Winter is finally drawing to an end and, following Boris’s recent announcements, it looks like the restrictions on our lives might soon be doing the same. I for one am extremely keen to start making up for lost time with friends and family, but I must say that lockdown has not really led to any down time here at AJ Bell Investcentre. Indeed, we have been quietly forging ahead with a number of different initiatives, news of which I am very pleased to share with you in the following pages.

Back in November 2020, we added to our in-house fund range by launching the VT AJ Bell Responsible Growth Fund – designed for clients who care about people and the planet, but who still aim to make a profit. It was immediately popular, and we have been delighted with the uptake.

Since then, interest in environmental, social and governance (ESG) investing has continued to grow, and is becoming a key focus of regulators – so much so that potential amendments to suitability rules may mean that advisers could soon be mandated to take clients ESG preferences into account.

In light of all this, we have launched the AJ Bell Responsible Managed Portfolio Service (MPS). This is an addition to our existing passive, active and ‘Pactive’ MPS solutions, all of which are managed by the usual team at AJ Bell Investments. As ever, the portfolios are offered in a range of risk profiles, giving options for cautious investors with MPS 1, up to the more adventurous in MPS 6.

The guys at AJ Bell Investments take a multi-layered approach towards responsible investing, by using underlying products that have a strong range of values-based exclusions and ensuring that only companies with high ESG rankings are invested in. The team also does extensive due diligence on the providers of the securities in each portfolio, to make sure that they are taking their stewardship responsibilities seriously.

Within the portfolios, there is a 25% allocation to the AJ Bell Responsible Growth Fund. This helps to keep our costs low, and gives us flexibility to make investment decisions within the fund wrapper, rather than in the wider portfolio, meaning that we can broaden the universe of investible securities, make speedy tactical asset allocation calls and potentially reduce Capital Gains Tax exposure for your GIA clients.

Our focus is always on keeping costs low, and the Responsible Growth MPS is no different – it carries an investment management charge of just 0.15% p.a., with no VAT applicable.

If you’d like more information about the Responsible Growth MPS, or the rest of our investment range, please see our Adviser Guide and FAQ documents, or contact your Business Development Consultant.

The value of investments can go down as well as up and your client may not get back their original investment. Tax treatment depends on individual circumstances and rules may change.

