Tax year end hub

We want you to feel good, advising – even through your busiest period. That’s why we’ve created this online hub. Featuring important deadlines, a range of useful tools and some invaluable guidance, it’s all designed to make TYE as easy as ABC.

Key TYE deadlines for your diary

Tools and guidance to save you time

Technical expertise to grow your skills

Award-winning service when it matters

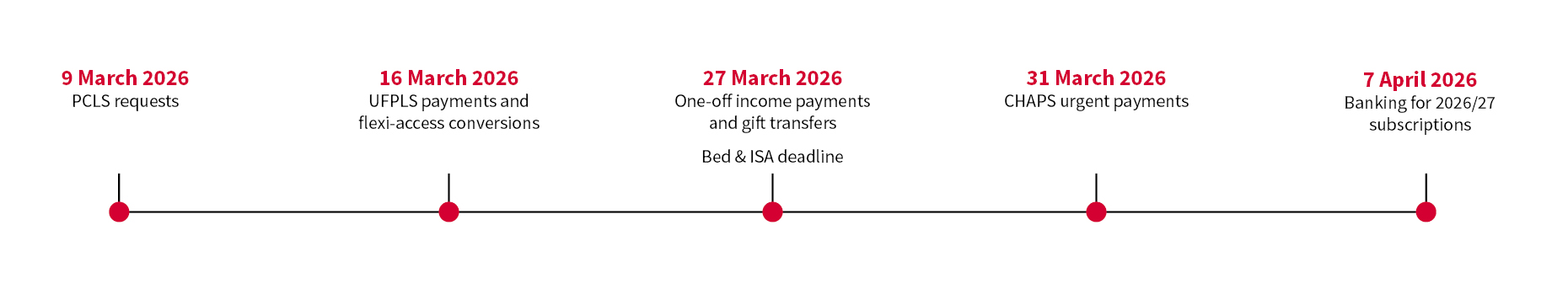

Key TYE deadlines for your diary

Never miss a deadline. All the critical dates in one place, so you can plan ahead and avoid last-minute worries.

Pension payments

- 9 March 2026 – Last date to request a PCLS (tax-free lump sum) before tax year end.

Tip: Ensure the SIPP is valued, transfers are complete, and cash is available.

- 16 March 2026 – Deadline for:

- Converting capped drawdown to flexi-access before taking income.

- Requesting an UFPLS payment (uncrystallised funds lump sum).

Tip: UFPLS depends on valuation and cleared transfers.

- 27 March 2026 (12 noon) – Final cut-off for one-off income payments for clients already in drawdown.

Tip: Ensure sufficient cleared funds are available in the SIPP cash account by this date.

- 31 March 2026 (10am) – CHAPS payment requests for urgent one-off payments.

Transfers

- 27 March 2026 – Last date to request a gift transfer by email.

Tip: Chase the ceding provider early to avoid delays.

Bed and ISA

- 27 March 2026 – deadline to submit an online Bed & ISA for it to be included in the current tax year.

Tip: Instructions can't be cancelled once submitted, and only one Bed & ISA can be in progress per clients. Submit early to allow time for trades to contract and avoid missing the cut-off.

- From 6 April – online Bed & ISA reopens for new tax year.

Tip: New tax year ISA allowances apply from this date. Check there are no active rebalances or scheduled investments that could prevent you submitting an instruction.

ISA and GIA withdrawals

- Allow 1–3 working days for payments.

Tip: If funds aren’t available, the timeframe starts once they clear.

- Ensure verified bank details are in place before requesting withdrawals.

Tip: Some withdrawals may take longer if additional verification checks are required – please plan accordingly.

Payments

- Online payments are fastest and avoid paperwork delays.

- ISA Subscriptions for 2026/27 tax year will be banked on 7 April 2026.

Tip: If paying for both tax years by cheque, provide separate cheques and post-date the second for 6 April 2026.

Frequently asked questions

We’ve put our heads together and answered many of the questions you may have over this busy tax year end.

Tips to save you time this tax year end

TIP 1

Verify client bank details early to prevent delays.

TIP 2

Use online forms and calculators to speed up requests.

TIP 3

Fund ISAs from GIAs for quick transfers.

TIP 4

Submit requests well in advance – avoid the last-minute rush.

Tools and guidance to save you time

Work smarter, not harder. Watch our quick walkthrough videos to get the most from your platform, and use our range of practical tools to save time when advising clients.

Platform walkthrough videos

In the run-up to 5 April, we want to help make TYE as easy as ABC. As part of that drive, we’ve made a series of quick videos that show how you can do key tasks on our platform as efficiently as possible.

- Make an ISA subscription

- Make a GIA payment

- Make a one-off pension contribution

- Get an annual GIA tax summary

- Move cash between products

- Find annual pension statements

- Check remaining ISA allowance

Make an ISA subscription

Make a GIA payment

Make a one-off SIPP and RIA contribution

Get an annual GIA tax summary

Move cash between products - from GIA to SIPP or ISA

Find annual pension statements

Check remaining ISA allowance

Tools available in V2.0

Make planning easier and more efficient, with tools available exclusively to AJ Bell Investcentre users.

- Planning and research tool

- Capital gains tax calculator

- Costs and charges calculator

Compare pension costs and choose with confidence

Both our SIPP and RIA offer flexibility to suit different client needs.

