As an industry we have spent many years discussing Pensions Dashboards. But now the plans are about to become a reality.

Pensions Dashboards will allow an individual to see in one place information on all the pensions they have built up. It will include all their private pensions – defined benefit or defined contribution, retail or workplace, old or new – as well as any public sector pensions and, importantly, their state pension as well.

The Government is firmly behind the development of Pensions Dashboards. It hopes they will help people trace lost pensions, maybe from previous employers, or from pension providers that have been bought over by others.

It also hopes by seeing all their pension information in one place, people will engage better with their pensions. By building a picture of their expected later life income, people could be inspired to monitor investments, increase contributions, consolidate accounts, and even make better retirement decisions.

The Government has asked the Pensions Dashboard Programme (PDP), part of the Money and Pensions Service (MaPS), to build the Pensions Dashboards. Lying at the heart of the PDP’s proposition is the ‘ecosystem’.

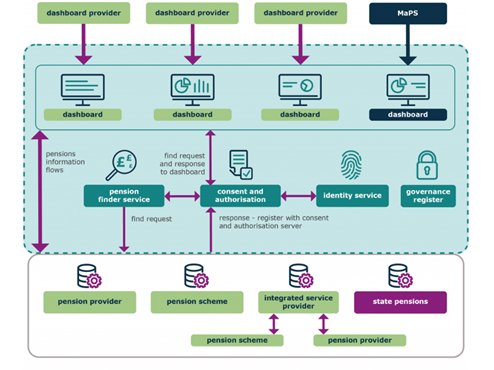

Put simply, people will, via a dashboard, ask to see their pensions. Once the person’s identity has been verified, the pension finder service part of the ecosystem will fire the person’s details to all pension schemes. If the pension scheme has a match to those details, it will let the ecosystem know, and once the individual has given consent, the pension scheme can send information to the dashboard. The individual can then view all their pension schemes’ information on the dashboard.

The ecosystem is an elaborate postbox. It will not hold information. Nor will it do any computation. It will simply make sure all the relevant data control permissions have been given, and pass information from the dashboard to the pension scheme, and from the pension scheme to the dashboard.

Source: The Pensions Dashboard Programme

MaPS will offer a Pensions Dashboard. However, the government realises that if there was only one dashboard provider, some people will never learn of its existence or use it.

So, the government is allowing others to offer commercial dashboards. Only ‘Qualifying Pensions Dashboard Services’ (QPDS) will be allowed to offer a dashboard. These organisations will have to be regulated by the FCA and have the relevant permissions for this new activity. The FCA will be setting the rules for governance of QPDS.

Many pension providers and schemes may choose to offer a commercial dashboard, as will banks and other financial institutions. Financial advisers and planners might also decide to offer this to clients.

The identity service part of the dashboard ecosystem has to be able to verify the individual’s identity. To do this they will use the matching criteria of name, surname, date of birth and current address.

This information will be sent to pension schemes, and they will use their records to determine if they have a match. If so, general information about the scheme should be sent back immediately.

Pension schemes, however, may not have a current postal address for all their members – especially the ones they have lost touch with. But they may have a national insurance (NI) number or an email address. Hopefully the dashboard can strongly encourage (but unfortunately may have to stop short of forcing) people to input that data to help pension schemes match records to requests.

If a pension scheme can match some of the information, but not all of it, then they can return a message saying a partial match has been made and ask the individual to contact them to help them make a full match. The DWP has suggested pension schemes will have to resolve partial matches within 30 days.

The Pensions Dashboards will show general information about the pension scheme, including contact details, and link to details about charges and any statement of investments.

It will show the current value of the pension built up. For a defined benefit scheme this will be the accrued pension and for a money purchase scheme this is the current value of the pot. The PDP is also suggesting pension schemes convert this pot value into an annuity income – although it’s unclear how this could work in practice.

As well as showing the current value, the dashboard will also show the projected value of the pension at the ‘retirement date’. For a money purchase scheme this will be the projected value of the pension pot, assuming all regular contributions continue, and adjusting growth for inflation. This pot value is then converted into an estimated retirement income (ERI).

The current and projected values do not need to be calculated afresh for every request – they can be up to 12 months old.

The DWP and the PDP have decided when calculating an ERI for a money purchase scheme, the pension scheme should use the same basis that is used to calculate figures for the Statutory Money Purchase Illustration (SMPI) or annual statement.

The Financial Reporting Council (FRC) is in charge of setting the calculation method for SMPIs. It has just consulted on changing this so pension schemes have to use a different growth assumption for each fund invested in based on the volatility of the fund over the last five years.

This approach could be confusing for customers in understanding the link between volatility and growth rates. It will also mean additional work for pension schemes to calculate the right growth rate for each fund, especially if that runs to thousands held on a platform. FRC will also need to outline how to treat direct investments such as ETFs, although it has said unquoted assets, such as property, should assume a real growth rate of zero.

As the calculation methods for point-of-sale illustrations and annual illustrations are different, in the interests of keeping things simple and accessible for pension consumers it would be good if the FRC and FCA work together to agree a single workable approach.

The ERI will be the level single life annuity (with no guarantee) that can be bought at the retirement age for the member using the projected pot value. It won’t assume any tax-free cash is taken. Obviously, many consumers will choose a different way to secure their later life income – using drawdown and probably taking some lump sum. The Pensions Dashboards will have to carefully explain how the income is illustrated, but that consumers still have choices about how to take income.

Yes. The intention is the Pensions Dashboards will only ever show static information. The PDP is clear the ecosystem will not do any computation or store information.

However, it’s recognised this may not encourage people to engage with their pensions. So, the DWP is considering allowing those who offer a commercial dashboard to ‘export’ data out of the dashboard environment into another part of their website where people can explore ‘what if’ scenarios using the data, for example, by changing their retirement date, or paying in higher contributions.

Some dashboard providers may also encourage people to explore consolidating their various pensions plans, in order to access lower charges or different investment strategies. The government might also see this as a way to solve the ‘small pots issue’ where an individual has built up multiple small automatic enrolment pension plans with a variety of providers.

The Pension Schemes Act 2021 compels all pension schemes, regardless of size, to eventually connect with the dashboard ecosystem. For Pensions Dashboards to be a ‘success’ they have to cover the whole pension environment, and it is only by putting this compulsion into legislation can the government be assured all schemes will participate.

Pension schemes will connect with the PDP ecosystem on a staggered basis. There will be three waves. The first wave will start April 2023 and will include the biggest schemes. Medium schemes will form the second wave between October 2024 and October 2025, and small and micro schemes are likely to be in 2026.

Once a ‘critical mass’ has been reached, covering, say, 95% of all pension accounts, then the Pensions Dashboards will officially launch to the public. Currently there is no set date for this, although it’s expected to be around Summer or Autumn 2024.

The government intends to publish in the summer the final staging timetable.

Pensions Dashboards will, of course, be of practical help to financial advisers and planners.

It’s anticipated consumers will be able to give their financial advisers permission to access their Pensions Dashboard information. They can then form a picture of all the pension provision their clients have built up, without raking through old shoe boxes of past statements and terms and conditions.

Some advisers may decide to become a QPDS. And Pensions Dashboards may trigger new client requests as well. Once people have a view of all their pension wealth, they may seek regulated advice to help them make better decisions about how to consolidate these pensions or to convert them into an income to meet their personal circumstances.

The government has committed much resource – including legislation time – to ensuring pensions dashboards are a success and is certainly relying on them to inspire engagement amongst those saving for later life. Depending on the final details, Pensions Dashboards could be a gamechanger for how people view their pensions.

This article was previously published by FT Adviser

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.