On the last day of April, Royal Dutch Shell cut its first quarter dividend by two thirds, its first cut since World War Two. Although equity analysts are eternally optimistic, forecasts over the next twelve months indicate the total Shell dividend will be halved, equivalent to a cut of £6 billion.

Clearly the combination of the COVID crisis and the fall in the oil price has created a perfect storm for the energy sector, and it has been deemed by management that a cut to the dividend is a prudent step.

Over the next two trading days, the share price fell by just over 17%, highlighting how many investors in Shell were holding it mainly for the dividend. This has thrown further shade on the outlook for dividends, and posed a quandary for those who rely on them as part of their investments.

Before delving deeper into the outlook more generally for both UK and global dividends, it is worth going back a step to consider why some investors favour income returns over capital returns.

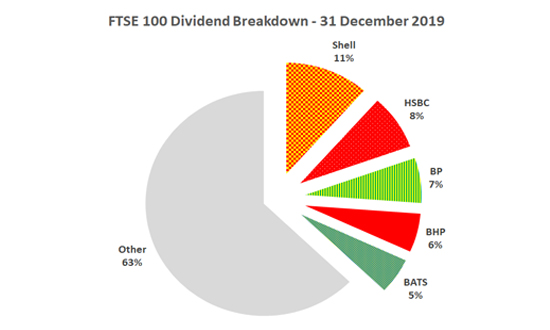

The UK in recent years has paid a higher dividend compared to global equities in general. For example, at the end of 2019 the expected dividend yield for the FTSE 100 was 4.5% –almost twice that of the MSCI World index at 2.3%. This is driven by the makeup of the UK market, dominated by Banks, Energy, Materials and Consumer Staples, which are traditionally seen as mature, dividend-paying businesses. This is in contrast to global benchmarks, where Technology tends to dominate. The combination of the largest companies also being some of the largest dividend payers created a concentration risk to UK dividends – for example, Shell represented 11% of the total yield. The following graphic provides a breakdown of the FTSE 100 yield at the end of last year:

Source: Bloomberg LP, May 2020

The top five dividend payers made up over one third of the total payments of the index, highlighting the concentration risk. BP saw a dividend cut in 2011, a consequence of the Deepwater Horizon disaster, and more recently BHP saw dividend cuts following the collapse of commodity prices, however – barring these two incidents – the top five payers have consistently grown their dividends over the last decade, and as such they have been considered a relatively safe source of income. However, following the current pandemic and oil oversupply, the dividend situation has dramatically changed in the UK. Alongside the Shell cut, the UK market has seen significant dividend cuts, including one other of the big payers, whilst the others remain at risk.

The PRA, the UK regulator of banks, strongly encouraged UK banks to suspend their dividends and, in a coordinated move at the beginning of April, all UK-headquartered banks stopped distributions and share buybacks until the end of the year at the earliest. The five UK banks in the FTSE 100, including HSBC, represented £15 billion of dividends, around 15% of the index total.

At the time of writing, BATS, BP and BHP have not announced cuts, however all three are at risk, representing another 20% of the index yield.

However, it is not just the big companies at risk. Even if they have the ability to pay, there is both social pressure and regulatory pressure to suspend payments whilst the crisis is ongoing, affecting all areas of the UK market. According to Link Asset Services, by mid-April 45% of UK companies had cut or suspended dividends and, as highlighted by the more recent Shell cut, this number has continued to grow. This puts holders of UK shares for income purposes between a rock and a hard place: do you hang around waiting for a capital recovery, whilst forgoing an income, or do you move to other asset classes, where income is more reliable? It is worth remembering that, although the lower bound of Link’s forecasts is a 40% dividend cut in absolute terms, the price of the FTSE 100 index has also fallen by 22%, leading to a more modest cut to the yield, which is currently sitting around 4%.

The UK has been hit particularly hard by the coronavirus, with the second-highest death toll in the world by the beginning of May; as such, the effect to the UK economy may be longer and deeper compared to other regions. Coupled with Brexit uncertainty and the makeup of the UK market, the level of dividend cuts appears to be unique to the UK in the developed world.

