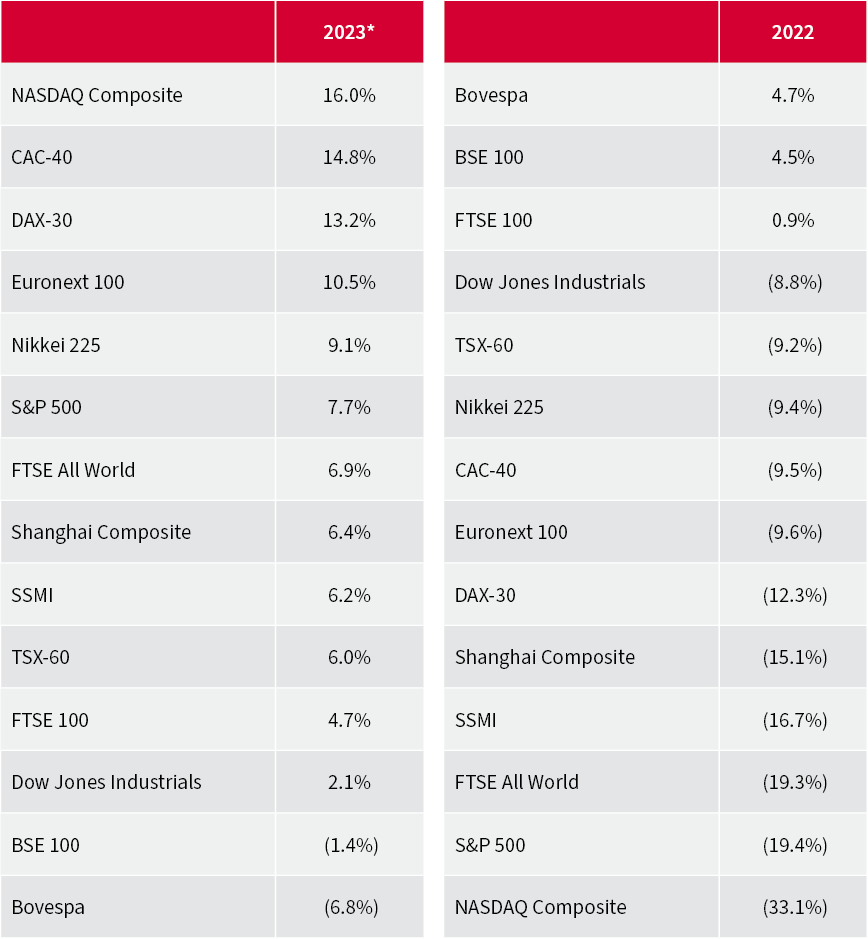

“It was the worst-performing major equity index in 2022 and, so far, it has been the best in 2023. Is the NASDAQ back?”

It was the worst-performing major equity index in 2022 and, so far, it has been the best in 2023. Is the NASDAQ back? It is tempting to think so, especially after the meaty rally in stocks such as Meta Platforms and Microsoft following their first-quarter results. In addition, the US (and probably global) bellwether for technology stocks is up by 18% from its autumn 2022 low and, arguably, on the cusp of a new bull market.

NASDAQ Composite is the best performing major index in 2023 to date

Source: Refinitiv data

“The NASDAQ is actually trading some 24% below its 2021 peak, so it is just as easy to argue that tech stocks are still mired in a bear market.”

Some would say that a new bull run does not begin until the old peak is eclipsed and exceeded by 20%, and the NASDAQ is actually trading some 24% below its 2021 peak, so it is just as easy to argue that tech stocks are still mired in a bear market.

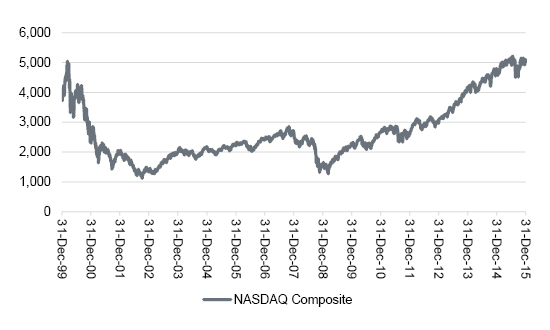

Anyone who remembers the NASDAQ’s collapse of 2000-2003, after the dizzying bull market of 1998 to 2000, may be inclined to proceed with caution:

It took the NASDAQ fifteen years to recover from the 2000-2003 bubble

Source: Refinitiv data

That last stat is particularly telling, not least because it is possible to argue the NASDAQ bull market this time around was even more egregious than the one of 2000 to 2003, given the unfettered enthusiasm for meme stocks, Special Purpose Acquisition Companies (SPACs), initial public offerings, cryptocurrencies and a lot more besides.