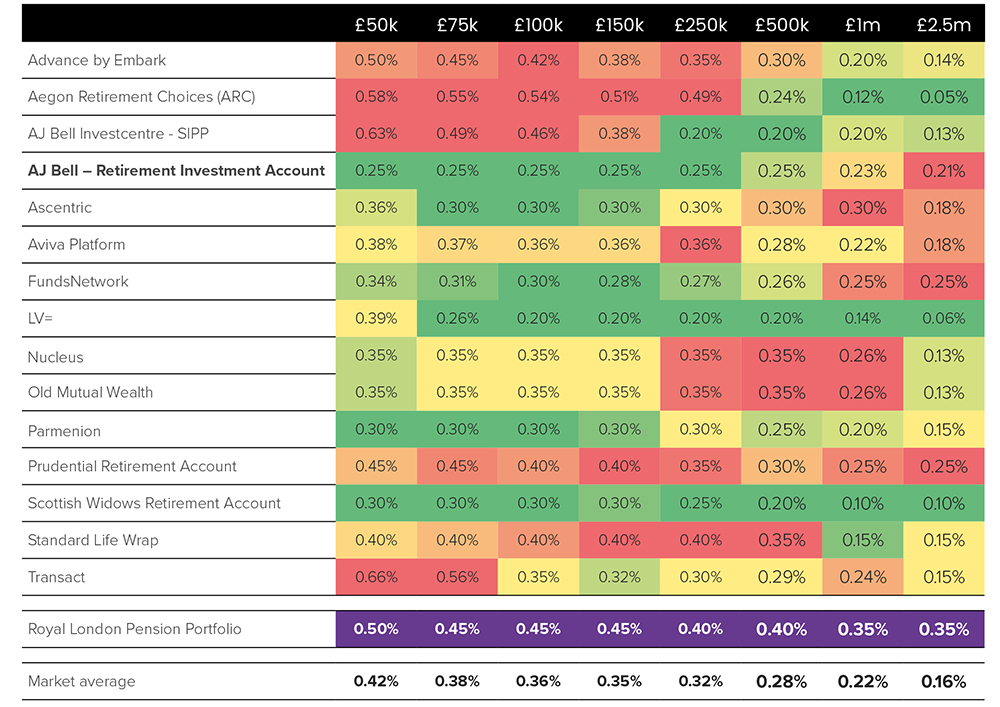

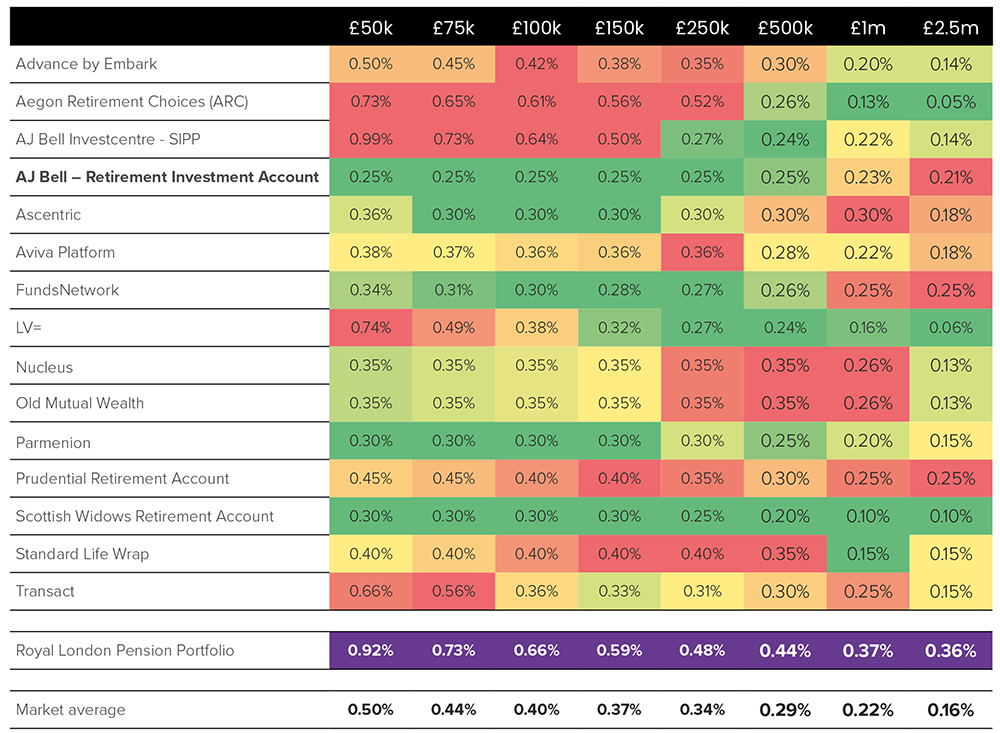

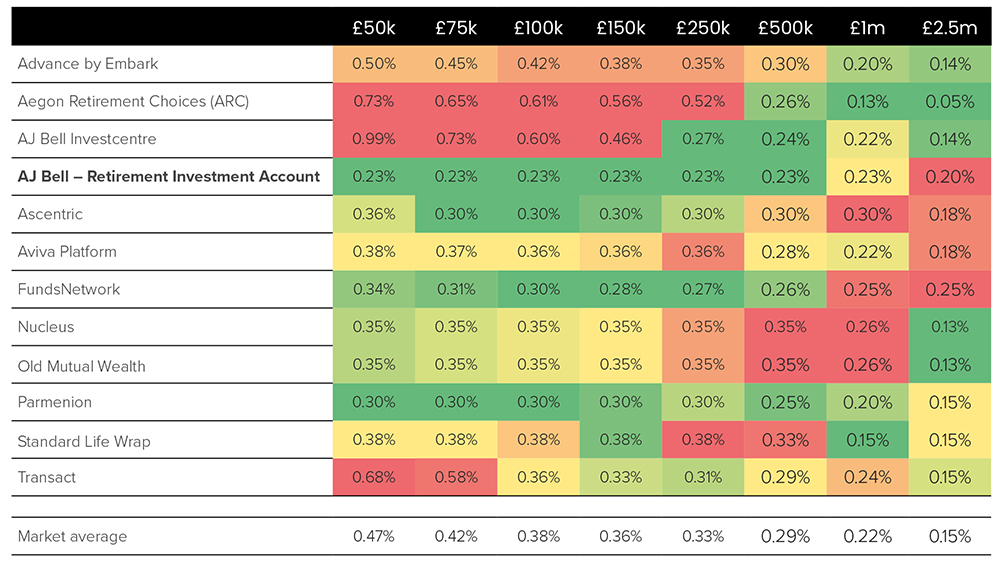

The lang cat has updated its heat maps that outline how our Retirement Investment Account and SIPP are positioned relative to our peers, and we’re very pleased to share the latest findings with you.

The tables and heatmaps showcase our pricing across a range of scenarios. The first table looks at accumulation only, while the second table introduces drawdown functionality. The third table shows a mix of 50% holdings in drawdown and 50% split equally across an ISA and GIA.

As you can see, we remain highly competitive across the board, with our RIA being particularly strong for lower fund values.

Accumulation

Drawdown

Mixed wrapper

For more information, please don’t hesitate to contact your Business Development Team.

For obvious reasons, we had to cancel our usual face-to-face live roadshow sessions, so instead we’ll be hosting our virtual Roadshow Special on Thursday 18 March at 10am that you can attend online from the comfort of your own home or office.

The 90 minutes of structured CPD time will begin with a business and platform market update from our Sales Director, Gary Dale, who will then introduce a session with three of our resident techies and Senior Consultants, namely Lisa Webster, Rachel Vahey and Charlene Young. Our Chief Investment Officer, Kevin Doran, will then deliver another insightful talk before bringing things to a close.

