An American former colleague from my investment banking days was always tickled when he quoted a sketch from the comedy show Saturday Night Live, where the punchline was “And today on the New York Stock Exchange, no shares changed hands. Everyone finally has what they want.”

Oh, how he used to laugh, even if, like all good comedy, it raises a serious issue and one that all investors must consider. What purpose does the perpetual wheeler-dealing on stock exchanges serve? And what dangers can it bring, especially if even this frenetic activity is not enough for some because they want more and use borrowed money – leverage – to try and get it by gearing up their returns?

“There are plenty of examples of what can go wrong when leverage or complex trading strategies are deployed to try and goose profits.”

The truly funny thing is that there are plenty of examples of what can go wrong when leverage or complex trading strategies are deployed to try and goose profits. These include Barings in 1995 ($1 billion loss), LTCM in 1998 ($3.7 billion) and Amaranth in 2006 ($6 billion). As such, the only surprise with the latest such accident – Archegos Capital – is that anyone is surprised at all. Even supposed ‘hedging strategies’, designed to dampen market risk, have often only served to accentuate it. Examples here includes the ‘portfolio insurance’ programmes that contributed to the 1987 Crash, Metallgesellschaft losing its shirt in the oil market in 1992 and AIG’s significant contribution to the Great Financial Crisis of 2007–09.

Frankly, we were overdue. The question now for advisers and clients is whether the damage is limited to the Archegos hedge fund, the US media and Chinese internet stocks which appear to have got it into trouble and those banks which acted as its prime broker – Nomura and Credit Suisse are the names in the frame here – or whether there is a wider, spill-over effect.

“When an investment firm with lots of debt has large positions that are becoming stressed, that institution may be forced to sell assets in order to meet margin calls and make good on its borrowing, according to the demands of its creditors.”

Such a knock-on effect can develop quickly. When an investment firm with lots of debt has large positions that are becoming stressed (and, in the case of leveraged entities using margin, that can mean even small drops below the initial entry price), that institution may be forced to sell assets in order to meet margin calls and make good on its borrowing, according to the demands of its creditors. Such selling leads the market to drop further, which prompts further loss of value of the collateral, which forces yet more selling – and so on. This also means that assets classes entirely unrelated to the initial problem position(s) can be caught up in the melee – which explains the old market saying about how ‘all correlations go to one’ in a bear market, as distressed sellers just liquidate anything for which they can find a buyer.

This is why Richard Bookstaber argues in his history of markets and hedge funds A Demon of Our Own Design that risk management models fail during crises, no matter how well designed they are. During a crisis, nothing else matters, other than who owns what, and who must sell even if they do not want to sell.

As highly-respected bond fund manager Howard Marks once notes in his blogs for Oaktree Capital Management, liquidity is best-defined as being able to buy or sell what you want, at the price you want, at the time you want and in the size you want.

“If someone wishes to sell, then, with the help of their broker or platform, they must find a buyer, or vice versa. History tells us this is not always as easy as it sounds, for anyone involved.”

But these lessons do not apply to just hedge fund managers. Advisers and clients, and their appointed money managers, must do so as well. If they wish to sell, then, with the help of their broker or platform, they must find a buyer, or vice versa. History tells us this is not always as easy as it sounds, for anyone involved, as J.K. Galbraith’s magisterial analysis The Great Crash shows. In his study of 1929’s market catastrophe, he notes:

“Of all the mysteries of the stock exchange there is none so impenetrable as why there should be a buyer for everyone who seeks to sell. October 24, 1929 showed that what is mysterious is not inevitable. Often there were no buyers and only after wide vertical declines could anyone be induced to bid. Repeatedly and in many instances, there was a plethora of selling and no buyers at all.”

Galbraith cites White Sewing Machine stock as an example. It plunged from $48 to $11 and yet no buyers emerged. Eventually an enormous block of stock was sold for one dollar a share.

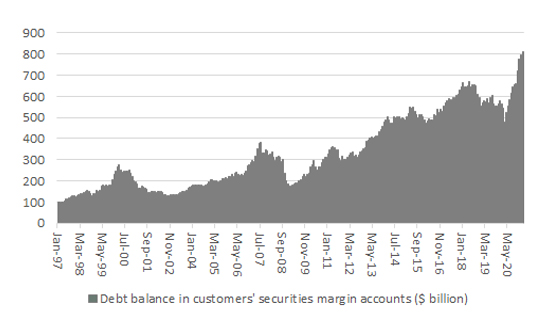

It is tempting to dismiss this as the follies of 90 years ago. But FTSE 100 stocks were very hard to sell in size in 2008. There is every likelihood that the next market upset – if, as and when it comes – could see further distressed selling and not just by institutions. US retail investors, for example, have never borrowed as much to buy stock as they have today.

US margin debt stands at record highs

Source: NYSE data to February 2010, FINRA data from February 2010

It is tempting to dismiss this, by saying that the numbers are not as lofty when presented as a percentage of US GDP or market capitalisation. But the 49% year-on-year growth rate is reminiscent of the market peaks in 2000 and 2007, to again show that risk-taking seems to be the order of the day. And it is that sort of risk-taking which makes market accidents worse as and when they happen.

The hard bit is no one knows when that will be. The comedian Groucho Marx was cleaned out in 1929 as he bought stock on margin only to see prices collapse and force him to sell even at depressed prices. Goldman Sachs stock was one of his biggest blunders – bought solely on the basis of a tip from his agent – though at least Marx was earning enough on stage and celluloid to keep him in wisecracks, noting after the Crash things were so bad “the pigeons started feeding the people in Central Park.”

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.