Whatever advisers and clients think of the quality and accuracy of the data coming out of China – on either the extent of the COVID-19 outbreak or the economy – they may be intrigued to note how the country is behaving, as that it much harder to obfuscate. Zijin Mining acquired Canada’s Continental Gold for C$1.4 billion in cash back in March and, last week, Shandong Gold agreed to acquire junior Canadian gold digger TMAC Resources for $149 million.

“Whatever investors think of the quality and accuracy of the data coming out of China, they may be intrigued to note how the country is behaving, as that is much harder to obfuscate. Two swoops to buy overseas gold miners therefore catch the eye.”

At a time when gold prices are holding firm at around $1,700 an ounce, this is intriguing, especially as leading Western precious metal miners had already begun to jockey to position and snap up assets which they clearly felt offered value. Canadian firms Endeavour Mining and Silvercorp Metals swooped for Semafo and Guyana Goldfields back in spring – the former having been rebuffed in its efforts to snap up FTSE 250 constituent Centamin – while 2019 saw the consummation of two huge deals, as Barrick Gold merged with Randgold Resources and Newmont Mining bought Goldcorp.

Investors could just dismiss this as necessary consolidation within an industry that failed to shine from an investment perspective for much of the last decade. But they could take note and at least ask themselves why gold executives in both the West and China are moving to acquire assets in such a hurry.

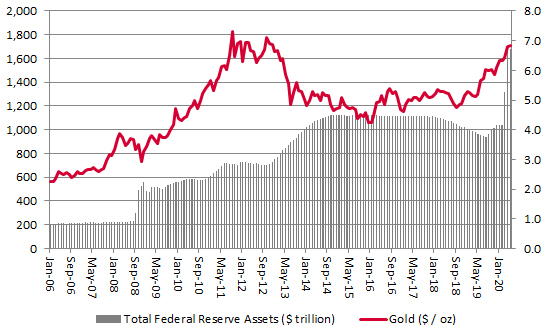

Governments and central banks, already running lofty deficits or swollen balance sheets, are going ‘all in’ as they try to keep economies going during the lockdowns that are being imposed as part of the fight against the viral outbreak. The US Federal Reserve’s balance sheet has grown by $2.5 trillion (or 62%) since February, while the US Government has begun to talk of adding to the $3 trillion in fiscal stimulus already provided. On this side of the pond, the UK Government’s discussion about phasing out the payment scheme for those unlucky enough to be furloughed is already encountering pushback from unions and those who are concerned about going back to work.

“Bearing in mind former US President Ronald Reagan’s maxim that ‘nothing lasts longer than a temporary government programme,’ governments around the world face a tricky balancing act between providing consumers with support when it is needed and weaning the nation off helicopter money.”

That is perfectly understandable on safety grounds. It is also easy to understand in the context of former US President Ronald Reagan’s maxim that ‘nothing lasts longer than a temporary government programme’. The Government now has a tricky balancing act between providing consumers with support when it is needed and weaning the nation off helicopter money – the longer that money is supplied, the greater the pressure will be to keep on creating it out of thin air.

Gold is holding firm at around $1,700 an ounce

Source: FRED – St. Louis US Federal Reserve, Refinitiv data

Governments and central banks had not got around to withdrawing the stimulus doled out in the wake of the Great Financial Crisis a decade ago before they had to start reapplying it, and the chances of this latest round of fiscal and monetary largesse being sterilised feel slim, even once the viral outbreak is finally contained.

This could be one reason why the gold price is holding firm within touching distance of its 2011 all-time high of $1,900 an ounce.

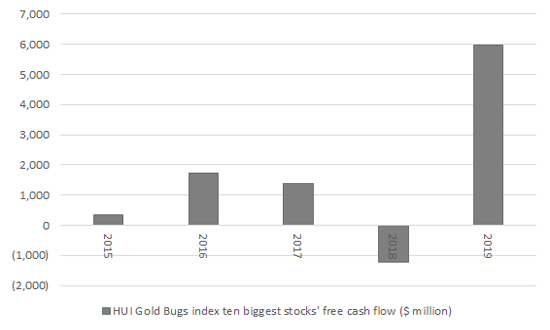

Strength in the gold price is also, quite naturally, bringing benefits to those firms which go exploring and drilling for the stuff. In its first-quarter results last week (5 May), Newmont Mining revealed a 43% year-on-year increase in sales, a 59% increase in operating profit and a three-fold increase in free cash flow (after interest, tax, working capital and capital spending), as higher gold prices supplemented increased metal production.

This continued a pattern across the 10 biggest members by weighting in the NYSE HUI Gold Bugs index. Since 2015, when gold bottomed at barely $1,050 an ounce and miners were writing down the value of their assets, aggregate annual free cash flow has surged from $341 million to $5.6 billion.

