as well as acting as a gateway to other benefits like free TV licenses and help with heating costs.

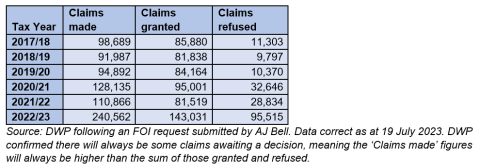

In this context, the fact Pension Credit claims have more than doubled in the space of a year is both heartening and depressing. Heartening because it means over 60,000 more people received Pension Credit and the benefits that go with it in 2022/23, but depressing because it shows just how much retirees are struggling as a result of price rises.

The fact almost 100,000 Pension Credit claims were turned down in 2022/23 is also deeply worrying, as these households may have been relying on receiving the benefit – not to mention the £600 of cost-of-living payments still to be distributed this year – to make ends meet. If your Pension Credit claim has been turned down you may still be entitled to other benefits, so it’s worth checking to see if you are eligible for other forms of financial help.

Background

Pension Credit is a key benefit provided by the state which often tends to go unclaimed by lower income retirees.

In 2023/24, if you are over State Pension age (66), single and your income is less than £201.05 a week then Pension Credit will top you up to that amount. For a couple, the combined income figure is £306.85.

In relation to Pension Credit, your income includes your State Pension, other pensions, employment or self-employment earnings and most social security benefits. As with the State Pension, it is up to you to claim Pension Credit.

For those who are entitled to receive it, claiming Pension Credit is also really important because it acts as a gateway to other benefits, such as help with heating costs, housing benefit, dental treatment and free TV licenses (if you are aged 75 or over).

In addition, those who claim Pension Credit currently qualify for cost-of-living payments from the government.

The government has made concerted efforts to boost Pension Credit take-up and recently launched a trial which will see 2,000 people the DWP believes could be entitled to claim the benefit receiving letters encouraging them to make a claim.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.