During the 90 minutes, we will be covering topics including:

You can find further information – including the agenda and speaker details – on our dedicated event page.

I am pleased to be able to confirm that we are now fully set up to provide Utmost Ltd (IOM) with electronic valuations.

This means your clients will now pay a discounted fee of just £129.00 per quarter on their Utmost IOM offshore bond when investing via our GIA.

We are fortunate to have an outstanding team of technical experts working for us at AJ Bell, and together they are responsible for producing the treasure trove of technical articles and guides that is our Infocentre. This easily searchable archive is being added to all the time, making it an invaluable resource for any adviser or paraplanner. You can access it any time, here. If you are interested in the very latest technical material produced by the team, please also keep an eye out for our Tech Tuesday bulletin that we issue on the first Tuesday of every month.

Tax year end isn’t very far down the track, so I wanted to make you aware of some key dates to bear in mind when planning your clients’ finances and investments in the coming weeks.

Pension payments

15 March 2021 – pension commencement lump sums

If you have any clients who are considering taking pension benefits and who require a pension commencement lump sum (PCLS) payment prior to tax year end, then please send us the completed benefit form by 15 March 2021. Please note that payment of a PCLS is dependent on the SIPP being valued, all transfers being received and cash being available to cover the payment. Funds will also need to be available to cover any corresponding income payment.

19 March 2021 – flexi-access conversion and UFPLS

If any of your clients wish to convert to flexi-access from capped drawdown before taking an income payment from their SIPP, or are considering taking an uncrystallised funds pension lump sum (UFPLS) payment prior to tax year end, please ensure that the relevant forms are completed and sent to us by 19 March 2021. Please also note that payment of an UFPLS is dependent on the SIPP being valued, all transfers being received and cash being available to cover the payment.

26 March 2021 – one-off income payments

If you have any clients who are already taking benefits from their SIPP and who would like to take a one-off income payment prior to tax year end, please ensure that you request the payment online no later than 12 noon on 26 March 2021. Any payments requested after this may fall into the next tax year. You will also need to ensure that sufficient cleared funds are available in your client’s SIPP cash account by this date.

If you have any clients who are already taking benefits from their SIPP and who would like to take a one-off income payment prior to tax year end between 12 noon on 26 March 2021 and 12 noon on 31 March 2021, then this must be requested by CHAPS. Any payments requested after 12 noon on 31 March 2021 may fall into the next tax year.

ISA and GIA withdrawals

For clients who are considering taking a withdrawal payment and who require the payment prior to tax year end, please be aware that an ISA/GIA withdrawal can take up to five working days to be paid to your client (although we always aim to make payment at the earliest opportunity, and typically do so within 48 hours).

The easiest and quickest way for your clients to request a withdrawal is online. Please note that trades need to have settled in your client’s account prior to the payment being instructed.

Scanned documents and electronic signatures

As the number of cases you will be processing increases in the run up to the tax year end, it’s worth noting our stance on scanned documents and electronic signatures. Click here to see full details of our approach, something that I am sure will make it quicker and easier to process cases where an online journey does not already exist.

If you have any questions regarding the above, please email us on enquiry@investcentre.co.uk or contact our Adviser Support Team on 0345 83 99 060.

As you may know, the FCA has introduced four ‘pathways’ to help non-advised drawdown customers make better investment decisions. What you may not have realised is that, although the initiative is aimed at non-advised customers, it does actually have implications for financial advisers.

The four pathways are a range of ready-made investment options which correspond to one of four statements that a client may identify with.

The FCA investment pathways rules define a customer as ‘non-advised’ if their provider has not determined that the customer has received, in the last 12 months, a personal recommendation on either taking drawdown, or transferring from one drawdown plan to another.

If any adviser has set an investment strategy for a customer, but not given them advice on these particular transactions, then the customer will have to be taken through the investment pathways process.

Our benefits forms ask you to confirm that you have given advice to your client on drawdown transactions. This is to ensure that we do not have to take the customer through the investment pathways process unless absolutely necessary.

If you make a personal recommendation to a client about investing their capped drawdown or flexi-access drawdown funds, then its suitability assessment should also include consideration of pathway investments.

You can learn more about all this by reading our investment pathways adviser guide.

I am proud to say that, as part of our Wage War on COVID campaign, we have teamed up with the Sale Sharks Community Trust to deliver a fantastic new initiative called ‘AJ Bell Easter Eats’.

In the build up to the Easter holiday, this ambitious project will aim to distribute 2,500 food hampers to families of school-age children in our local Salford area. Each hamper is designed to give families a helping hand over the Easter period, by providing a mixture of fresh and long-life food items. To engage the kids over the break from school, hampers will also include a special holiday activity pack from the mental health charity Place2Be.

AJ Bell and Sharks Community Trust will be working with local schools in and around Salford to identify families who would like an AJ Bell Easter Eats hamper and will deliver them to their school or home. And as a little extra treat, AJ Bell staff will also be donating Easter eggs for distribution via the local schools we are working with. I’m sure you’ll agree that this is a great initiative that will hopefully help a range of families in what we all know have been difficult times.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.