Upon finding James Bond crossing his path for a third time in quick succession, in Miami over cards, Kent for golf and then Geneva, Auric Goldfinger finally senses trouble and tells 007, “Mr Bond, they have a saying in Chicago: Once is happenstance. Twice is coincidence. The third time it’s enemy action.”

“Regardless of whether China sees its economic woes as self-inflicted or the efforts of third parties to undermine its prospects, there can be no denying that its troubles are currently coming in threes.”

Regardless of whether China sees its economic woes as self-inflicted or the efforts of third parties to undermine its prospects, there can be no denying that its troubles are currently coming in threes.

American and Western sanctions designed to restrict investment and the flow of intellectual property as well as certain products, such as cutting-edge silicon chips and semiconductor production equipment, could be seen by China as enemy action. But none of this can be coincidence and it suggests there may be further trouble ahead.

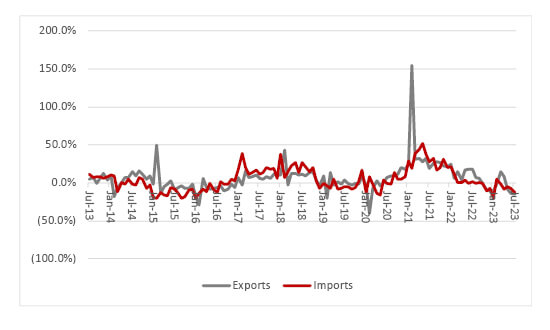

Chinese global trade flows have sagged badly in 2023

Source: Refinitiv data

Some even argue that the country is facing its own Minsky Moment, as its economy reaches the third stage of the debt cycle outlined by economist Hyman Minsky in his 1993 paper ‘The Financial Instability Hypothesis’.

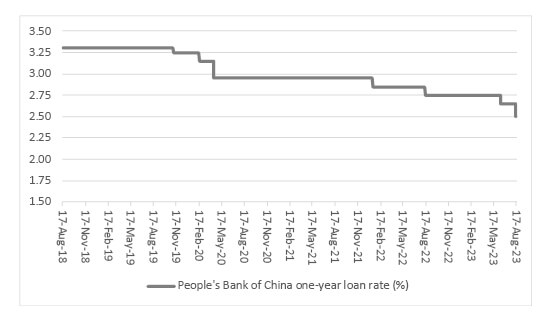

China is doing its best to keep the plates spinning, cutting both interest rates and the amount of capital that banks have to hold (thus boosting their ability to lend) but some economists are arguing that the debt numbers mean China simply cannot grow at its current rate for too much longer. Some even argue that the country is facing its own Minsky Moment, as its economy reaches the third stage of the debt cycle outlined by economist Hyman Minsky in his 1993 paper The Financial Instability Hypothesis:

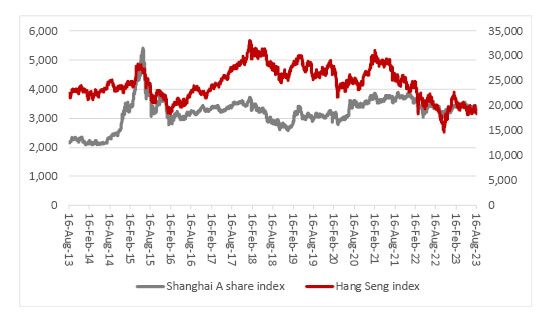

“Advisers and clients may think this sounds a little apocalyptic, but it may help to explain why the Shanghai Composite index is going nowhere fast.”

Advisers and clients may think this sounds a little apocalyptic, but it may help to explain why the Shanghai Composite index is going nowhere fast – and is no higher now than in was in early 2018, when stock market index constructors such as MSCI and FTSE Russell began to include onshore Chinese A-class shares, and not just Hong Kong-traded H shares, in their benchmarks. The higher weighting given to Chinese equities raised the possibility that a wall of money from passive index trackers would flood into the market and push prices higher. It may have done at first, but not for long, and there is a danger that falling prices and falling weightings prompt a similar reflex, only this time to prompt a wave of passive selling.

The Chinese and Hong Kong stock markets have made little progress in the last five years

Source: Refinitiv data

Beyond the narrow confines of equity markets in Shanghai and Hong Kong, China’s property pickle begs the question of what it means, if anything, for the global economy and, in turn, investment portfolios. Three immediate topics spring to mind:

How the Communist Party manages to support economic growth without piling up too much debt, or cutting interest rates to the point that the stock market becomes bubbly (as it did in 2007 and 2015) or the renminbi weakens (as it did in 2015-17 and 2019, leading to trade troubles with America) will be fascinating to watch. In the end if feels as if something will have to give – the currency or economic growth targets – especially if Minsky is right.

China is cutting interest rates …

Source: Refinitiv data

… but the currency is weakening as a result

Source: Refinitiv data

“If there is any good news here, it may be that less demand for commodities and a weaker Chinese economy and currency take away some of the inflationary pressures that currently bedevil the West.”

If there is any good news here, it may be that less demand for commodities and a weaker Chinese economy and currency take away some of the inflationary pressures that currently bedevil the West. Factory gate inflation in China, as measured by the producer price index, is already in negative territory, after all.

Past performance is not a guide to future performance and some investments need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.