As you may have recently read, after 27 years in charge, Andy Bell stepped down as CEO of AJ Bell on 1 October and handed the reins to Michael Summersgill. This move marked the end of a succession plan that’s been carefully playing out over several years.

Since he joined AJ Bell, Michael has taken on responsibility in nearly every area of the business. I’ve worked with him in several of his different roles over the years, and I know that he’ll do a fantastic job as CEO.

As for Andy, well, he’s stepping down, but by no means out. He will be focusing on a number of areas that he is hugely passionate about, principally brand, PR, campaigning and lobbying on issues that affect financial advisers and their clients. I know he’ll also be keeping a keen eye on developments in our rapidly changing platform market too.

Andy makes no secret of his gut feel and instinct-based approach to recruitment. Some 17 years ago he asked me, over a beer, whether I fancied coming on a little journey with him at AJ Bell. I jumped at the chance. It’s been a fantastic journey so far, but we know that there is work to be done and the journey continues. It’s been a privilege to get a ringside seat, watching one of the finest entrepreneurial brains I have ever encountered in my 35 years in the industry go to work driving the business forward in so many ways it’s impossible to mention.

Andy will still be around, but it goes without saying that I wish both Andy and Michael all the very best for this next stage and I look forward to helping them both continue to drive the future evolution of AJ Bell.

At the Money Marketing Awards 2022 we were extremely proud to take home prizes for Best Retirement Provider, Provider of the Year, and – for the third year in a row – Best Platform.

AJ Bell Asset Management have also been awarded ‘Best Overall Medium Firm’ at the recent Citywire Investment Performance Awards.

None of these awards would be possible without the hard work and effort across the entire AJ Bell team, alongside the fantastic support we get from advisers across the country who use our platform. Thank you.

Please be aware that Royal Mail staff have announced strikes on:

This industrial action will cause delays to our postal deliveries and collections, so please do plan carefully if you need to post any forms or documents to us.

The good news is that we can also accept scanned copies of all our forms, across all our wrappers. In fact, our online processing capabilities are generally the most efficient way to complete many transactions, even when there isn’t a strike on.

We have reviewed, and decided to increase, interest rates payable on cash balances held with us in AJ Bell Investcentre SIPP, RIA and Funds & Shares Service cash accounts, ISAs and GIAs.

The change applies from 1 October 2022, with the first payments due to be made in early January 2023 for the three months to 31 December 2022. The new rates, shown below, are tiered so the actual rate each account receives may be blended, depending on the balance held.

| Cash balance | Interest rates (gross) for this tier only | Interest rates (AER) for this tier only |

|---|---|---|

| £0 to £10,000 | 0.20% | 0.20% |

| £10,000 to £50,000 | 0.45% | 0.45% |

| Above £50,000 | 0.70% | 0.70% |

Being mindful of rising interest rates, it’s worth pointing out that you can find full details of the current interest rates, and how they apply, at any time in our rates document.

We have now announced the following new dates and locations for our AJ Bell On the Road tour:

These sessions pack a lot into two hours of CPD accredited time. As well as giving updates on AJ Bell Investcentre and the wider platform market, the local BDM for each area will also share news on the latest performance of our AJ Bell Investments range.

As usual, a member of our Technical Team will be there too, looking at current and future FCA regulations. You will also get to hear from our Head of Investment Solutions, Jamie Ward, who will be explaining why he feels the traditional 60:40 portfolio split and risk parity portfolios probably don’t provide enough downside protection right now.

If you’re interested in attending one of the seminars, register now and secure your place, as seats are limited.

The nights are drawing in, which means that Investival will start to appear on the horizon very soon. Those of you who have attended our annual investment conference in previous years will know what a big event this is, and 2022 will be no different.

On 17 November we will once again be bringing our stellar line-up of speakers to the Shaw Theatre in London for a full day of CPD content, followed by an evening of food, drink, relaxation and networking. I can’t reveal too much right now, but it will be a date to remember – contact us if you would like to be added to the advance registration list.

