Responsible investing can be done in several ways.

Within our Responsible Growth Fund, we take two approaches.

This article explains in more detail how each approach works, the effects they have on both risk and return, and how both approaches complement each other.

Historically, the most popular responsible investment style has been ethical investing. This involves excluding companies that do not fit with your morals or values and spans back as far as 18th century, when the Quakers prohibited members from being involved in companies linked to slavery.

Common areas avoided today include tobacco, alcohol and gambling.

However, following an exclusionary-only or ethical style of investment presents three main problems:

One of the biggest challenges is defining a set of business areas to exclude that match the values of different investors. For example, many business areas are avoided for religious regions, whereas others are avoided either because of their impact on the environment or because of the damage they can cause to people (such as tobacco). Some exclusions are fairly universally accepted – for example, companies that produce nuclear weapons – however, other areas are much more subjective. An investor excluding for religious reasons may avoid companies that produce contraceptives, whereas for others this may be a perfectly acceptable investment.

Similarly, companies involved in oil and gas extraction may be excluded by some investors, whereas other people may decide they are still suitable, especially given many of the companies are now pivoting towards alternative energy sources.

To balance this tightrope, the AJ Bell Responsible Growth Fund invests predominantly in ETFs tracking an MSCI SRI (Socially Responsible Investment) index. These have a standard set of exclusions that we believe will cover the majority of companies deemed to be ‘sin stocks' by most investors, but it is important to note that certain industries are still included that may appear counterintuitive. For example, some oil and gas companies are still held. This is to ensure we strike the balance of different investors’ needs and, as we will discuss later on, to not sacrifice returns.

The sectors that are excluded with the SRI indices are: alcohol, adult entertainment, civilian firearms, gambling, genetically-modified organisms, tobacco, controversial weapons, nuclear power, shale and oil sands extraction, thermal coal extraction and power generation.

This leads onto the next issue: defining companies within these areas is often straightforward – such as an alcohol-producing company – however, for some companies it is less straightforward. Should exclusion extend to a company producing cigarette packets or a supermarket selling alcohol?

The idea of excluding companies within certain business areas is simple. The process for doing so is much more complex.

Public companies disclose information, such as the breakdown of revenue into different business areas. However, this is often fairly ‘high level’. For example, ITV may disclose the revenue they generate from advertising; what is less clear is how much of this revenue might be for advertising gambling or alcohol products. In addition, a product has a ‘supply chain’. A tobacco company may produce cigarettes, but different companies make the packaging, the filters, distribute the products and then sell them. Excluding the producer is easy; the question of also excluding the other companies within the supply chain is much more subjective. By using mainly ETFs tracking MSCI SRI indices, we can use MSCI’s expertise in defining how to exclude companies. As at 30 June 2020, MSCI had over 370 employees focused on environmental, social and governance issues. It also leverages off third-party data as well as the disclosures from the companies. It can calculate approximate exposure using a combination of sources. Although it is not perfect, we believe using MSCI provides some consistency across our products, and allows us to state that we do not knowingly have exposure to any of the stated business areas.

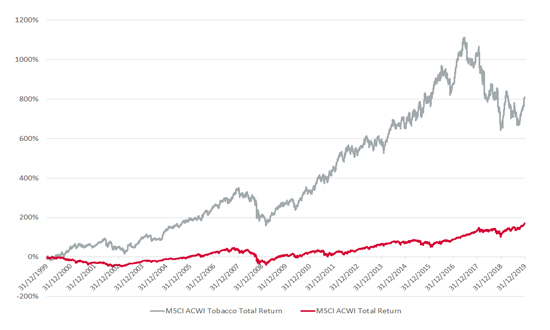

Ethical investing in the last millennium was largely concentrated around charities, churches and universities, and failed to gain traction within mainstream investments. This, perhaps, was due to the notion that excluding companies would lead to lower returns. This is fairly intuitive: just because a company generates revenue from a product that is deemed unethical by some, it doesn’t mean it cannot make good profits. Reducing your investment opportunity set based on business segment alone reduces the potential of picking the winning companies. As can be seen in the graph, excluded business areas (such as tobacco) may outperform the broader markets over certain time periods.

The business areas excluded are often mature, profitable, but low growth – these types of stocks perform differently to high growth companies. This means that, depending on the economic backdrop – such as a bull market – a strategy excluding these areas is likely to underperform.

Source: Bloomberg, December 2019

It is also worth noting that companies within a controversial business area may be pivoting their strategies – a tobacco company may be moving towards vaping, or an energy company could be moving towards green energy sources. This has helped evolve the idea of rewarding companies making a positive change, rather than blanket exclusions across many parts of the market.

By excluding companies, you are essentially wiping your feet of them, which could be argued is actually counterintuitive in encouraging them to change their practices. Instead, a ‘best-in-class’ approach has emerged in recent years. The idea here is to select companies best placed to navigate environmental, social and governance risks and opportunities. The big difference between this approach and an exclusionary approach is that it doesn’t necessarily lead to lower returns, and in fact some evidence shows it can enhance returns – or at least has historically.

Before looking at the data, it is perhaps worth considering this intuitively. The share price of a company is based on the future cash flows of a company – a company that can produce a growing, consistent profit over a number of decades is rewarded with a higher share price. Navigating environmental and social issues is an indicator of a company’s ability to deal with changing consumer views and regulations, helping it to hit its profit targets.

For example, Amigo Loans floated on the stock exchange at 275p in July 2018, and immediately saw a move to a premium of over 300p a share. However, as increasing regulation has come into the space, capping interest charges, coupled with its practice of lending to the least financially secure, it has seen its share price suffer significantly this year. It is now down around 97% since its floatation, at just 6p a share. This is an example of a company with questionable social practices suffering due to a business model that may not be sustainable in the long term, and a poor ESG rating score would be a red flag.

As well as social and environmental issues, it is again intuitive that a company with good governance practices is likely to deliver a more predictable stream of profits. Diversity of thoughts and views is likely to lead to more rounded decision-making, and create a culture of accountability. Perhaps the most famous recent example of poor governance is Volkswagen. Being a largely family-owned business, with little accountability to an independent board, facilitated its poor practices with regards to cheat devices to trick emissions testing.

Although history is no indication of future performance, the below graph from MSCI shows how moving from a strategy of just excluding companies to a strategy that both excludes and then rewards the best-placed remaining companies on ESG issues affected both risk and returns for the period June 2013 through to May 2018.

Source: MSCI, June 2019

The starting point is the MSCI ACWI benchmark. It can be seen that, by following various exclusion methodologies, initially the dot moves to the left for the index after SRI exclusions – i.e. the potential drawdown is larger due to less diversification. However, when integrating the MSCI ESG ratings, the drawdown is reduced and the total return increases. The MSCI methodology ensures the resultant strategies are broadly sector and region neutral compared to the starting MSCI ACWI index, indicating that the difference is not down to factor biases, but instead down to stock specifics.

Within our fund, the use of MSCI SRI ETFs means that we get a set of exclusions, whilst focusing on the best 25% of remaining companies for ESG rating scores within each sector.

We acknowledge that any rules-based approach will not be perfect, and that some companies will be included that some individuals may disagree with. However, we believe our approach allows an investor to improve the ESG characteristics of their investments – for example, the Responsible Growth Fund has a carbon footprint 40% lower than the MSCI ACWI index – without having to sacrifice long-term returns or take on excess risk. It will not be suitable for all investors, but for anyone who wants to make a conscience-led choice but who doesn’t know where to start, our fund aims to provide an easy way to get going.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.