What links passive property investing, a fine mess and a working holiday?

Physical property indices cover a vast number of properties and assets. For example, the MSCI UK Real Estate Index consisted of 8,993 properties with a total value of £162bn at the end of March 2019. To invest passively means purchasing a proportionate share in every financial security of an index. The logistics of securing a part share in each property would be nigh impossible and come at great cost.

On paper – like a deafening silence and an open secret – passive property investing is a contradiction in terms. Herein lies the conundrum: on one hand, arguably the biggest advantage of multi-asset investing is the benefits of diversification – by using lowly correlated asset classes one is able to construct a portfolio that delivers a given level of return with a smoother path than, say, a portfolio of just equities or bonds. On the other hand, for a long-term investor the virtues of keeping costs low are well appreciated. As an example, a portfolio with a starting value of £100k, delivering an average gross annual return of 5% with investment costs of 1% (a typical active portfolio) will be worth £45k less than the same portfolio with investment costs of 0.35% (a typical passive portfolio) viewed over a 25-year time horizon. However, this is predicated on both portfolios generating the same 5% gross return; this is much harder for the cheaper portfolio if it isn’t able to benefit from the use of alternative asset classes such as property.

So how do multi-passive funds tackle this issue? We run through the different options, and the benefits and drawbacks of each.

One option is to eschew property as a separate asset class (although some exposure may be gained through equities investing in property in broad equity indices). This is the approach taken by the Vanguard Lifestrategy range. The clear advantage here is lower costs. By focusing on broad equity and fixed income asset classes, the Lifestrategy range is the cheapest in the market, with an OCF of 0.22%. The proposition is simple and easy to understand. However, as multi-passives have only come to the market post-2008, portfolios without alternative investments have not been properly stressed in prolonged downturns. As an investor choosing a multi-passive without property a consideration should be made as to what may happen if bonds and equities fall at the same time, especially in a lower-risk portfolio.

Another route for a multi-passive fund is to go active. This is the approach taken by the L&G multi-index range. This brings all the diversification benefits discussed, however it (literally) comes at a cost. The panic after the EU referendum vote in June 2016, and the ensuing suspension of dealing in active property funds, highlighted the lack of liquidity for physical property. To combat this, active fund managers have, amongst other measures, protected its investors in two ways. First, many active UK property funds have moved to full bid-ask pricing. This means the entrance and exit price of the fund can differ by as much as 6%. This means any investors buying or selling into the fund bear the cost of buying or selling the underlying properties, covering significant legal and administration costs. The second tool used by active managers is to hold a cash buffer to cover any potential redemptions. This means an investor in the fund is essentially paying a management fee of 1% and beyond on cash!

When looking at the L&G multi-asset range, the average bid-ask spread of its funds is around 0.6%. The majority of this will be to cover the entrance and exit costs of its active property investments. 0.6% represents around two years of ongoing management fees! It is also worth bearing in mind that if an active property fund is suspended in the future, the multi-passive fund will be unable to sell its investments during the suspension.

Although it may be impossible to passively invest in all the individual properties, it is possible to invest in an index tracking the performance of public companies that in turn invest in property (known as REITs). This is the route taken by the Blackrock Consensus range – investing in a global REIT fund. This represents a half-way house. It brings longer-term benefits of investing in property, as over a medium-term timeframe REITs tend to exhibit similar return characteristics as a bricks-and-mortar property fund. A typical REIT tracker fund will have ongoing charges of between 0.2% and 0.5% per year, and bid-ask spreads of up to 0.5%, significantly lower on both fronts compared to an active property fund. Therefore it presents a compromise between diversification and costs. However, with any compromise there must be some give. Although over the longer term a REIT performs similarly to a physical property fund, over the short term this is not true. This is due to three factors:

These issues can lead to additional volatility, which is most likely to be suffered at times of market falls. This means the benefits of diversification may dissolve when needed most.

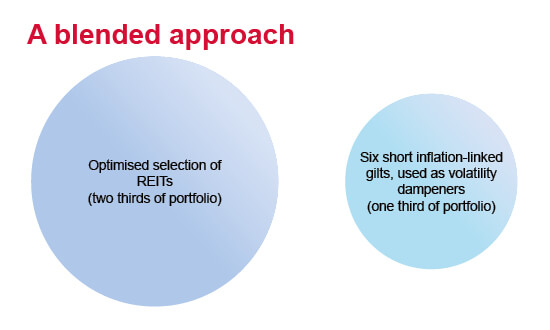

A novel approach to passive property investing is emerging, and is used by our range of funds and passive MPS. The starting point is an index of REITs, as previously discussed. However, attempts have been made to adjust for the drawbacks of short-term REIT volatility.

The resultant index can be summarised as follows:

Figure 1: AJ Bell’s investment approach to UK passive property

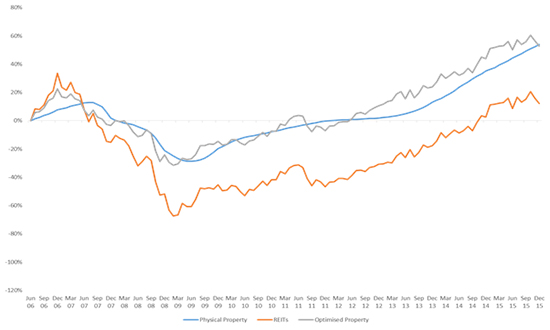

Over a 10-year period it can be seen that the grey line (representing the blended approach) delivers a return similar to that of a physical property index (blue line), whereas the REIT index (orange line) lags due to the downturn during the financial crisis.

Source: MSCI

This means it delivers the diversification benefits of physical property, and with a management cost of 0.25% in our funds and 0.4% in our MPS (due to slightly different implementation routes) it is also low-cost. The bid-ask spread also remains reasonable at around 0.5%. The one drawback that isn’t addressed is the ability for a REIT’s share price to differ from the fair value of the assets. This leads to some short-term volatility compared to physical property. It could, however, be argued that a physical property index understates risk, as property valuations tend to remain robust even when sentiment is negative, and only fall when fund managers become forced sellers, which is only likely to happen in times of stress. It is also worth noting that this approach is untested in the market, however the robust back-testing, covering the financial crisis, does provide some comfort.

There is no right or wrong approach to investing in property as a passive investor. However, it is important to note that the approach differs across different ranges. Studies show that over 80% of long-term portfolio returns are delivered from the asset allocation decisions. Therefore it is important to understand the manager’s approach to property: there is no point in paying lower costs if gross returns are significantly lower – you certainly don’t want to find yourself in a fine mess!

For any further information, or if you would like a meeting to discuss the AJ Bell investment solutions, please contact your Business Development Team.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.