Use our cost comparison tool to see annual charges side by side, helping you decide which is best for protecting your client’s wealth.

Tax year end checklist

Compiled by our Tech Team, this checklist will help you really prove your worth to clients by spotting quick wins and overlooked opportunities.

Simplified Bed & ISA

Our newly-enhanced Bed & ISA journey is fully online and designed to streamline the process. Follow our step-by-step guide to understand how it works.

Technical expertise to grow your skills

From our planning webinar and Bitesize videos, to detailed technical guides and articles, these expert-led resources are designed to help you navigate tax year end with ease.

On demand

Your tax year end planning essentials

To help with your client conversations, our Senior Technical Consultant, Lisa Webster, discusses everything you need to know ahead of 5 April, including:

- optimising pension contributions to avoid tax traps and the loss of funded childcare;

- making the most of key allowances, including rates for IHT gifting, CGT and venture capital trusts; and

- upcoming changes to taxation rates and allowances in April 2026 and subsequent years.

Top tips for outsmarting the taxman

Methods of giving pension tax relief

Navigating the money purchase annual allowance

Charity gifts from pensions: key considerations

Investing for children adviser guide

Money Purchase Annual Allowance guide

Carry forward guide

ISA adviser guide

Technical guides and articles

Our expert guidance gives you the clarity you need to plan with confidence and make the right decisions for your clients.

Award-winning service when it matters

Get answers quickly and make the most of every opportunity.

Speak with your regional Support Team

Let our Business Development Team help with those all-important opportunities.

Frequently asked questions

Pension payments

What do I need to do before submitting a pension payment request?

Please add and verify your client’s bank details on our V2.0 website. Verified details help prevent delays when payments are time sensitive.

What happens if pension payment deadlines are missed?

Payments requested after the cut offs are likely to be paid in the new tax year and recorded accordingly.

ISA and GIA withdrawals

How long do ISA and GIA withdrawals take?

Withdrawals usually take one to three working days. If we need to validate the request with a phone call, your client or their nominated contact must be available.

Can I request a withdrawal if the account doesn’t have enough cash yet?

Yes. You can submit the request, but the one to three day timescale starts once funds are available, not from the date of the request.

Do I need to verify bank details before requesting a withdrawal?

Yes. Please make sure bank details are correct and verified. For individuals and joint accounts, new bank details can be added online. For non standard accounts (trusts or company GIAs), a signed Change of Nominated Bank Account Form is still required.

Transfers

How can I speed up a transfer in?

Chasing the ceding provider can help, as it may speed up their processing. We will also chase the transfer from our side.

What is the deadline for gift transfers?

Please email transfersin@investcentre.co.uk by 27 March 2026 if your client wants to make a gift transfer.

Payments into SIPPs ISAs and GIAs

What’s the easiest way to make contributions before tax year end?

Online payments are the quickest and most efficient option for existing SIPPs, ISAs and GIAs. They remove the need for paperwork and help prevent delays.

Our walkthrough video shows you how to make a contribution quickly.

How do clients make an online payment?

Go to the client account summary page and select ‘Additional contribution / subscription / payment’.

A unique reference is generated for that payment – it must be used exactly for the funds to be applied correctly. The payment must be set up using the online portal and money received by AJ Bell by 5 April 2026.

Can clients use the same payment reference more than once?

Only if they are making multiple payments towards one intended amount. Otherwise, each reference is unique and must only be used for the specific payment created online.

ISA subscriptions and funding options

What’s the quickest way to fund an ISA?

One of the quickest methods is to move money from a client’s GIA using the ‘Move cash between accounts’ option on the client account summary page. Our short walkthrough video shows you how to quickly move cash between accounts.

Do trades need to settle before placing a product switch into an ISA?

Yes. Trades in the GIA must settle before 2 April 2026 to leave enough time to submit the switch.

Dual ISA application and subscription forms

How do dual ISA forms work?

They allow you to use your client’s 2025/26 ISA allowance and set up their 2026/27 subscription at the same time.

When will 2026/27 ISA subscriptions be banked?

Subscriptions for 2026/27 will be banked on 7 April 2026.

Do I need separate cheques for each tax year?

Yes. If subscribing for both years, you must provide two separate cheques, with the second one post dated 6 April 2026.

Please do not send cheques for the 2026/27 tax year until 9 March onwards.

New tax year documents

When are P60s sent?

P60s are sent around May and are posted directly to your clients.

When are SIPP annual statements produced?

SIPP annual statements are produced between July and August each year.

When are GIA tax summaries produced?

Tax summaries are produced around May / June and will be sent directly to your clients.

Adviser support and processing

Will Adviser Support extend its opening hours?

Yes. Adviser Support will be available 8am–7pm from 30 March to 2 April 2026. Please note, we’re closed on Friday 3 April due to the Bank Holiday.

Do you accept scanned documents and e signatures?

Yes, in a range of circumstances. You can view the full acceptance matrix here.

Need to get in touch? We’re here to help

Our Adviser Support Team will extend opening hours to 8am–7pm from 30 March to 2 April 2026 to support you through tax year end.

- Send queries to enquiry@investcentre.co.uk (include your client's account reference within your subject line).

- Alternatively, you can call us on 0345 839 9060 and select ‘Option 1’ for general queries or case updates.

- For specialist queries, find the specific team contact details, here.