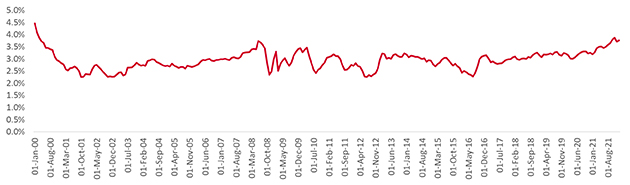

In February 2022, the Bank of England forecast that inflation would reach around 7% by springtime. It then expects inflation to move back towards the 2% target over the course of the next two years. The idea that inflation is ‘transitory’ is a view still largely priced into the market, although the spectre of persistent inflation has crept into the lexicon of more and more investors over recent months. One popular index used to measure this is the 5y5y index. This is average expected inflation over a 5-year period, starting 5 years in the future. This is calculated from looking at interest rate swaps, a derivative used by institutional investors to hedge against inflation risk, so can be described as the inflation rate ‘priced in by the market’.

Source: Bank of England, January 2022

In the UK this uses the RPI index, rather than CPI, a measure of inflation more widely used across the globe, and by the Bank of England as its 2% target. RPI typically runs around 1% higher than the CPI measure.

The 5y5y expectation for RPI inflation in the UK has ticked up towards 4%, after bottoming-out at around 2.5% back in 2016, just before the EU referendum results. Although this may seem like a significant increase, when judged over a longer time it is still modest. As recently as February 1985, this measure stood at over 8%.

At AJ Bell Investments our view is inflation may end up persisting for longer, and perhaps at a higher level than has already been priced in.

What may therefore seem contradictory is that across all the portfolios we manage we have zero direct exposure to UK inflation-linked gilts. At first glance this probably seems counterintuitive given our view, but this article will explain why inflation-linked gilts may provide weak protection in the case of higher inflation, how we position our bond allocations in this environment, and how we position other elements of our portfolios to build robust portfolios in what are uncertain times.

Bond yields have ground lower and lower over the last 15 years. As such, when using them in a multi-asset portfolio, we view them as a diversification tool rather than a long-term investment. In times of uncertainty, such as war, pandemics or political unrest, equity markets tend to fall, and often bond prices rise as investors undertake what is known as ‘flight to safety’. This means holding a combination of equities and bonds can help dampen short-term losses, however we expect most of the long-term expected returns of our portfolios to be delivered by equities. In the event of an inflation shock, equities are likely to fall in the short-term, however inflation-linked gilts may not actually increase in price, especially if the market expects the Bank of England to increase base rates to combat this higher inflation.

To understand why this is, you need to understand the two separate elements that make up the return of an inflation-linked bond.

Coupon payments – the coupons paid by an inflation-linked bond, as you would expect, increase in line with inflation, so this element offers some protection. However, given the starting coupon on an inflation-linked bond is often as low as 0.125% this represents a very small part of the investor’s return.

Change in capital value – the capital price of the bond changes daily based on a combination of two things: future inflation expectations and the future expected central bank rate (which in turn determine what is known as the risk-free real yield). If this increases, then bond prices tend to fall. This is where the problem lies – to combat persistent higher inflation the Bank of England is likely to react by increasing base rates, something we have seen twice already in the last year.

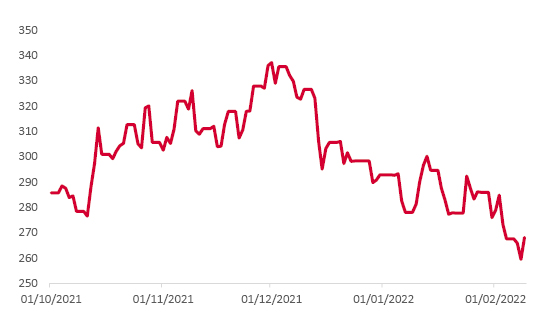

For example, the following graph shows the changing capital price of a UK Inflation Linked Gilt due to mature in 2068. Despite inflation expectations increasing over the last couple of months, the capital value of the bond has fallen from 330 to 260, equivalent to a loss of -21%!

Source: Bloomberg, February 2022

Given we cannot separate the inflation expectations from the expected real yield, we avoid using inflation-linked gilts in the portfolio – we could be right about higher inflation but still end up losing money if not!

The UK bond market is unique, in the sense that there is high investor demand for inflation-linked bonds as they are used by pension funds to hedge against pension payments increasing due to higher inflation. These buyers are insensitive to short-term changes in capital value, and instead are only focused on the changes between the value of its assets (inflation-linked bonds) and liabilities (future pension payments). This means that when buying inflation-linked bonds ‘passively’ in the UK, the average maturity of bonds in the FTSE Actuaries UK Index-Linked Gilts All Stocks Index, a measure of all inflation-linked gilts issued by the UK government in sterling, is 21 years. This means the change in capital described previously is greater in magnitude, as this is linked to the length of time left until it matures. A 1% increase in real yields would lead to fall of around 20% for the index, dwarfing the inflationary increase in coupon payments.

In international bond markets, the demand for long-dated inflation-linked bonds does not exist, due to a different retirement structure. As such, the average maturity is much shorter. For example, looking at US government bonds with inflation protection (known as TIPS), the average maturity of this market is around 8 years. Although these may still fall in value if real yields increase, the magnitude is much smaller, so a greater proportion of the return is delivered through changes in inflation. As such we have limited holdings in TIPS in our portfolios to deliver some direct inflation protection.

Given the use of bonds to offset any short-term losses in equities, we feel it is still necessary to invest in this asset class to maintain the right level of risk in all portfolios. All bonds, linked to inflation or not, see the capital value fall in the event of higher real yields. As such we focus on keeping the average maturity of our bonds as short as possible within the risk budgets. For example, where we hold UK gilts, we allocate to bonds maturing in the next 5 years. In a similar fashion, a large element of our sterling corporate bond allocation is in bonds maturing in the next few years. Although this does not immunise us from any sort of loss, it does mean that the magnitude of loss is much smaller whilst keeping the portfolios diversified.

Although we can’t do anything within the bond element of the portfolio to avoid short term absolute losses, in the longer term we have pivoted our equity allocation to benefit from a higher inflation environment. We have long-standing positions in sectors such as infrastructure, consumer staples and health care: high-quality companies that can pass on inflation increases to their customers. In 2021 we introduced an allocation to energy companies in our portfolios where appropriate, and more recently we have added in dedicated exposure to financials. The link to inflation within the energy sector is obvious, whereas within financials it is slightly more subtle, but in essence financial institutions make money by borrowing money in the short term (customer deposits) and lending money for the long term (mortgages). As real yields increase (as discussed, this is linked to higher inflation) they can make a higher margin.

In the short term if inflation does run higher than the market is expecting, overall portfolio losses should be expected across the board. However, we invest for the longer term and by being proactive within the portfolios to position for this, we feel we are well-positioned for the years ahead, whilst dampening short-term falls as much as possible.

This area of the website is intended for financial advisers and other financial professionals only. If you are a customer of AJ Bell Investcentre, please click ‘Go to the customer area’ below.

We will remember your preference, so you should only be asked to select the appropriate website once per device.