One of the most interesting things about watching the markets in times of volatility is just how quickly the so called ‘professionals’ start behaving like amateurs. That’s not meant to be any slight on amateur investors, but certainly is intended to be a slight on those professional investors who panic when the going gets tough, as they should know better.

The last few months have been an enlightening time to be involved in financial markets. The extreme volatility seen in fixed interest markets thrust the technical world of bonds onto the front pages, with the country quickly becoming familiar with 10yr gilt yields and LDI schemes amongst other terms. This extreme volatility wasn’t just confined to the UK though, as similar market movements occurred across developed markets as yields spiked and the USD strengthened sharply against other major currencies.

A few weeks on, the dust has settled somewhat and relative calm has returned to markets. The 10yr bond yield in the UK has fallen back from its 4.5% high to just over 3%, the same level it was at in early September. The pound has also rallied sharply against the USD, clawing its way back to a rate of 1.20, up 13% from its low of around 1.06.

As we look back on those crazy few weeks during September and October, it’s obvious that the extreme moves were driven by the flow of money from professional investors rather than the amateurs. After all, the sheer size of this part of the market dictates the direction of prices as institutional investors move their money around. And here is the problem; those professional investors lost all sense of rationality at the same time, causing extreme volatility in markets. While of course during September and October in the UK we had the fallout from the Liz Truss / Kwasi Kwarteng debacle, which caused untold levels of uncertainty in our market, this shouldn’t have impacted bond yields in the EU or Japan or Australia or anywhere else. But every time it does, and those supposed professionals who should know better fall into the trap of behaving like amateurs.

Despite everyone knowing that investment is a long-term commitment, professional investors during the autumn effectively became day traders, reacting to short-term noise as if their lives depended on it, but then again maybe their jobs did!

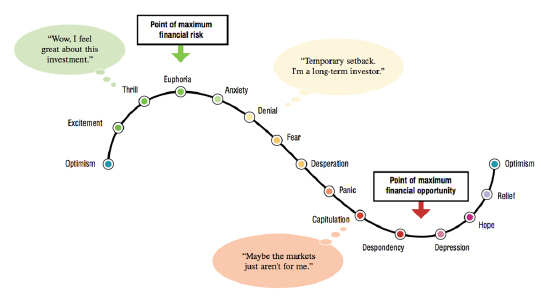

The extrapolation of the here and now is one of the most dangerous activities of any investor because it drowns out rational thought. It reminds me of a cartoon that frighteningly explains how stock markets work with each participant reacting to the last bit of news they heard with the story moving from ‘this stock should excel’ to ‘sell’, to ‘goodbye’ to ‘good buy’ with investors simply following the herd. This is exactly what happens in the market and can be linked to the famous investor psychology cycle that plots human emotions against stock market performance.

We all know the old adages about ‘time in the market, not timing the market’, fear and greed, and behavioural biases, but how many people can genuinely say they stayed calm during September and October and resisted the urge to tinker with their portfolio? After all, it’s evident that the professionals didn’t. Investors who panic-sold UK gilts as prices collapsed have missed out on a 15% rally since the end of September while GBP is up over 10% against the USD too. The whole point of an investment process is to give a framework to follow regardless of what’s going on in the markets, but it is of little value if it gets thrown out of the window at the first signs of market volatility.

The reality of human nature is that we are all programmed to feel the need to do something when the going gets tough. When markets are volatile, we get numerous emails and calls asking if we are making any changes to our portfolios. However, too few investors realise that deciding to do nothing is an active decision in its own right. As I said to an investor recently ‘never underestimate how much thought goes into doing nothing’. It may sound flippant, but the reality is that just about every day in the world of fund management, doing nothing is exactly the right decision, and very occasionally, the right decision is to do something. The skill is in knowing when to act and when to ignore the noise. Right now, the world is very noisy but by remaining calm, not blindly following the herd and being prepared to stick to the process, the AJ Bell Investment Solutions continue to carefully navigate their way through a very challenging world.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.