Although it was billed by the Treasury as definitely NOT a Budget, the Spring Statement was certainly quacking and waddling like one. Given the current ‘cost of living crisis’ millions are facing, the resulting headlines were naturally focused on the increase in the National Insurance threshold and a future cut in basic rate tax.

However, as is often the case, there were other interesting nuggets of information buried in the Treasury documents. One of these was on the amount of tax the Treasury receives from people flexibly accessing their pensions.

Data from the first three quarters of the tax year 2021-22 shows the number of withdrawals is, once again, outstripping expectations, with a 20% increase on the same period in 2020-21.

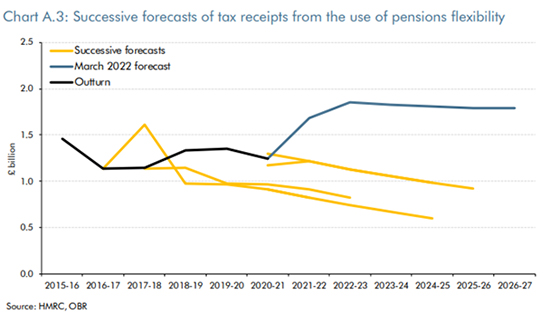

The Office of Budget Responsibility (OBR) has therefore – significantly – revised upwards its forecast of how much tax will be paid by people flexibly accessing their pensions.

The OBR now expects receipts in this tax year to be £1.7 billion – up £0.4 billion on the previous tax year – and a massive 39% higher than they expected in October. It has also increased its prediction of how much money these taxes can bring in over the next few tax years by an average of £0.8 billion a year.

The OBR puts the increase down to more people bringing forward their retirement plans and accessing their pension. There is no doubt that living with the pandemic over the last couple of years has meant more are viewing their pension as a bank account. But I’m not convinced people are necessarily bringing forward their retirement plans. It’s probably more a case of they need some extra funds, and if over 55, dipping into your pension pot is one way to do this.

What is really interesting is the OBR don’t regard this as a pandemic blip. They expect the tax receipts to just keep on coming, and the same amount of tax to be raised over the next four to five years.

This is backed up by HMRC figures which show that after an initial flurry, the number of people accessing pensions, and the amount they withdraw on average, is more or less consistent.

The question is, though, should these predictions cause alarm, and will the Treasury or the FCA be tempted to act off the back of them?

I don’t think the Treasury will do anything. After all, this is an increase in expected tax receipts.

The FCA may take a different view, depending partly on its own retirement income data. The last set for the six months to March 2021 showed over 300,000 plans had been accessed during that period. Of these about 55% were fully withdrawn, around 30% went into drawdown and just over 10% bought an annuity.

The problem with the statistics is that it is so difficult to say that flexibly accessing funds is the wrong choice, when we simply don’t know why people made that choice or their personal circumstances, number and size of pension pots and other wealth.

That the FCA is worried about decisions made in this area is obvious, as evidenced by the introduction from June of stronger nudges to guidance for non-advised customers. But it – and The Pensions Regulator – may decide other action is needed, and one avenue could be automatic appointments with Pension Wise. This would bring a host of challenges – pushing people to an appointment they don’t want or need, delays in accessing their money, cancelling appointments, and other costs.

In the meantime, accessing pensions is going to remain a popular option over the next few years. As time unfolds, we should get a clearer picture of what the long-term impact of these decisions are.

This article was previously published by Money Marketing

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.