Investing made easy

We are always looking for ways to make investing more straightforward, and one way of doing that is to offer advisers a one-stop shop for all their needs on a single platform. As part of this, we wanted to deliver a range of investment and fund management solutions capable of meeting all of your clients’ differing objectives and appetite for risk.

The result is AJ Bell Investments, a team with more than 100 years’ collective experience of managing funds for retail and institutional investors, and of building sophisticated investment management solutions – including Centralised Investment Propositions.

At a market-leading cost of just 0.15% p.a., our portfolios are designed to suit a variety of client scenarios.

- A diverse range of outcome-orientated portfolio solutions, mapped to the leading risk profiling tool providers.

- Available in Active, Passive or our blended 'Pactive' format.

- A low charge of just 0.15% p.a.

- Simple, transparent disclosure of portfolios and OCFs.

- Portfolios managed with a long-term, multi-asset approach by an experienced team of professionals.

- Backed by our ongoing commitment to outstanding choice, cost and communication.

- Passive, Pactive and Responsible solutions work most effectively when at least £20,000 is invested; for the Active solution, this amount is at least £10,000. Please see our adviser FAQ for more details.

There’s also our Money Market portfolio, which offers your clients cash-like returns with no charge for portfolio management.

- Daily liquidity

- A total indicative charge of just 0.11%

- Available exclusively on AJ Bell Investcentre

Our commitment on choice

We know your clients are best served when you can find the best solution for their particular needs. That’s why we offer a broad range of investment options.

Find the right fit

Using the buttons below, please select the investment objective and appropriate risk level to find the solution that best fits your client’s needs.

Designed in conjunction with advisers, this low-cost Centralised Retirement Proposition is for clients seeking retirement income in a world of flexibility and pension freedoms.

- A flexible discretionary portfolio service that leaves you in control.

- Transparent disclosure of the underlying portfolios and their Ongoing Charge Figures (OCFs).

- Simple to understand and explain.

- Reduces sequencing risk.

- No investment charge on the cash element of the portfolio.

- Investment charges capped at 0.65% p.a. (based on the standard initial portfolio weightings).

Our RPS brings together a range of strategies used to help clients deal with the complexities of investing and meeting ongoing income requirements in later life and, in particular, the problem of sequencing risk.

Sequencing risk

At its simplest, sequencing risk acknowledges that the ‘order’ in which investment returns are experienced can have a larger impact on the end result if investments are being sold along the way. If investments are sold after a fall in value, the remaining funds would need to work harder to make that loss up – especially if those losses come early on in the journey.

For clients drawing down on their investments, this means that the early years of retirement can be particularly precarious, given that this is when sequencing risk is at its highest.

- Sequencing risk

Sequencing risk can never be completely removed, but there are some strategies that can be used to manage it. - The ‘4% Rule’

Backtesting shows that if a pension pot was invested in the RPS, at outset, and no more than 4% of the initial amount* is removed from the portfolio in any given year, there hasn’t been a series of returns from markets over the last century that results in the monies running out over a 30-year period or retirement life. That includes two World Wars and periods of high inflation as seen in the 1970s.

*increased in line with inflation. Figures refer to simulated past performance and past performance is not a reliable indicator of future performance. Simulated past performance is calculated gross of fees. - Natural income

The ‘natural income’ strategy involves choosing investments that should produce an income to fund the client’s lifestyle. This reduces the need to nibble away at the capital and so lowers the risk of having to sell the investments after a fall in value – which is the source of sequencing risk. - ‘Smart Rebalancing’

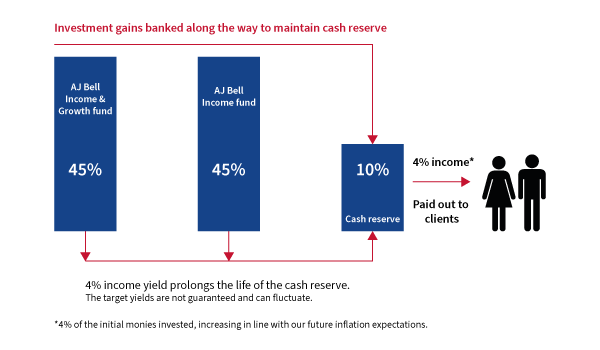

Less prevalent, but just as powerful in reducing sequencing risk, is the idea of banking profits along the way. Since the length of retirement is unknown but can last a long time, it is inevitable that over the retirement journey, there will be periods of strong gains as well as times in which investment values may fall sharply. With ‘Smart Rebalancing’, the need to sell after a fall is reduced by taking profits only after the gains have been banked. If neither of the conditions are met, the portfolio is not touched, giving any investment losses the benefit of time to recover. - Bucketing

By splitting the investment pot into a series of simpler strategies, ‘bucketing’ helps clients understand what is going on with their funds. Typically, the monies are split into three ‘buckets’, each of which is designed to be used over a different time period.

Short-term cash bucket Medium-term bucket Longer-term bucket Since sequencing risk is at its highest in the early years, the immediate income needs of your client are held in cash. Built primarily of lower risk investments such as government and corporate bonds, plus some exposure to income producing shares, the medium-term bucket is designed to generate a consistent level of income and to hold its capital value. Consisting of more risky assets like shares and property, the longer-term bucket should grow in value as well as generating an income that also grows over time.

Putting it all together

Combining four well-known retirement income strategies in a single solution, the Retirement Portfolio Service from AJ Bell Investments provides a simple, transparent, low-cost way to manage your client’s investment needs in later life.

Our commitment on choice

We know your clients are best served when you can find the best solution for their particular needs. That’s why we offer a broad range of investment options.

Whether your clients are looking to accumulate wealth with our 'growth' range, align their portfolio and personal values with our ‘responsible’ fund, or earn a yield from our 'income' options, AJ Bell Funds are designed to deliver outcome-orientated returns to suit a variety of different needs.

- A wide range of outcome-orientated fund solutions.

- A fixed OCF starting from as little as 0.31% to ensure investors know the maximum they will pay.

- Multi-asset exposure to global bond, equity and property markets.

- Long-term tactical asset allocation undertaken by an experienced team of professionals.

- Simple, transparent disclosure of portfolios and OCFs.

- Backed by our ongoing commitment to outstanding choice, cost and communication.

Our commitment on choice

We know your clients are best served when you can find the best solution for their particular needs. That’s why we offer a broad range of investment options.

Find the right fit

Using the buttons below, please select the investment objective and appropriate risk level to find the solution that best fits your client’s needs.

Our dedicated Business Development Team is here to help

Our services are provided with a focus on choice, clear communication and the need to keep costs low.