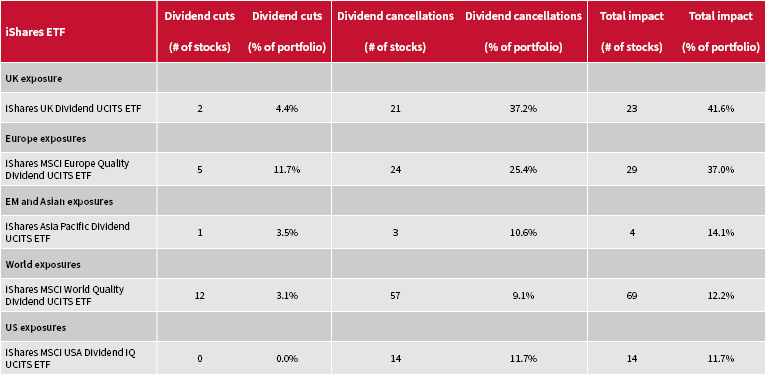

Blackrock produced the following analysis covering expected cuts across the major equity income ETFs:

Source: BlackRock, MSCI and IHS Markit as of 29 April 2020. Important note: this list is not an exhaustive or complete list.

It can be seen that the cuts are greatest in the UK and, although closely followed by the European product, this is because this index also includes a 30% weighting to the UK. Other regions have seen between 10% and 20% of companies cutting or cancelling dividends.

As such, the more modest cuts mean there is no need to panic for non-UK equity exposure, where dividend falls are broadly in line with capital falls, leaving dividend yields broadly unchanged, meaning – in the short term – yields look fairly secure.

Dividends are not the only source of income for an investor. The other traditional source is fixed income. Within this asset class the income is contractual so, unless the company defaults on its obligations, the income remains payable.

Bonds can be broadly split into government (or government-linked) and corporate. Although developed market government bonds are lower risk, corporate bonds and emerging market bonds offer a higher income, due to the higher risk, and are often favoured by income seekers. Of these, corporate bonds offer an extra layer of protection, given the majority also have a listed equity. This will take the first tranche of any economic losses from the crisis, providing a cushion to bond holders.

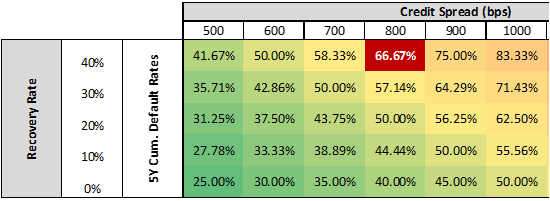

The extra return above government bonds for the Bloomberg Barclays Global High Yield Index sat at 8% on 12 May. If we assume a 40% recovery rate on default, this lets us infer that two thirds of bonds within the index will go bust in the next five years:

Source: AJ Bell calculations

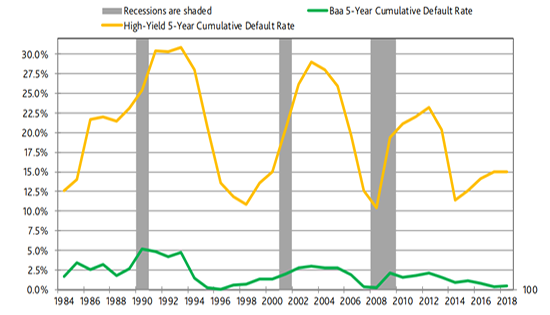

The following data from Moody’s shows the five-year default rate of both investment-grade (green) and high-yield (gold) bonds. This peaked at around 30% in the 1990 and 2001 recessions, compared to a lower peak of 22.5% in 2008. This is perhaps due to the action of central banks to lower interest rates and provide liquidity support. Given the coordinated central bank support this time around, and coupled with the equity buffer, we believe the situation will be more akin to the 2008 situation. This means that even default-adjusted, high-yield bonds offer a competitive income if history repeats.

Source: Moody’s

Other than fixed income, other strategies such as derivatives and private equity can provide a source of income, however we prefer to focus on simple, transparent solutions within our analysis.

We believe income strategies will remain popular given the three main drivers we highlighted earlier. However, the current crisis has provided a stark reminder of the risks income investors face, and caused many to review their current income strategies.

The four simple rules we follow when building our income funds and portfolios are as follows.

At AJ Bell, we run both active and passive Income MPSs, with a higher-risk and lower-risk portfolio for each. In addition, we have two income funds, which use a blend of passive and active holdings. We use these funds as part of our Retirement Portfolio Service, which is designed to deliver a consistent income and reduce sequencing risk where possible. We recently took the decision to move 10% of our UK equity in the higher-risk portfolios into high-yield bonds, whilst leaving the rest of the portfolios unchanged. Although this will bring us to the lower end of the target income range, we believe it provides a sustainable yield, without compromising the potential for capital recovery. For information on the portfolios, or any of the portfolios in the AJ Bell Investment range, please contact your Business Development Team.

The value of investments can go down as well as up and your client may not get back their original investment.

Past performance is not a guide to future performance. Target yields are not guaranteed and can fluctuate.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.