Investors have been using futures contracts as far back as the 18th century as a method for trading commodities and protecting against changes in prices. Over time, the futures market continued to grow, and in the 1980s the first futures contract was launched on the S&P 500. By 2020, the number of futures contracts traded across the globe reached an all-time high of 47 billion.

The futures market is popular given it allows an investor to easily take an outright positive or negative view on an entire index or market, or to use them to hedge systematic risks within their portfolios – such as reducing market beta (through a short equities contract) or reducing interest rate risk (through a short treasury contract).

However, when the first ETF was launched in 1990, investors probably did not envisage the structure as a rival to the futures market. They have proved to be a credible rival to futures for taking an outright long view on a market and for certain investors, during different time periods, offer a more cost-effective way of getting access to a market. An article by ETF Stream in 2019 discussed the relative merits of both options, with this debate still rumbling on.

However, outside the cost debate, one clear advantage of using ETFs as a way of taking a view on a market is the myriad of options available to investors. With over 6,000 ETFs available globally, they offer the ability to take a more granular view – themes or sectors, niche bond exposures or an ESG strategy. On the other hand, the advantage of futures is a liquid two-way market, allowing an investor to take a short view easily.

It may surprise you to hear, then, that it is also possible to go ‘short’ on an ETF. Unlike a typical fund, an ETF is listed on a stock exchange, which means it can be shorted in a similar way to any other listed security. For this to be a viable option to investors, the ability to borrow ETFs is required, and this is one of the reasons the ETF lending market has grown rapidly – a virtuous circle of supply and demand. However, it is not the only reason an ETF lending market is required.

ETFs trade in two fashions. A primary trade is when the market maker (known as an authorised participant) subscribes or redeems directly into the fund, through either a cash payment or the delivery of a basket of securities. A secondary trade is when an ETF share trades between investors, with no impact on the underlying ETF. Primary trades typically involve higher transaction costs, as they involve purchasing all the underlying securities in the ETF which, in many regions, incurs several transaction costs and taxes (such as Stamp Duty Reserve Tax in the UK). On the other hand, secondary trades are exempt from Stamp Duty. Although complex to understand, this can mean secondary trading can have lower trading costs, and it incentivises market makers to use the ETF lending market to temporarily settle positions whilst they look to close out a position, rather than being forced into a primary trade. In summary, this means an ETF lending market is a benefit for both short-term reasons, such as trade efficiency and liquidity, as well as for longer-term speculators, such as fund managers.

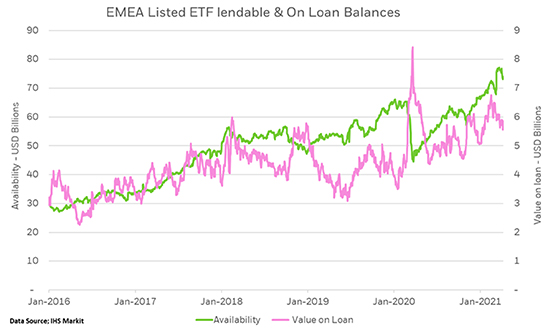

The following analysis from IHS shows that, over the last five years, the ETFs that are available to be lent in Europe have more than doubled their value to $70bn, however this represents a modest 5% of the overall European ETF market.

Source: IHS Markit

The rates that can be earned through lending out ETF securities are driven by supply and demand. This means popular exposures – such as an S&P 500 ETF – may only attract a return of a few basis points, while non-vanilla exposures – such as high-yield ETFs and ESG ETFs – can often attract rates of over 1%. At the extreme, some of the ARK ETFs run by Cathie Wood in the US currently attract a borrowing fee of over 5% per annum.

When investing ‘passively’ using index-strategies, the aim is to achieve the market return whilst minimising fees. This has led to a fee war as ETF providers aim to lure in assets. However, as a long-term investor, making your ETF securities available to loan offers an alternative way of reducing the cost of investing. It can in some cases lead to a situation where, as an investor, you are earning a return above the index. Engaging in ETF lending needs to be done in a cautious fashion, considering areas such as collateral and counterparty management. However, given the elusive search for ‘alpha’ amongst active managers, ETF lending is a different way to potentially beat the benchmark!

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.