The Financial Conduct Authority’s (perfectly understandable) decision to give companies additional time to prepare their financial statements may elongate the process but the imminent reporting season for UK plc could go a long way to shaping how the headline FTSE indices perform for the rest of this year and beyond.

The good news is that few if any companies have made a rod for their own back by giving any specific guidance for revenues, profits or dividends, owing to the uncertain environment created by the pandemic and their inability to predict how customers and clients will respond even as lockdowns are (generally) eased around the globe.

The bad news is that analysts still have to provide forecasts and it is by these estimates that the reporting season for the first six months of calendar 2020 will be judged, especially if companies do feel able to offer some sort of forecast of their own for the second half of the year or 2021, unlikely as this seems right now.

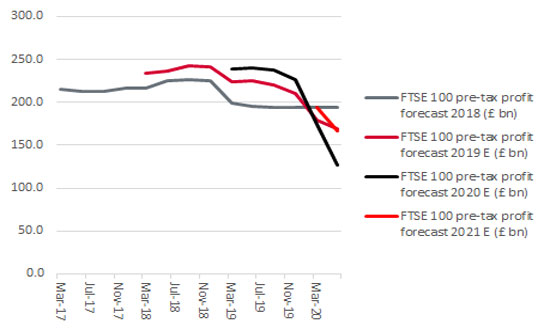

Analysts have been busy cutting their estimates for aggregate FTSE 100 profits throughout 2020. Advisers and clients will hardly be shocked by this, as at the turn of the year no one could have forecast the pandemic and the UK stock market was instead preoccupied by the Conservatives’ General Election victory in December and what this might mean in terms of policy with regard to the economy and Brexit.

“Forecasts for the FTSE 100’s aggregate pre-tax profit in 2020 have plunged by 45% to £126 billion since Christmas.”

It now looks like the FTSE 100 in aggregate delivered £169 billion in pre-tax profit in 2019, compared to the £240 billion analysts were expecting at the start of that year. Forecasts for 2020 have plunged by 45% to £126 billion since Christmas.

FTSE 100 profit forecasts continue to slide…

Source: Company accounts, Sharecast, consensus analysts’ forecasts

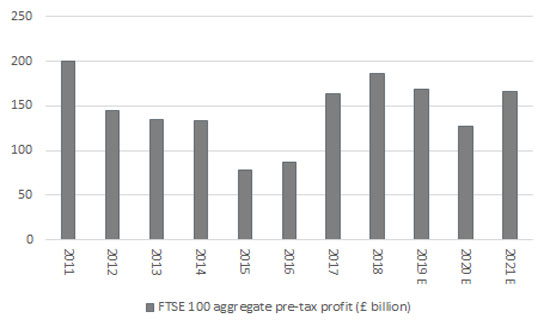

At the moment, pre-tax income is seen reaching £166 billion in 2021. That is just less than the members of the FTSE 100 generated between them in 2017, to suggest analysts feel the recovery will be a tepid one, at least initially.

“The FTSE 100’s pre-tax income is seen reaching £166 billion in 2021. That is just less than the members of the FTSE 100 generated between them in 2017, to suggest analysts feel the recovery will be a tepid one, at least initially.”

This could be seen as a good thing, as it does not make companies or their shareholders too much of a hostage to fortune relative to lofty expectations.

… with the result that 2021 aggregate earnings are seen undershooting those of 2015 and 2016.

Source: Company accounts, Sharecast, consensus analysts’ forecasts

Equally, advisers and clients would guess that even £166 billion in 2021 needs the world to duck a big second wave of COVID-19 during the Northern hemisphere’s autumn and winter, so that may the biggest variable of which investors in UK stocks must be aware, whether they picks their own shares or prefer actively- or passively-managed funds.

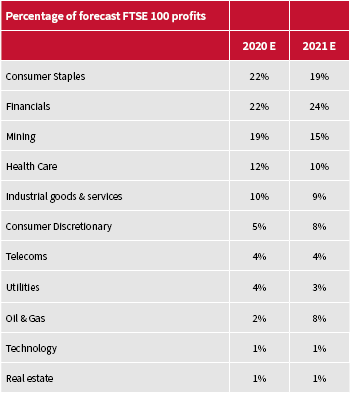

Advisers and clients may decide it is impossible to second-guess COVID-19’s impact whether there is a second wave or not, especially as central banks and governments still seem determined to throw everything that they can at the economy. But analysis of the profit mix within the FTSE 100 may at least help portfolio-builders develop an awareness of the key sensitivities.

“It may be a source of relief to some advisers and clients, either on ethical or purely financial grounds, that oil stocks are no longer expected to be big profit contributors to the FTSE 100, at just 2% of the total in 2020.”

For example, it may be a source of relief to some advisers and clients, either on ethical or purely financial grounds, that oil stocks are no longer expected to be big profit contributors to the FTSE 100, at just 2% of the total in 2020. Looking at that, they may not be able to do much more damage either and could be a source of potential upside if oil and gas prices forge a sustained and unexpected recovery.

Instead, consumer staples – food producers, food retailers, alcohol and tobacco stocks – are providing the bedrock to profits in 2020. Note also how healthcare, consumer staples, telecoms (Vodafone) and utilities are expected to generate earnings growth, albeit not enough to offset the collapse at consumer plays, miners, banks and oils. It could be argued that this may give the FTSE 100 some defensive qualities.

Defensive areas are providing support to FTSE 100 earnings in 2020…

Source: Sharecast, consensus analysts’ forecasts, company accounts

… but oils, banks and consumer plays are seen leading the recovery in 2021.

Source: Sharecast, consensus analysts’ forecasts, company accounts

However, more than 40% of pre-tax income is still expected to come from financials and miners, so it may not pay to overplay that theory, as a sluggish recovery (or a downturn) and interest rates staying lower for longer are not likely to help here. The same concerns apply to 2021, where forecasts of a rebound in overall earnings rest heavily upon oils, financials and consumer discretionary plays like retailers and media stocks.

“Any adviser or client, and especially one looking for passive exposure through an index tracker, now knows exactly what they are getting with UK stocks: some downside protection but a lot of gearing into any economic upturn, through commodity prices, consumer plays and banks.”

Any adviser or client, and especially one looking for passive exposure through an index tracker, now knows exactly what they are getting with UK stocks: some downside protection but a lot of gearing into any economic upturn, through commodity prices, consumer plays and banks. It could be argued that is not an especially high-quality earnings mix, not least as those areas are fiendishly difficult to forecast. Investors must now decide whether forecasts of a 3.6% dividend yield in 2020 and 4.3% in 2021 are sufficient compensation for them while they wait to find out what is coming next.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.