“Since 2015, when gold bottomed at barely $1,050 an ounce and miners were writing down the value of their assets, aggregate annual free cash flow has surged from $341 million to $5.6 billion across the 10 biggest stocks by weighting in the NYSE HUI Gold Bugs index.”

HUI index’s biggest constituents are starting to generate lots of cash

Source: Company accounts. Top 10 stocks by weighting in the NYSE Arca HUI Gold Bugs index are: Newmont Mining, Barrick Gold, Agnico Eagle, Novagold Resources, Alamos Gold, Equinox Gold, Kinross Gold, Eldorado Gold, B2Gold and AngloGold Ashanti.

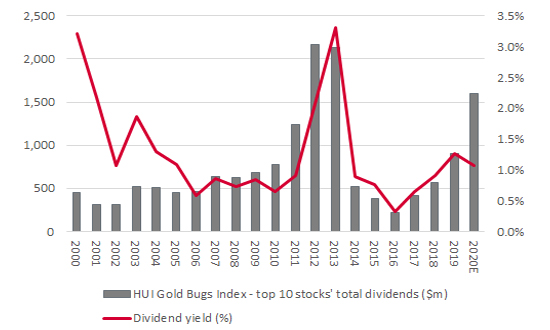

Better still, that surge in free cash flow – after taxes, interest, working capital and capital expenditure needs had all been met – prompted a 78% increase in Newmont’s quarterly dividend to $0.25 a share.

At a time when over 40 FTSE 100 firms have cut, cancelled or deferred their dividends, this may catch the eye of income-seekers. The bad news is that the aggregate dividend yield across the 10 biggest members of the HUI index was 1.1% in 2019. The good is that 2019’s aggregate payments were less than half of 2012’s peak and, if gold stays firm or goes higher still, that sum could be soon within reach, given that the weighted all-in sustained cost (AISC) of production across those 10 names was $949 last year. Any further surge in gold prices thanks to further money creation or deficit accumulation could turn gold miners into cash machines and the source of income that many investors crave.

HUI index’s biggest constituents are starting to increase dividend payments

Source: Company accounts, Refinitiv data. 2020E annualises last declared quarterly payments and uses market caps as of 8 May to calculate the 2020 yield.

Equally, if COVID-19 can be contained (and then eradicated) quickly and the global economy can rebound sharply, investors may not need gold’s perceived defensive qualities and any drop in the metal’s price would erode miners’ cash flow and ability to pay dividends.

This scenario remains perfectly possible and, as such, not all advisers and clients will feel the need to have gold as part of diversified portfolio. Even those who do face the choice between owning the metal or the miners – or a mix.

As shown by the surge in free cash flow and dividends, miners offer more leverage into gold price increases but the reverse applies, so they – and their share prices – will be hit harder if the metal price starts to melt once more.

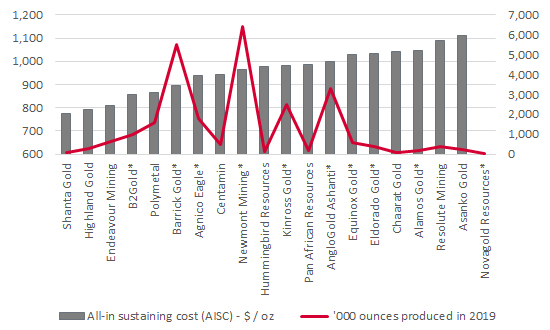

In addition, choosing between miners is hard work and neither advisers nor clients may have the time or expertise required. The AISC of a miner is one key consideration, as the lower the cost of production, the more the miner can cash in should gold prices keep rising. The next graphic shows the AISC of the 10 largest stocks by weighting in the HUI Gold Bugs index and also 10 leading producers whose shares trade in London. Their latest annual gold production figure is also given to provide some degree of context.

Leading gold producers’ all-in sustaining cost (AISC) and production figures

Source: Company accounts for 2019. *Signifies member of the NYSE HUI Gold Bugs index; others traded on the London Stock Exchange.

But besides cost and scale, advisers and clients would need to consider geopolitical risk (and whether the miner’s operations are based in nations where taxes could be increased or assets appropriated); operational risk (due to location or weather); financial risk (such as debt); and, finally, valuation, where multiples of book or net asset value may prove a more reliable benchmark than fast-moving earnings or cash-flow ratios.

If advisers and clients think that fathoming this lot is arduous work, then they are correct. The good news is that there is a good number of London-traded tracker funds and a selection of open- and closed-ended actively-run funds which will do the job for them and provide exposure to a basket of miners, be they established producers, junior explorers or a mix of the two.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.