Birthday parties seem to be in the news a lot at the moment and seemingly largely for the wrong reasons. But on 18th April, the Investment Team here at AJ Bell indulged ourselves just briefly with a small slice of cake, to celebrate the 5th anniversary of the first AJ Bell Funds.

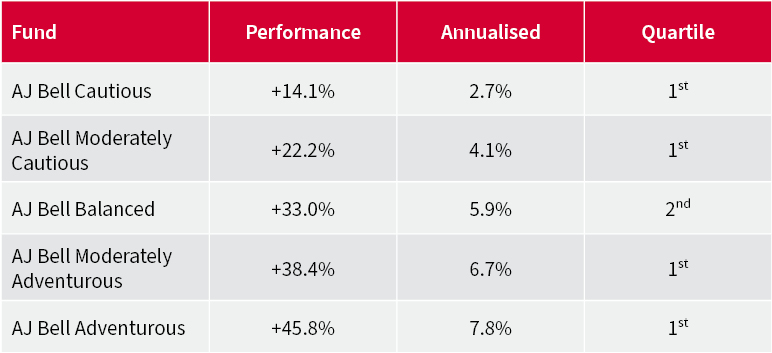

You will all know that anyone writing about a fund anniversary is generally doing so because they have done well and I’m happy to say this is no different. Let’s cut to the chase straight away:

Source: Financial Express, total return, 18th April 2017 to 18th April 2022

Unsurprisingly, we are thrilled with these results and since our first five funds were launched in 2017 we have course added the Global Growth fund, two income-focused funds and a Responsible fund too, with the range growing to over £1 billion in assets. We thank all of you who have put your trust and your clients’ hard-earned money into our funds and MPS over the last five years.

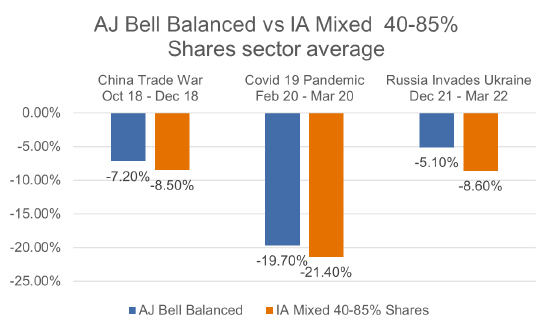

Looking back on the past five years, the portfolios have clearly had to contend with a wide array of different economic, macro, political and social events, so it is heartening to see them come through so strongly. When analysing the returns, it’s interesting to see something of a pattern appearing; that is winning by not losing. While it sounds simplistic, the easiest way to make money over the long run is to not lose too much of it in the first place. While the AJ Bell funds have had drawdowns as the market has fallen, we note that in the three big market sell-offs during the past five years, the funds have typically outperformed our peers.

Source: Morningstar, total return, net income reinvested

This performance profile is not necessarily by accident given how we have designed our asset allocation approach. We are unashamedly long-term investors, who believe in the power of diversification, keeping costs as low as possible and trying not to be too clever. These principles have helped guide us through the maze of the challenges we have seen in recent years and will remain integral to our future performance too.

This focus on the long term has highlighted some key opportunities over the last few years that have helped drive returns. Utilising sectors and not just regions saw the funds have exposure to technology, healthcare and consumer staples which helped navigate the Covid sell off; while adding energy in February 2021 when the market was focused solely on renewables has helped more recent performance, especially during the sell-off when Russia invaded Ukraine. Looking more granularly at countries has seen first China and then India be added to the funds alongside traditional Asian and emerging markets exposure. China was fantastic in 2020 but more challenged in 2021, and this was largely offset by the very strong returns from India. Within fixed interest, holding US Treasuries during Covid softened the most extreme of market moves while adding US TIPS before people were worried about inflation has also been beneficial.

The key takeaway from above is that it’s not been one or two big calls that drives the performance of the AJ Bell Funds but a robust investment process that allows us to adapt the asset allocation to the long-term pricing of assets. This is exactly how our strategic allocation has been designed and takes away many of the behavioural biases that risk over-influencing the approach and potentially destroying returns.

It’s not just the AJ Bell Funds that follow this approach, as our entire range of products, including our MPS, utilises the same approach, meaning that whichever route is right for your clients, they will be able to benefit from the principles which have driven our returns so far.

We also recognise how important it is to keep costs low, and are proud to have been able to use our growing scale to drive down costs. Whether this is via negotiating better terms for underlying investments, helping launch new strategies that undercut overcharging incumbents or by cutting our OCF, all of these have contributed to an OCF that has fallen from 0.51% at launch to just 0.31% today.

With the continuation of challenges in investment markets, especially today given the significant shift in inflation and what this means for asset classes, we recognise that the hard work doesn’t stop with a five-year anniversary. Many advisers and wealth managers rightly want to see proof in the pudding for new entrants and hopefully the strong performance of the AJ Bell Funds over the past five years will give you confidence that the pudding looks pretty tasty. In fact, nearly as tasty as the aforementioned birthday cake!

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.