“The run from the NASDAQ’s autumn low is 195 days old, so the good news is it already has more longevity than any of the nine 2000-2003 rallies that ultimately failed.”

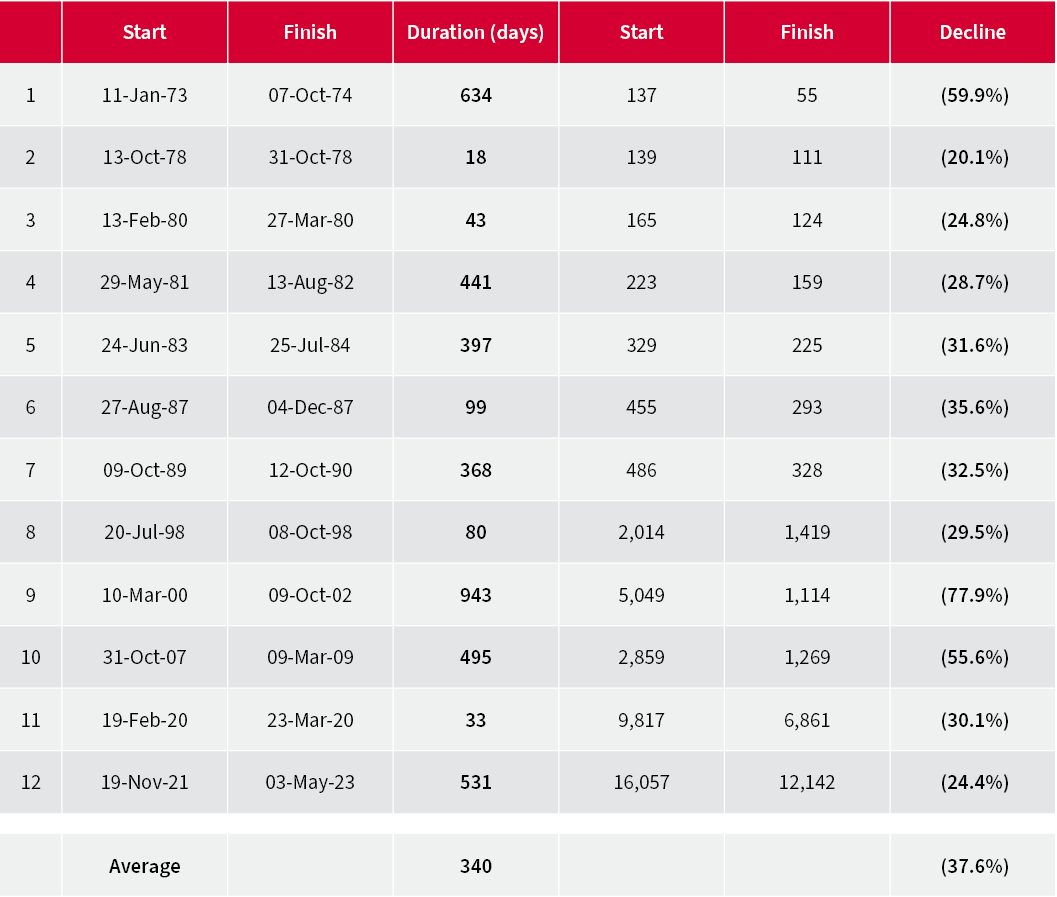

The run from the NASDAQ’s autumn low is 195 days old, so the good news is it already has more longevity than any of the nine 2000-2003 rallies that ultimately failed. That may encourage investors to think that NASDAQ’s last pullback is more akin to the short, sharp bear markets of 1978, 1980, 1987, 1998 and 2020 rather than the soul-crushing slumps of 1973-74, 2000-02 and 2007-09 which saw the index lose 60%, 78% and 56% of its value, respectively.

There have been 12 bear markets in the NASDAQ since 1971.

On average they have lasted 340 days and shaved 38% off the index’s value. The current slump is now 525 days old and has cut 24% off the benchmark.

