For the past five years, not only has the FCA had vulnerable customers at the forefront of its mind, it’s been at pains to make sure they are at the forefront of everyone else’s too.

Most customer protection legislation is underpinned by the notion of the average or typical customer and what they might expect or understand, or how they might behave. Customers in vulnerable circumstances, however, may be significantly less able to represent their own interests and more likely to suffer harm than the average customer.

All firms involved in delivering financial services, including financial advisers and planners, have a huge role to play in ensuring vulnerable and potentially vulnerable customers are identified and protected as much as possible. Firms are required to develop, monitor and review a vulnerable customer policy.

At the end of July, the FCA published its latest consultation in this area, building on the feedback it received from last year’s consultation. It also published new research.

The FCA’s report card on the industry’s incorporation of a vulnerable customer policy read ‘good, but could do better’.

Whilst some firms have made significant progress, the FCA wants firms to do more to make sure vulnerable customers are receiving positive outcomes. It found examples of good practice and firms thinking carefully about their customers and potential vulnerability. But it also came across cases where vulnerability is either not considered by firms or is positively exploited for gain.

The FCA’s latest research showed vulnerable customers’ experiences were likely to depend upon the firm they engaged with. And that’s not what the FCA wants; it’s after consistency across the industry. Those firms that were able to spot vulnerable customers were able to offer them a much better experience. But the FCA also highlighted that communication was a two-way street: people needed to tell the firm if they were struggling. The sweet spot for firms could be getting the right practices in place, not only to spot vulnerability, but to create the right atmosphere where people feel safe in confiding.

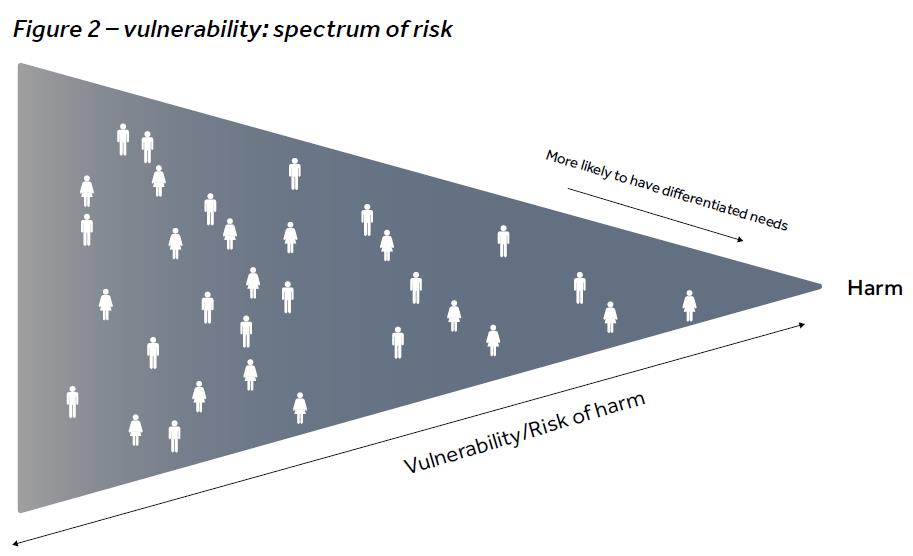

In its latest consultation paper, the FCA introduces a new concept to help firms respond to the needs of all customers. This avoids client categorisation into three fixed groups of actual/potential/not vulnerable and acknowledges instead that there is a spectrum of risk. Those customers to the left of the spectrum are less likely to be vulnerable and therefore face a lower risk of harm than those on the right of the spectrum, where risk of harm is more acute. Customers along the spectrum will have different needs.

This seems a much more realistic approach. It recognises that life is nuanced and that people can easily experience different things at different points in their life.

Source: FCA GC20/3

The outbreak of coronavirus has brought the issue of vulnerability firmly into the spotlight. It’s expected more customers will find themselves newly vulnerable due to the pandemic or will have their existing vulnerabilities added to through ill health, bereavement, financial difficulties or job loss. (The FCA states in the consultation that 23% of workers have been furloughed or lost jobs, hours and pay.) The FCA advises that it’s important now – more than ever – that firms pay attention to the needs of vulnerable customers.

Many advisers have stepped up their vulnerability work in recent months, finding now is the time to focus on improving experiences and outcomes for the most vulnerable. They have used the time and experience of the outbreak and lockdown to review and improve their vulnerable customer policies.

The FCA will continue to closely focus on supervision and monitoring firms’ work. Once this latest guidance is finalised, the FCA will be quizzing senior managers who need FCA approval on how they have embedded their vulnerable customer policies and procedures into the culture of their firms.

The FCA’s overarching message is developing a vulnerable customer policy cannot be a mere tick-box exercise. To truly achieve better outcomes for these customers, firms need to embed the principles into the culture, policy and procedures of the firm. It needs to touch every point of the customer’s journey. This can only be achieved when we all consider, think, and act automatically – and even perhaps unconsciously – to better vulnerable customers’ outcomes.

This article was previously published by Professional Paraplanner

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.