The last two months have felt like an eternity for all of us as our entire way of life has changed. I’m sure many of you, like me, have been trying to get to grips with home-schooling, working out how to download Zoom and getting those jobs around the house done that you always said you were too busy to do. However, if you looked at the performance of the stock market over the past few weeks, it would be easy to think that the world is returning to how it was before very quickly.

At the time of writing, the S&P 500 Index has bounced 27% off its lows a month ago and now stands down just 15% from its peak on 19 February. In many respects, that is remarkable given that the global economy is facing its worst crisis since the Great Depression nearly 100 years ago. However, we also have to remember that the equity market is forward-looking in how it behaves. Back in late February, when the coronavirus was spreading quickly across the world, there was a total lack of clarity on what the impact on the global economy would be. At that point, it was very clear that panic was in the air, with some professional investors behaving like amateurs and dumping risk assets as quickly as possible. Of course, the result was a spike in volatility higher than we saw even in the financial crisis.

During this period, it was interesting to observe that the fund managers we were talking to were very reticent to make changes to their portfolios. When questioned as to whether they were looking to take advantage of price dislocations, or even taking risk off the table, there was a clear response that the outlook was just too uncertain to make a rational decision.

When central banks and governments made it clear that they were stepping to support the economy, the clouds parted and there was a gain in confidence from investors that the far horizon on the other side of the coronavirus was visible. And it is the forward-looking nature of equity investors that can sometimes make some moves, which initially look irrational, understandable. This improvement of clarity was the catalyst for investors to pile back into the equity market and drive it higher. Towards the end of March, we detected a clear change in fund manager behaviour when the tone on our calls shifted to one of opportunity.

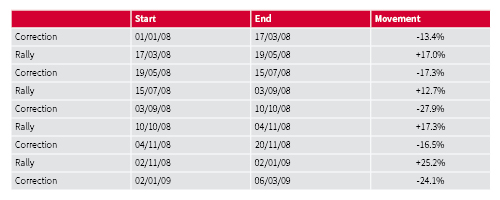

However, a look back in history shows that we have seen this kind of behaviour before. The whole of 2008 turned into one big rollercoaster ride with sharp falls in the MSCI World Index followed by large rallies time and again.

Source: Financial Express

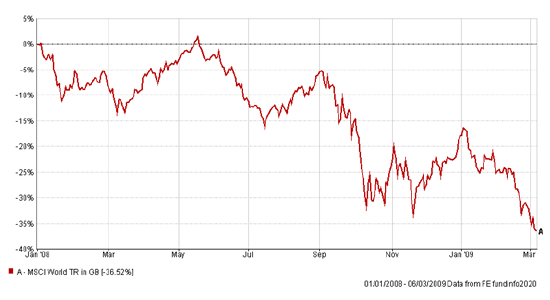

When looking at the chart of these movements, it’s interesting to observe that every single correction drove the market lower than the previous one, until the market bottomed on 6 March 2009, with the market having lost 36.5% over the period.

Source: Financial Express

While I’m not suggesting that this pattern will be followed again this time around, it would be remarkable if, in the face of the biggest economic crisis for nearly 100 years, the market essentially priced it all in during the space of just four weeks. After all, the real economic pain has yet to be seen, with the full force of business collapses, job losses, bond defaults, dividend cancellations, and soaring government debt (again) only just beginning.

So while markets have been a little calmer in recent weeks – aided by a big injection of liquidity from the central banks and the announcement that the Federal Reserve would directly buy not just investment grade bonds, but high-yield bonds too – it is right to expect more volatility from here as the true economic cost of the coronavirus becomes clear.

As a result of this uncertainty, we continue to be cautious in our approach within our MPS and have not been looking to increase risk, preferring to focus on ensuring we remain diversified should volatility pick up again. We believe it is right to continue in this manner despite many in the equity world believing that a strong ‘V’ shaped recovery is coming once the worst of the coronavirus is over. As we saw in 2008, markets rarely instantly bounce back from bouts of turbulence, let alone genuine global crises, and therefore evidence of a genuine recovery needs to be seen – otherwise there is a real risk that the last four week have just been a pretty bouncy dead cat.

All data in GBP.

Past performance is not a guide to future performance and some investments may need to be held for the long term.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.