The current NASDAQ downturn looks mild compared to prior bear markets …

Source: Refinitiv data

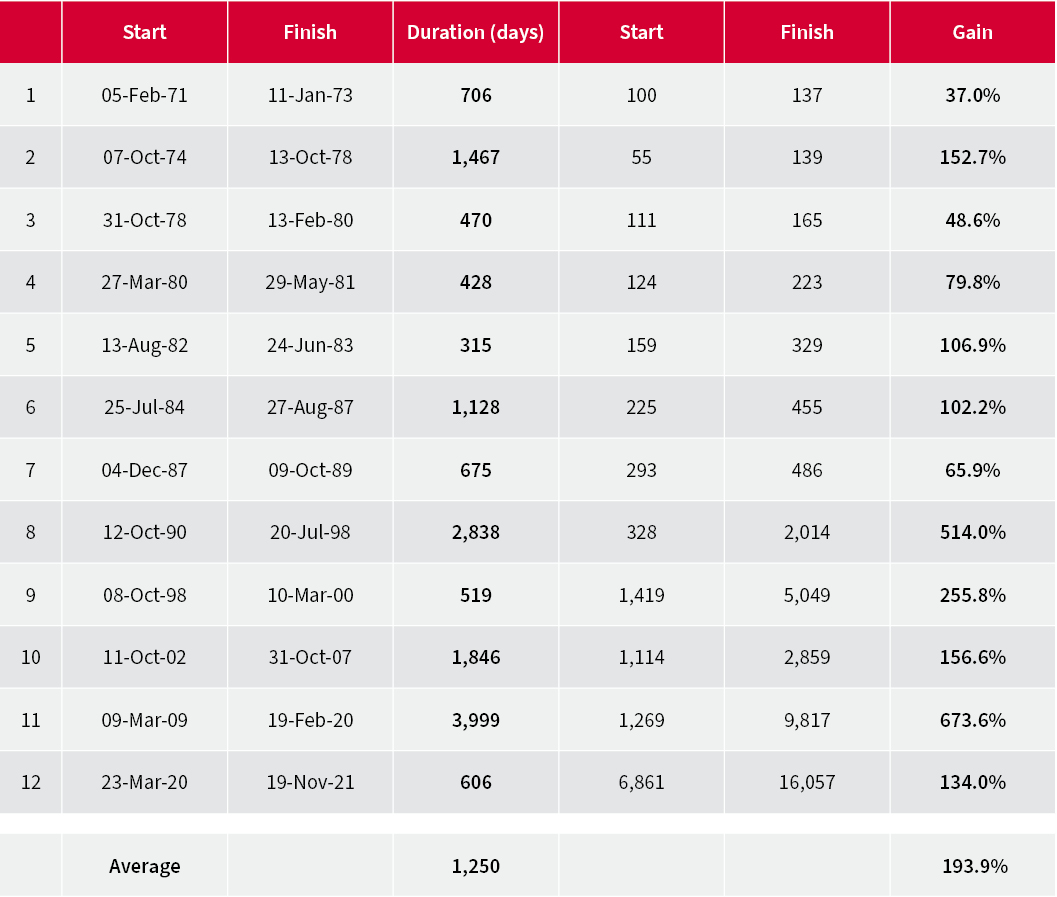

Sceptics will therefore assert that there could still be worse to come, especially as the worst downturns have come after the most rampant advances and the index’s addition of 9,196 points in just 606 days in its last bull run does look like a classic blow-off top.

... even though the last bull run was a huge one

Source: Refinitiv data

“If the world returns to the low-interest-rate, low-growth, low-inflation mire which characterised the 2010s and early 2020s then you can see why tech could excel again.”

But tech is rallying. This may be in response to the sharp share price falls of 2022, which mean valuations are now more attractive, or fears of a recession and the search for relatively reliable earnings and cashflows or hopes for interest rate cuts later in the year. If the world returns to the low-interest-rate, low-growth, low-inflation mire which characterised the 2010s and early 2020s then you can see why tech could excel again, because such an environment places a premium on any firm that is capable of producing secular growth.

“Equally, if a 40-year era of cheap energy, cheap money, cheap labour and cheap goods is over, and higher inflation and higher rates are with us to stay, then it is more difficult to argue that what has worked before will work again, simply because the environment will be so different.”

Equally, if a 40-year era of cheap energy, cheap money, cheap labour and cheap goods is over, and higher inflation and higher rates are with us to stay, then it is more difficult to argue that what has worked before will work again, simply because the environment will be so different.

That backdrop would seem better suited to “jam today” cyclical stocks, which could start to offer nominal rates of growth that mean there is no need to pay a premium valuation for perceived “jam tomorrow” long-term growth stocks. It could also persuade investors to lessen exposure to equities in favour of commodities and ‘real stuff’, which, by and large, outperformed ‘paper’ assets in the 1970s.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.