April gave equity markets a taste of corporates’ need for cash, as listed firms tapped shareholders for £3.3 billion in March – according to London Stock Exchange data – but Compass and Whitbread moving to raise £3 billion between them in the space of a few days in late May takes the figures to a different level, as firms continue to adjust to what the viral outbreak and lockdown mean for their business. The question now is whether the likely rash of fund raisings is a threat, an opportunity or something in between for the fund managers to whom advisers and clients have entrusted their own money and UK equity exposure.

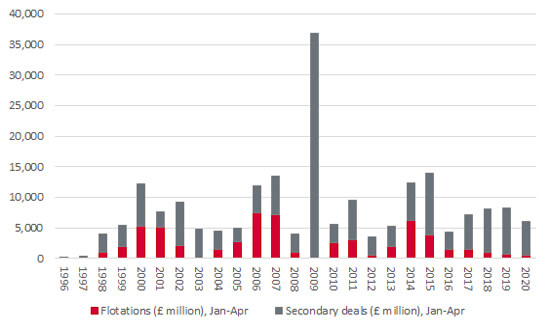

The London market has been relatively quiet so far in 2020. London Stock Exchange data shows that new flotations had raised barely £500 million by the end of April, the slowest start to a year since 2009, while secondary deals by firms that were already listed had generated some £5.6 billion.

2020 has been very quiet for new listings in the UK

Source: London Stock Exchange

“Compass and Whitbread’s fund raisings made them the fourth and fifth FTSE 100 firms respectively to raise fresh equity this year, after Auto Trader, Carnival and Informa, and the scale of their deals suggests that the pace is about to pick up markedly across the UK equity market as a whole.”

Compass and Whitbread’s fund raisings made them the fourth and fifth FTSE 100 firms respectively to raise fresh equity this year, after Auto Trader, Carnival and Informa, and the scale of their deals suggests that the pace is about to pick up markedly across the UK equity market as a whole.

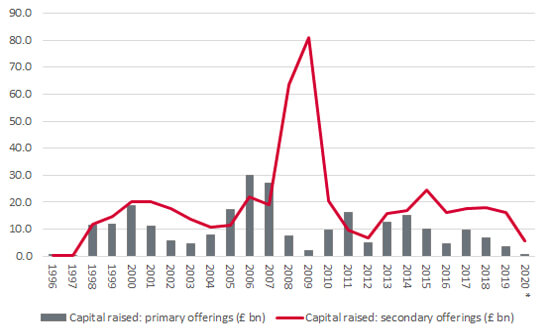

The experiences of the London market after the 2000–03 and 2007–09 recessions and bear markets would suggest that new listing activity may stay quiet, as reduced risk appetite and lower equity valuations deter would-be buyers and would-be sellers alike.

The historic data does, however, show much greater activity among firms that were already listed in the wake of the bear markets and recessions, as they focused upon balance sheet repair or raising capital so they could take advantage of investment or acquisitive opportunities that arose during the downturns and emerge all the stronger – financially and strategically.

Secondary listings proliferated during the last economic and market downturn

Source: London Stock Exchange. Shows full-year figures. *2020 to the end of April

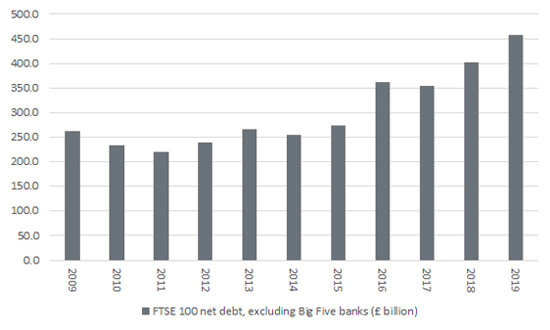

“Outside the Big Five banks, FTSE 100 total net debt (excluding pension deficits and lease liabilities) has soared by three quarters since the Global Financial Crisis ended.”

It therefore seems logical to expect that Carnival, Informa, Auto Trader, Compass and Whitbread will be followed by others, especially if the world emerges from lockdown only slowly and the economic upturn proves gradual. Outside the Big Five banks, FTSE 100 total net debt (excluding pension deficits and lease liabilities) has soared by three quarters since the Global Financial Crisis ended.

FTSE 100 aggregate debt has soared since 2009

Source: Bloomberg. *Excludes the Big Five banks.

Cutting dividend payments by some £24.8 billion for 2019 and 2020 – so far at least – is preserving some cash and cost cuts, and Government support schemes will also be helping, but many firms may be reluctant to take on fresh debt in their attempts to manage their way through the viral outbreak. Even allowing for record-low interest rates and central banks’ efforts to manipulate bond yields and compress credit spreads to make it cheaper for companies to borrow, many management teams may already feel they have enough borrowing on their balance sheet, especially given the uncertainty over future revenues, let alone profits and cash flow.

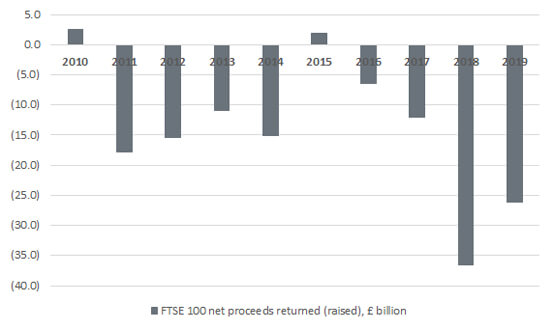

“The trend toward de-equitisation, as companies worship at the altar of the cash-light, ‘efficient’ balance sheet and buybacks outpace fund raisings, could therefore come to an end.”

The trend toward de-equitisation, as companies worship at the altar of the cash-light, ‘efficient’ balance sheet and buybacks outpace fund raisings, could therefore come to an end. Data from Bloomberg shows how the current crop of FTSE 100 firms has returned more cash to shareholders via buybacks than it has raised from them on eight occasions in the ten years since the end of the financial crises and cash-raising boom of 2009. Firms may therefore begin to favour cash buffers instead.

Buybacks have consistently outpaced fund raisings in the past decade

Source: Bloomberg, based on current crop of FTSE 100 constituents

UK equity fund managers can therefore expect more calls upon them, especially as Compass and Whitbread may well open the floodgates, just as more firms were emboldened to cut their dividends as growing numbers of boards offered the unkindest cut of all.

“Whether any switch from net buybacks to net issuance actually holds back share prices and headline indices is harder to divine but substantial equity issuance did not hold back the FTSE during the economic upturn and bull market of 2003–07 or the early stages of the recovery from the financial crisis.”

Whether any switch from net buybacks to net issuance actually holds back share prices and headline indices is harder to divine. In theory, buybacks have been a big source of support for share valuations over the past few years, especially as companies have frequently been gormlessly price-insensitive buyers.

However, substantial equity issuance did not hold back the FTSE during the economic upturn and bull market of 2003–07 or during the early stages of the recovery from the financial crisis. As central banks pump out Quantitative Easing and interest rates remain anchored near zero, cash is still looking for a home and investors are still seeking out the best risk-adjusted returns that they can find.

As a result, fund managers may view rights issues or placings as a good chance to average down and top-up holdings or build new positions in firms – providing they have some liquidity to hand themselves. Those firms that are blessed with a strong competitive position and management acumen, and which have simply been blindsided by an impossible-to-predict plunge in revenues thanks to the outbreak, may well merit support from money managers. Those trying to patch-fix prior strategic or financial errors may not. But, if nothing else, lower debt means less risk and less risk can mean higher equity valuations over time, all other things being equal.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.