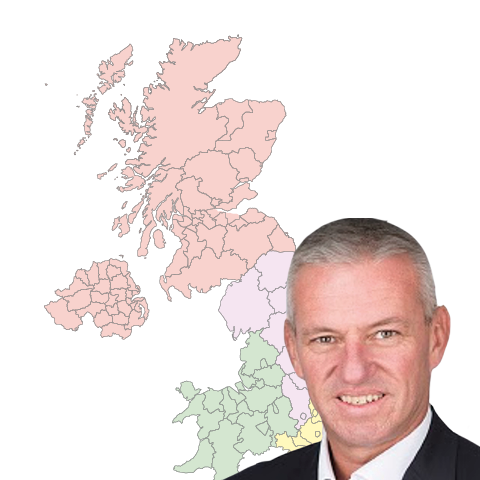

The team at AJ Bell Investcentre keeps on growing, and I’m now delighted to welcome Martin Clement to the company as our new Business Development Manager for the South East – South area and Andy Adshead as our new Investment Business Development Manager for the North region.

Martin has over 20 years’ experience in the platform industry, and will be putting all the knowledge he has gained to good use by helping our adviser firms ‘south of the river’, and enhancing their clients’ overall experience of our platform.

Andy brings 28 years’-worth of extensive knowledge in the investment markets. He will support our existing AJ Bell platform firms in using the AJ Bell Fund and MPS ranges, and help our external platform partners to support the AJ Bell Funds and MPS portfolios.

Welcome aboard Martin and Andy!

I have a favour to ask. Our 2022 adviser survey is now live, and I would really appreciate it if you could spare a few minutes to take part. As somebody who uses our platform, it’s in your interests to help us make it as good as it possibly can be, and that means telling us what works, what doesn’t and what you think is missing.

Any feedback or suggestions you share with us will be used to shape the future development of our website functionality, product range and service. Every year the responses we get to the survey directly result in several enhancements, and we really want to keep up the momentum.

To show our appreciation for taking part, you’ll have the option to enter your name into a free prize draw to be one of three winners of a case of wine (terms and conditions apply).

It’s always good to hear how you think we can improve our service; the majority of changes to the platform we make are in respect of adviser and client feedback. A recent example is the issue of regular income payments that fall on a non-working day.

Traditionally, we made regular income payments on the 16th of the month. When this date fell on a non-working day, we made the payment on the first working day after that date instead. However, in response to your feedback, we have now changed this approach.

From now on, in months where the 16th falls on a non-working day, payments from your clients’ SIPPs and Retirement Investment Accounts will be made on the working day prior to the 16th. You will notice the change this month, when income payments will be made on Friday 14 October, so please make sure there’s enough cash available in the relevant SIPP/Retirement Investment Account cash accounts by Monday 9 October.

Please note that this change only impacts regular income payments. Regular UFPLS payments that fall on non-working days will still be paid on the working day after the scheduled payment date.

In another move to increase the range of investment options available to you, we have added four new third-party MPS providers to our platform. This gives you and your clients access to more investment expertise, whilst benefiting from our competitive charges, excellent service and outstanding functionality.

In direct response to demand from advisers, we have added Cantab Asset Management, EQ Investors, Sarasin & Partners and Timeline to the panel of third-party Discretionary Fund Managers (DFMs) available via AJ Bell Investcentre’s Retirement Investment Account, SIPP, ISA and General Investment Account.

There is no explicit fee for the third-party MPS service itself – your clients simply pay the existing platform charge, and any charge levied by the external DFM. If you would like to know more, please contact our Business Development Team.

Please note that the value of investments can go down as well as up, and your client may get back less than originally invested.

In its wisdom, Microsoft has decided to stop providing new updates for its Internet Explorer (IE 11) browser. Without these updates, IE 11’s performance will probably suffer, to the detriment of your experience on our website. What’s more, if you continue using IE 11 without updates, you’ll also be at greater risk from cyber and fraud threats. As a result of all this, we’re no longer going to support the browser on our website.

We recommend that you switch instead to Microsoft Edge, which offers the highest-rated protection against both phishing attacks and malware. Alternatively, you could switch to the latest versions of Chrome, Firefox or Safari.

If you have any queries about this, please email us at enquiry@investcentre.co.uk or contact our Adviser Support Team on 0345 83 99 060.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.